Hillman Solutions Corp. Stock Up 0.26% to $7.77, Analysts Remain Optimistic for 2023.

March 29, 2023

Trending News ☀️

Analysts remain optimistic about the future of Hillman Solutions ($NASDAQ:HLMN) Corp. despite the turbulence seen in the stock market in recent weeks. This is evidenced by the fact that the closing price for the day was $7.77, which is a 0.26% increase from the previous closing price of $7.75. This is a sign that investors are still confident about this company’s prospects going into 2023. Hillman Solutions Corp. is a technology company that specializes in providing innovative solutions to businesses in the area of customer experience, artificial intelligence and automation. Their services range from website development and hosting to data analytics and machine learning.

With their cutting-edge technology, they have been able to provide higher levels of efficiency and automation to businesses across different industries. The company has shown an impressive capacity for adaptation and innovation, both in its products and services, as well as its overall business model. With such a positive outlook going into next year, investors are optimistic that Hillman Solutions Corp. will be able to maintain its upward trajectory.

Price History

Analysts are optimistic for the upcoming year, 2023, as coverage of Hillman Solutions Corp. has been mostly positive till now. This slight uptick in stock prices could be a signal that the company is doing well, and this could indicate a positive outlook for the future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Hillman Solutions. More…

| Total Revenues | Net Income | Net Margin |

| 1.49k | -16.44 | -1.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Hillman Solutions. More…

| Operations | Investing | Financing |

| 119.01 | -72.82 | -28.72 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Hillman Solutions. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.47k | 1.31k | 5.95 |

Key Ratios Snapshot

Some of the financial key ratios for Hillman Solutions are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 7.0% | 73.1% | 2.7% |

| FCF Margin | ROE | ROA |

| 3.3% | 2.1% | 1.0% |

Analysis

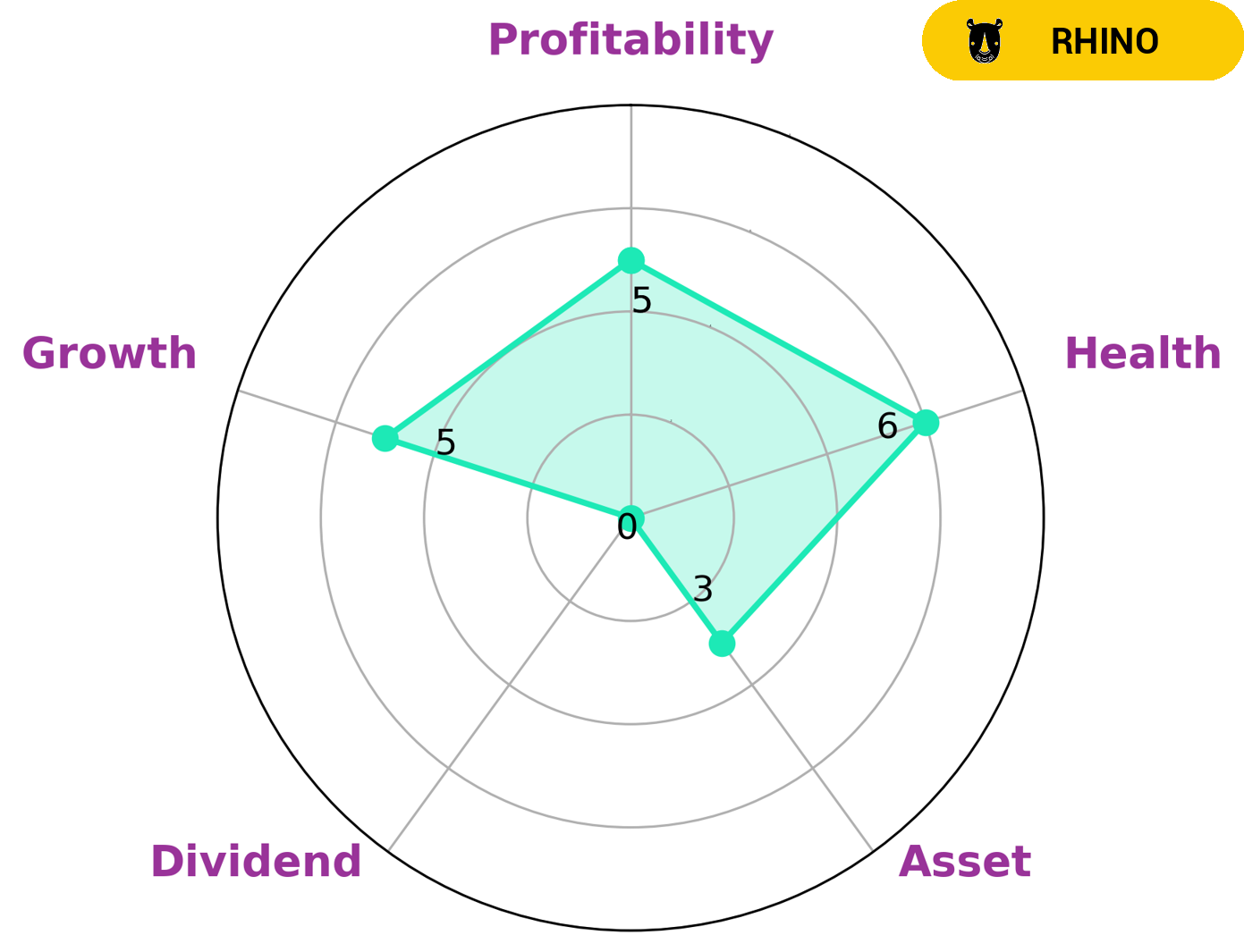

GoodWhale has done an analysis of HILLMAN SOLUTIONS‘s fundamentals. Through our Star Chart, we see that HILLMAN SOLUTIONS is strong in liquidity, medium in growth, profitability, and weak in asset and dividend. In terms of their health score, we have assigned HILLMAN SOLUTIONS an intermediate score of 6/10. This reflects the company’s strong cashflows and potential to pay off debt and fund future operations. We also classify HILLMAN SOLUTIONS as a ‘rhino’ company. That is, they have achieved moderate revenue or earnings growth. Given this information, what type of investors might be interested in HILLMAN SOLUTIONS? Investors who are looking for stability and moderate growth may find this company attractive. Moreover, those looking for a company with strong cashflows and the potential to pay off debt may also find HILLMAN SOLUTIONS worth their consideration. More…

Peers

Its competitors are Q.E.P. Co Inc, Shinvest Holding Ltd, and StrongPoint ASA.

– Q.E.P. Co Inc ($OTCPK:QEPC)

Q.E.P. Co., Inc. engages in the manufacture and sale of flooring and flooring-related products. The company operates through three segments: Wood, Laminate, and Tools. It offers engineered hardwood, bamboo, cork, and laminate flooring products; ceramic and porcelain tiles; adhesives, grouts, underlayments, tools, and trims for flooring installation and finishing; and products for concrete surface preparation, including concrete saws, grinders, polishers, scarifiers, shot blasters, and floor scrapers. The company sells its products through distributors to specialty retail stores, home centers, hardware stores, and other retailers. Q.E.P. Co., Inc. was founded in 1979 and is based in Boca Raton, Florida.

– Shinvest Holding Ltd ($LTS:0JEZ)

StrongPoint ASA is a technology company that provides retail and logistics solutions. The company has a market cap of 846.68M as of 2022 and a return on equity of 4.23%. StrongPoint ASA’s solutions are used by retailers and logistics providers to increase efficiency, optimize operations and improve the customer experience.

Summary

Hillman Solutions Corp. has seen its stock price rise 0.26% to $7.77 in recent days, indicating an optimistic outlook from analysts for 2023. So far, news coverage surrounding the company has been largely positive, with the stock price reaching a new peak the same day as the news was released. Investing in Hillman Solutions Corp. is seen as a viable option for those looking for steady growth and stability going forward.

With a wide variety of products and services, Hillman Solutions Corp. provides its clients with a wide range of options and potential opportunities. Analysts are confident that Hillman Solutions Corp. will continue to be a profitable investment in the future, making it an attractive option for long-term investors.

Recent Posts