Rlx Technology Intrinsic Value Calculator – RLX Technology Stock: Analysts See Potential in High Price-to-Earnings Ratio

April 9, 2023

Trending News 🌥️

RLX ($NYSE:RLX) Technology Inc. is a technology company that specializes in the design and development of complex software, hardware and cloud-based systems. Its stock has recently been receiving considerable attention from analysts due to its relatively high price-to-earnings ratio of 17.45x, which is significantly higher than the average price-to-earnings ratio of 12 for the sector. Analysts are beginning to take note of RLX Technology Inc.’s stock, as they believe that the company has potential given its high price-to-earnings ratio. They are evaluating the current market conditions and looking at the potential for the stock to increase in value over the long-term. Some analysts also believe that the company’s current price-to-earnings ratio could be a good indicator of future growth, as it could suggest that investors are willing to pay a premium for the stock due to its potential for long-term gain.

Additionally, analysts are noting that RLX Technology Inc. is well positioned in terms of its competitive products and services, allowing them to carve out a niche in the industry. Its innovative solutions are continuing to bring in customers, which adds to their long-term growth prospects. Furthermore, due to its focus on technological advancements, it is expected to remain at the forefront of its industry. Overall, analysts are seeing potential in RLX Technology Inc.’s stock given its high price-to-earnings ratio. They are taking a closer look at this company in light of its current market conditions and innovative products, which could lead to long-term growth and profitability.

Price History

On Friday, the stock opened at $2.8 and closed at $2.9, a 5.8% increase from the previous day’s closing price of $2.7. Analysts have stated that the P/E ratio is one of the main drivers that is bringing potential investors to RLX Technology Inc. stock. They have stated that the relatively high P/E ratio makes the company attractive to investors looking for value in the current market. Furthermore, analysts believe that this trend could continue as the company continues to perform well and its stock price rises. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Rlx Technology. More…

| Total Revenues | Net Income | Net Margin |

| 5.33k | 1.44k | 25.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Rlx Technology. More…

| Operations | Investing | Financing |

| 486.83 | -4.13k | -477.27 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Rlx Technology. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 16.38k | 838.45 | 8.76 |

Key Ratios Snapshot

Some of the financial key ratios for Rlx Technology are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 51.0% | 166.2% | 19.9% |

| FCF Margin | ROE | ROA |

| 9.1% | 4.3% | 4.1% |

Analysis – Rlx Technology Intrinsic Value Calculator

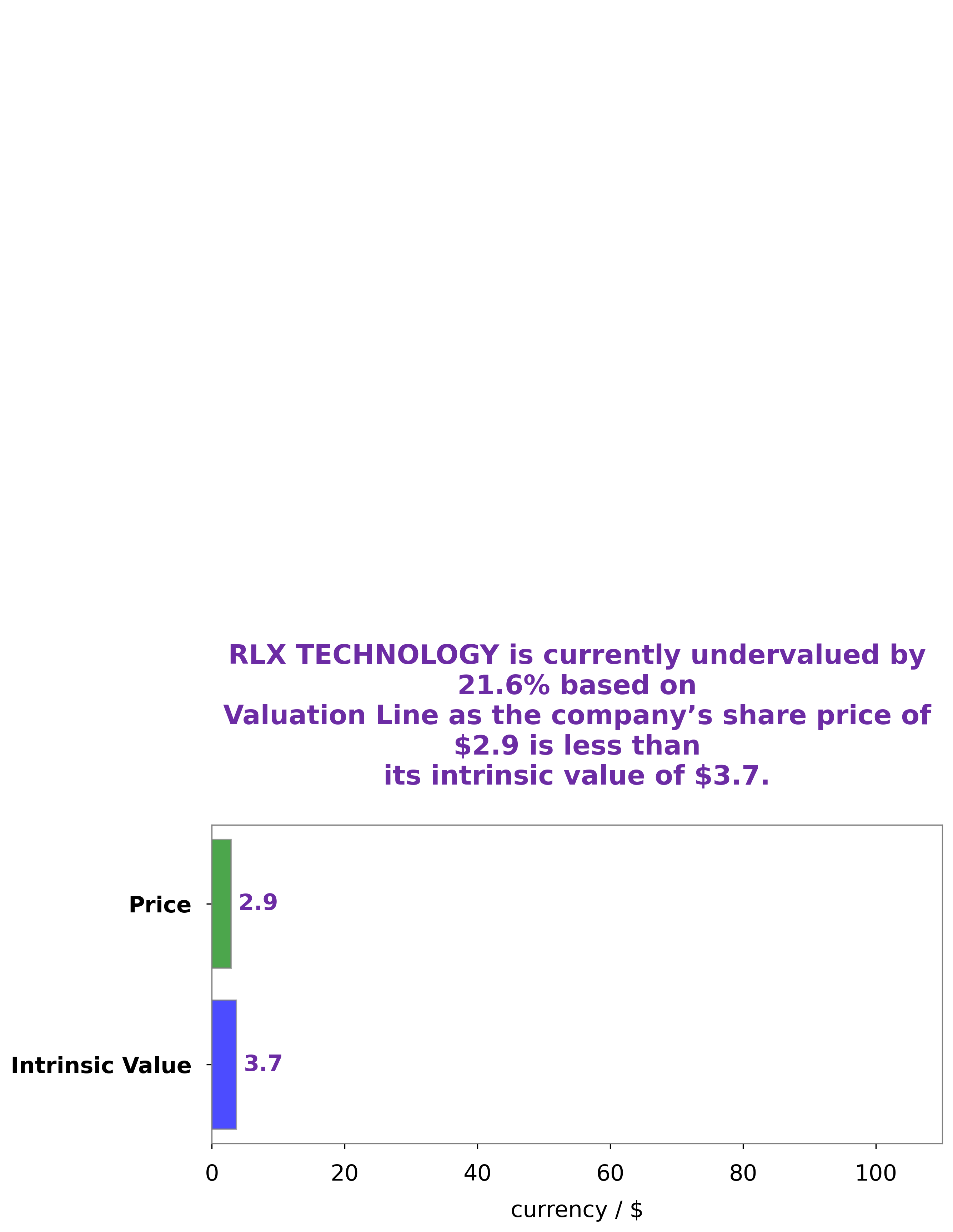

At GoodWhale, we recently did an analysis of the financials of RLX TECHNOLOGY. After careful consideration, we concluded that the intrinsic value of RLX TECHNOLOGY’s share is around $3.7, calculated by our proprietary Valuation Line. Interestingly, the current market price of RLX TECHNOLOGY stock is only $2.9, indicating that the market has underestimated the true worth of the company and that investors can take advantage of this undervaluation. The stock is currently undervalued by 22.4%. More…

Peers

In the technology industry, RLX Technology Inc competes against Kim Teck Cheong Consolidated Bhd, Crown Confectionery Co Ltd, and White Organic Retail Ltd. All of these companies are striving to be the best in the industry and provide the best products and services to their customers. Each company has its own strengths and weaknesses, and it is up to the consumer to decide which company they want to purchase from.

– Kim Teck Cheong Consolidated Bhd ($KLSE:0180)

Founded in 1957, Kim Teck Cheong Consolidated Bhd is one of Malaysia’s leading suppliers of construction materials. The company has a market cap of 163.65M as of 2022 and a Return on Equity of 12.59%. Its products include cement, sand, aggregate, bricks, and tiles. The company also provides environmental solutions such as waste management and recycling services.

– Crown Confectionery Co Ltd ($KOSE:264900)

As of 2022, Crown Confectionery Co Ltd has a market cap of 106.92B and a Return on Equity of 11.73%. The company manufactures and sells confectionery products under the Crown, Meiji, and Morinaga brands. It offers chocolates, biscuits, crackers, cookies, candies, gum, and other confectionery products. The company also operates supermarkets and convenience stores.

– White Organic Retail Ltd ($BSE:542667)

White Organic Retail Ltd is a publicly traded company with a market capitalization of 4.89 billion as of 2022. The company has a return on equity of 16.17%. White Organic Retail Ltd is engaged in the business of retailing organic food and other products. The company operates a chain of stores under the name “White Organic Markets.”

Summary

RLX Technology Inc. is a publicly traded company that has seen an impressive rise in its stock price. Analysts have given the company a favorable outlook, citing its strong price-to-earnings ratio of 17.45x, which is above its average ratio. Investors should carefully consider the company’s performance, financial and operational metrics, and the potential for future growth before making an investment decision.

Additionally, investors should pay attention to the company’s overall financial health and any changes in the stock price. By carefully researching the company and its products, investors can make an informed decision and potentially benefit from any positive changes in the stock price.

Recent Posts