Greenlane Holdings Intrinsic Value Calculation – Greenlane Holdings Reports Strong Q4 Results, Beating Earnings and Revenue Estimates

May 17, 2023

Trending News ☀️

Greenlane Holdings ($NASDAQ:GNLN) (NASDAQ: GNLN) reported strong fourth-quarter results that exceeded Wall Street expectations. The company reported a GAAP EPS of -$0.64, exceeding expectations by $0.06, and revenue of $24M, surpassing estimates by $1.09M. Greenlane Holdings is a leading global provider of ancillary products to the cannabis, hemp, and CBD industry. The company operates through two divisions: vaporizers and accessories, and hemp-derived CBD products. They offer products such as vaporizers, refillable tanks, and cartridges, as well as various types of CBD products. The strong performance in the fourth quarter was due to continued strong demand for its products.

The company also enjoyed strong international sales, with revenue increasing by 24% year over year in the fourth quarter. This increase can be attributed to the company’s focus on expanding its international footprint in key markets such as Europe and Latin America. Greenlane Holdings has also been proactive in adapting to the changing consumer landscape by launching ecommerce platforms and enhancing their sales and marketing strategies. This has enabled them to better serve their customers and increase their market reach. Overall, Greenlane Holdings reported strong Q4 results, beating expectations on both the top and bottom lines.

Earnings

In its earning report of FY2022 Q4 ending December 31 2022, GREENLANE HOLDINGS earned 21.99M USD in total revenue and lost 13.26M USD in net income. This is a 60.7% decrease compared to the previous year, with the total revenue decreasing from 36.27M USD to 21.99M USD in the last 3 years. Despite the decrease in total revenue, GREENLANE HOLDINGS still managed to exceed its earnings and revenue estimates, earning it praise from investors.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Greenlane Holdings. More…

| Total Revenues | Net Income | Net Margin |

| 137.09 | -115.76 | -32.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Greenlane Holdings. More…

| Operations | Investing | Financing |

| -26.43 | 12.03 | 13.93 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Greenlane Holdings. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 146.05 | 50.69 | 5.97 |

Key Ratios Snapshot

Some of the financial key ratios for Greenlane Holdings are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -9.5% | – | -90.0% |

| FCF Margin | ROE | ROA |

| -21.3% | -78.4% | -52.8% |

Price History

On Monday, the stock opened at $0.3 and closed at $0.3, with a 13.9% gain from its prior closing price. This is a positive development for the company, as it reflects the ongoing strength of its performance and the trust that investors have in its ability to deliver on its goals. This indicates that Greenlane Holdings was able to capitalize on strong demand for its products and capitalize on market opportunities.

These results demonstrate the company’s commitment to delivering consistent performance and providing value to shareholders. Despite difficult market conditions, Greenlane Holdings is well positioned to continue to deliver solid performance in the coming quarters. Live Quote…

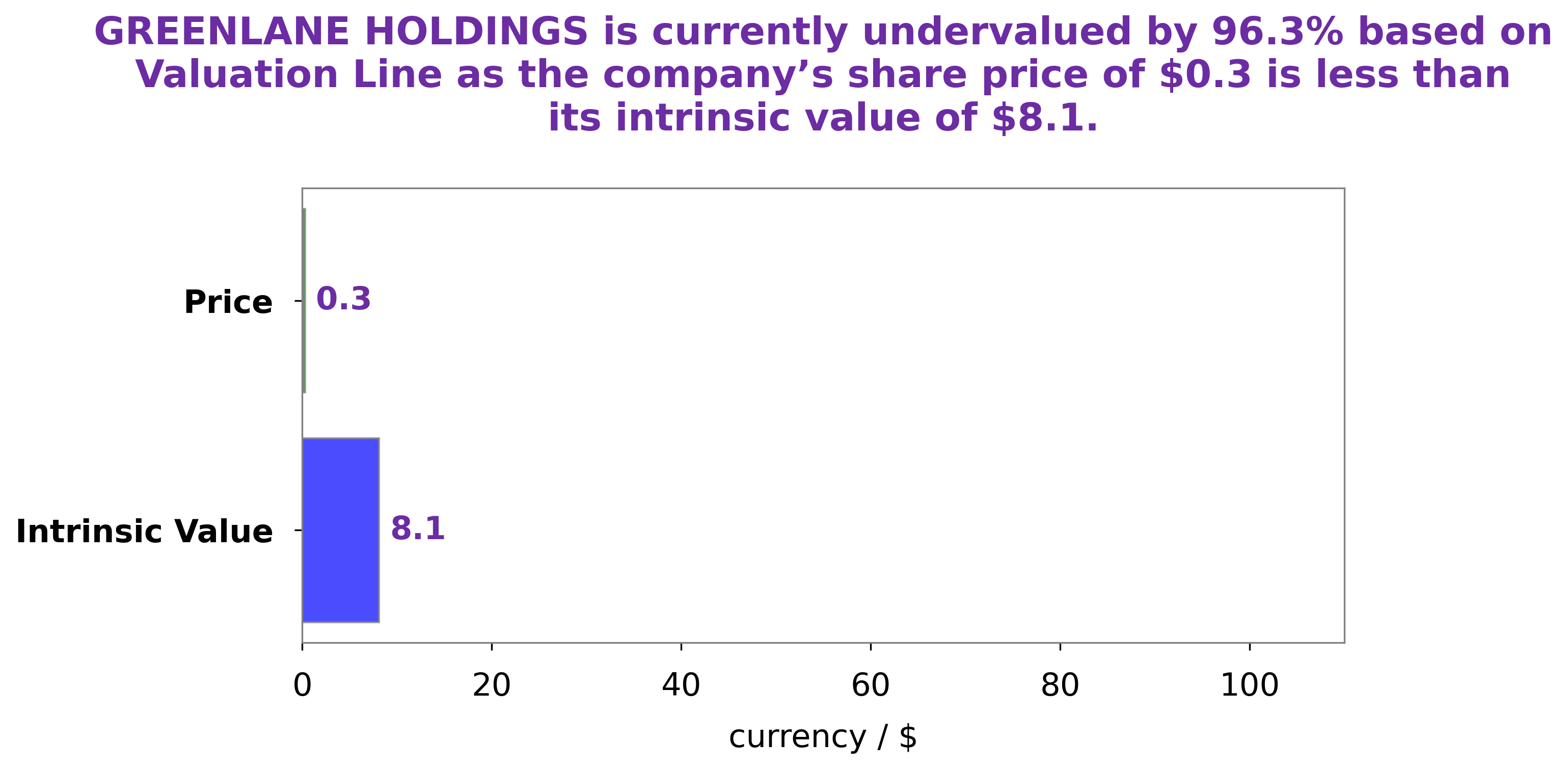

Analysis – Greenlane Holdings Intrinsic Value Calculation

At GoodWhale, we have conducted a thorough analysis of GREENLANE HOLDINGS, taking into account all the fundamental data. Upon examination of this data, we have determined that the intrinsic value of GREENLANE HOLDINGS stock is around $8.1, using our proprietary Valuation Line. This means that the current market price of $0.3 is severely undervalued, to the tune of 96.3%. Our conclusion is that investing in GREENLANE HOLDINGS now could be a great opportunity, to gain a high return on investment. More…

Peers

The competition between Greenlane Holdings Inc and its competitors, Hostess Brands Inc, Hyfusin Group Holdings Ltd, and Drinks America Holdings Ltd, is fierce. All three companies are engaged in a constant battle to offer the highest quality products at the best prices. Each company strives to create innovative products that will appeal to customers and ultimately lead to greater profits.

– Hostess Brands Inc ($NASDAQ:TWNK)

Hostess Brands Inc is an iconic American snack cakes and sweet goods company, selling a wide range of sweet treats and snacks that have been around for decades. As of 2023, the company has a market capitalization of 3.37 billion dollars and a Return on Equity of 8.77%. This is a solid financial performance that suggests that Hostess Brands Inc is doing well and is a viable investment option. The company continues to find innovative ways to expand into new markets and drive greater success. Hostess Brands’ strong financial position indicates that they are well-positioned to face the future and continue to grow their market share.

– Hyfusin Group Holdings Ltd ($SEHK:08512)

Hyfusin Group Holdings Ltd is a diversified holding company with a market cap of 163.9M as of 2023. The company operates in various industries including automotive, real estate, financial services, and technology. Hyfusin’s Return on Equity (ROE) for the same year was 15.94%, which is higher than the average ROE of its industry peers. This indicates that the company is making efficient use of its shareholders’ equity. Hyfusin Group Holdings Ltd is committed to providing its shareholders and stakeholders with long-term value by supporting and investing in high-growth businesses.

– Drinks America Holdings Ltd ($OTCPK:DKAM)

Drinks America Holdings Ltd is an American alcoholic beverage distribution and marketing company. The company specializes in the marketing, sales and distribution of premium beer, wine, and spirits brands in the United States. As of 2023, the company has a market cap of 278.3k and a Return on Equity of 64.66%, which are both indicative of the company’s strong financial performance. The high Return on Equity is indicative of the company’s ability to generate a healthy return for its stockholders. Furthermore, its market cap suggests the company has a strong presence in the alcohol distribution and marketing industry.

Summary

Greenlane Holdings recently reported their financial results with a GAAP EPS of -$0.64, which beat the analyst estimate by $0.06. Revenue of $24M also beat estimates by $1.09M. This news was met positively by investors, as the stock price moved up on the same day.

Investors should consider the potential upside of this company, given that it has beaten estimates in the past, and shows no signs of slowing down. It remains to be seen, however, if its current financial performance can be sustained in the long run.

Recent Posts