Argus Predicts Philip Morris International Stock to Reach Record Levels

April 25, 2023

Trending News 🌥️

PHILIP ($NYSE:PM): PMI’s stock has been performing well over the past few years, and now Argus, a financial analyst firm, is predicting that it may reach record levels. Argus analysts are expecting PMI’s share price to hit new highs as the company continues to benefit from its strong market presence and strong competitive advantage. They point out that PMI’s vast portfolio of innovative products, along with its vast distribution network, have enabled it to maintain its competitive edge. Furthermore, they believe that PMI’s strategic initiatives, such as its ‘Reduced-Risk Products’ line, will help the company capitalize on new trends in the industry. PMI is also benefiting from strong fiscal performance. It has seen increased profits over the last few quarters and has been able to maintain a healthy dividend payout ratio.

Argus believes that this trend is likely to continue, resulting in higher stock prices. They also note that PMI’s strong balance sheet and low debt-to-equity ratio, combined with its healthy cash flow, could further boost its stock prices. With Argus predicting that PMI’s stock could reach record levels, investors may wish to take a closer look at the company’s long-term potential. PMI has demonstrated its ability to capitalize on new trends in the industry and deliver consistent earnings growth, making it an attractive investment opportunity for investors.

Price History

On Monday, PHILIP MORRIS INTERNATIONAL stock opened at $98.0 and closed at $98.4, up by 0.6% from the previous closing price of 97.8. This puts the stock at a record high and is a sign of the company’s positive outlook in the coming months. Analysts from Argus Research have predicted that the stock will continue to reach new heights in the near future, greatly surpassing the current levels. This is supported by the growth in PHILIP MORRIS INTERNATIONAL’s revenue and profits, as well as the expanding product portfolio of their cigarette brands.

The company also remains focused on its global presence, with an increasing focus on emerging markets around the world. With all these factors in mind, Argus Research suggests that PHILIP MORRIS INTERNATIONAL’s stock is set to continue its upward trend. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for PM. More…

| Total Revenues | Net Income | Net Margin |

| 32.03k | 8.69k | 27.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for PM. More…

| Operations | Investing | Financing |

| 10.8k | -15.68k | 3.81k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for PM. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 62.06k | 69.11k | -5.75 |

Key Ratios Snapshot

Some of the financial key ratios for PM are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 2.0% | 1.3% | 36.9% |

| FCF Margin | ROE | ROA |

| 30.4% | -82.6% | 11.9% |

Analysis

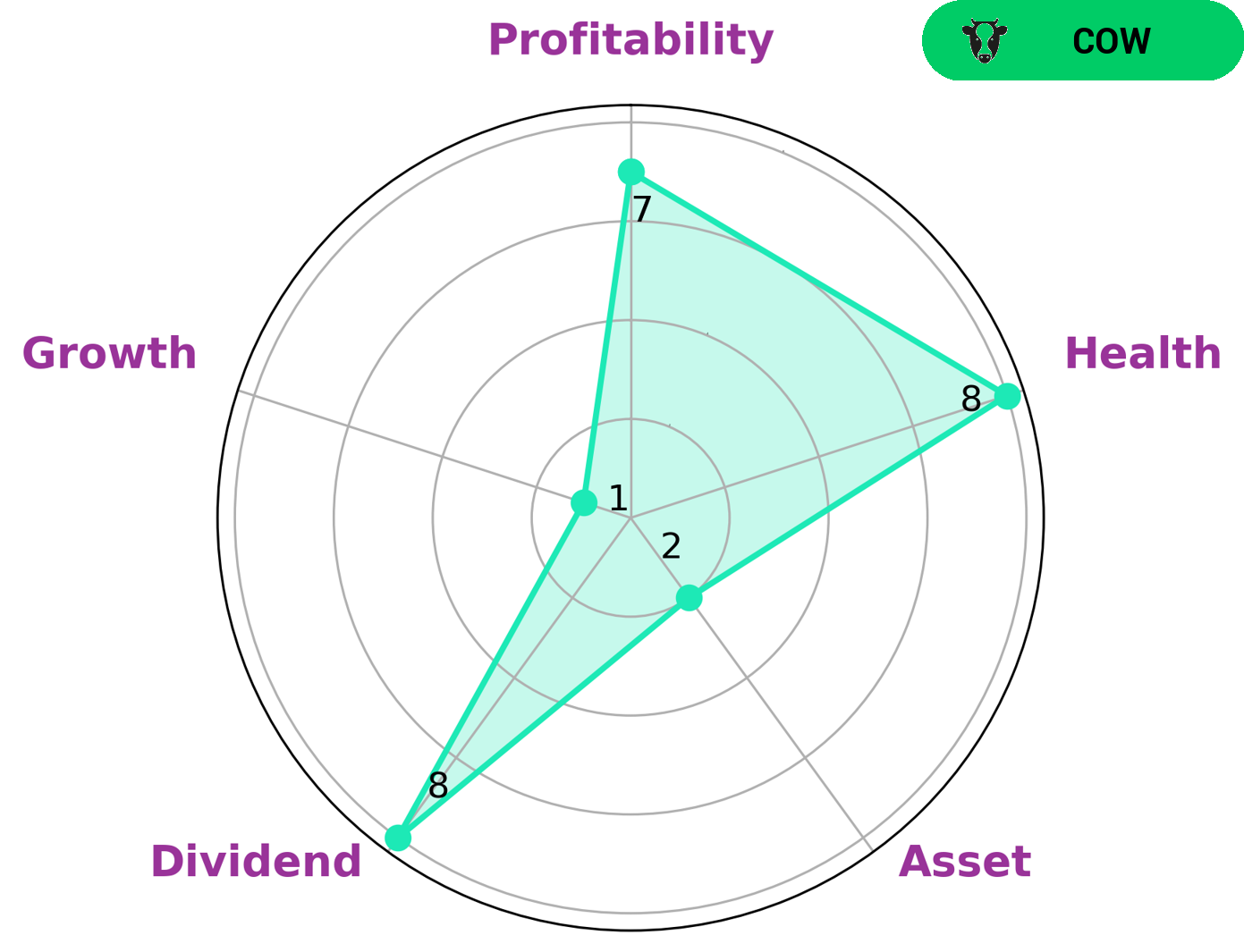

As GoodWhale’s analysis of PHILIP MORRIS INTERNATIONAL’s financials revealed, the company has been classified as a ‘cow’ based on our star chart. This type of company is known to pay out consistent and sustainable dividends, making it an attractive option for income investors. The company is strong in dividend and profitability, but weak in asset and growth. Nevertheless, its overall health score is still high at 8 out of 10, indicating that PHILIP MORRIS INTERNATIONAL is capable to pay off debt and fund future operations. Given its impressive financial standing, this company could be an ideal option for investors who are looking to invest with consistent income in mind. More…

Peers

The tobacco industry is highly competitive, with Philip Morris International Inc. (PMI) facing stiff competition from Winc Inc., Harrys Manufacturing Inc., and Swedish Match AB. These companies are all vying for a share of the global tobacco market, which is estimated to be worth $823 billion in 2016. PMI is the world’s largest tobacco company, with a market share of 29.3%. Winc is the second largest player, with a market share of 17.1%. Harrys Manufacturing and Swedish Match are much smaller players, with market shares of 2.6% and 1.9%, respectively.

– Winc Inc ($NYSEAM:WBEV)

Winc Inc is a publicly traded company with a market capitalization of 7.84 million as of 2022. The company has a negative return on equity of 63.55%. Winc Inc is a provider of business software solutions. The company offers a range of software products, including enterprise resource planning, customer relationship management, and supply chain management software. Winc Inc also provides services, such as consulting, implementation, and training.

– Harrys Manufacturing Inc ($OTCPK:WSRRF)

Harrys Manufacturing Inc has a market cap of 5.06M as of 2022. The company has a Return on Equity of -392.33%. Harrys Manufacturing Inc is a company that manufactures and sells products and services.

– Swedish Match AB ($LTS:0GO4)

Swedish Match AB is a holding company that, through its subsidiaries, manufactures and sells tobacco products, including cigarettes, smokeless tobacco, and cigars. The company has a market cap of 167.13B as of 2022 and a Return on Equity of -107.57%. Swedish Match AB’s products are sold in over 150 countries. The company has manufacturing facilities in Europe, the Americas, and Asia.

Summary

An analysis of Philip Morris International (PMI) reveals a positive investment outlook. Argus research has recently tipped PMI to run to a new high, indicating that the stock is poised for substantial appreciation.

In addition, the company has reported solid financial performance in recent quarters and is projected to continue to grow profitably in the foreseeable future. Investors should take a closer look at PMI in order to capitalize on the expected growth and potential upside. The company’s strong portfolio of brands and its international presence are likely to support its future performance, making it a good long-term investment option.

Recent Posts