Whitehaven Coal Monitors Maules Creek Site in March 2023.

March 29, 2023

Trending News 🌥️

Whitehaven Coal ($ASX:WHC) is set to monitor their Maules Creek Site in March 2023, as part of their ongoing commitment to the environment and the local community. On March 27, 2023, a team of Whitehaven Coal representatives will visit the Maules Creek Site with the purpose of evaluating the conservation, rehabilitation and reclamation activities that have been in place for more than a decade. The monitoring event will involve a thorough review of landforms, watercourses, vegetation and soils, as well as a review of noise and dust levels. Whitehaven Coal will also assess how active rehabilitation and biodiversity programs are being managed and applied. This is to ensure that the area is being restored to its former condition, while promoting sustainable mining practices.

Whitehaven Coal’s monitoring of the Maules Creek Site will also include an evaluation of the success and longevity of the land conservation initiatives that have been implemented. These conservation initiatives are designed to protect the local flora and fauna, and promote the sustainability of the environment for future generations. This monitoring event is just one of many initiatives that Whitehaven Coal is taking to ensure that their operations remain sustainable and environmentally responsible in the long term. The company’s commitment to protecting the environment of Maules Creek Site is a reflection of their dedication to the community and their belief in sustainable practices.

Price History

Whitehaven Coal continues to monitor its Maules Creek site in March 2023. So far, the media coverage for the project seem to be mostly neutral. On Monday, the company’s stock opened at AU$6.6 and closed at AU$6.4, a 1.5% drop from its prior closing price of 6.5.

This has been attributed to investor uncertainty surrounding the progress of the Maules Creek project and its potential impacts on the environment and local communities. Whitehaven Coal is continuing to work with stakeholders to ensure that their operations do not have a negative impact on the environment and surrounding communities. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Whitehaven Coal. More…

| Total Revenues | Net Income | Net Margin |

| 7.29k | 3.39k | 46.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Whitehaven Coal. More…

| Operations | Investing | Financing |

| 4.55k | -232.86 | -1.79k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Whitehaven Coal. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 7.71k | 2.66k | 5.68 |

Key Ratios Snapshot

Some of the financial key ratios for Whitehaven Coal are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 51.3% | 116.2% | 66.8% |

| FCF Margin | ROE | ROA |

| 59.6% | 65.7% | 39.5% |

Analysis

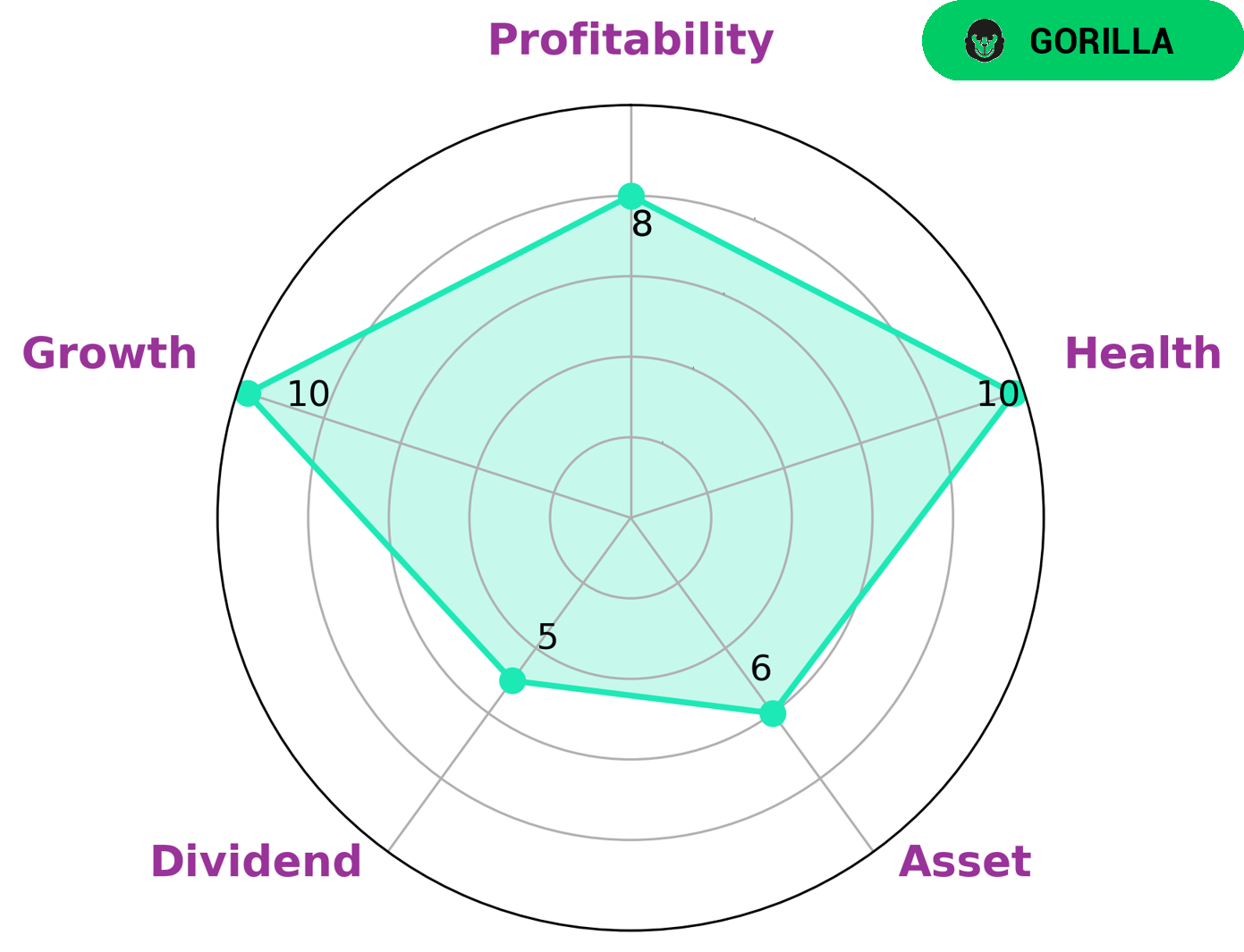

This means that it has achieved stable and high revenue or earning growth due to its strong competitive advantage. Investors who are interested in such companies would benefit from the strong growth, profitability, and medium asset and dividend scores of WHITEHAVEN COAL. In addition, the star chart gives it a health score of 10/10 with regard to its cashflows and debt, giving us confidence that it can sustain future operations in times of crisis. More…

Peers

Whitehaven Coal Ltd is one of the major players in the coal industry and is fiercely competing with its competitors – New Hope Corp Ltd, China Shenhua Energy Co Ltd and Guizhou Panjiang Refined Coal Co Ltd – to gain market share. As the demand for coal continues to rise, these companies are engaged in a fierce battle to become the top supplier in the industry.

– New Hope Corp Ltd ($ASX:NHC)

New Hope Corporation Limited is an Australian-based coal mining and energy company. The company engages in the production, transport, and sale of coal and related products. As of 2022, the market capitalization of New Hope Corporation Limited is 5.76 billion dollars. The company’s returns on equity (ROE) stands at 41.11%, indicating that the company is generating a high return on its invested capital. New Hope Corporation Limited is well-positioned to benefit from the increasing demand for energy resources, as it is one of the largest coal producers in Australia.

– China Shenhua Energy Co Ltd ($SHSE:601088)

China Shenhua Energy Co Ltd is a state-owned coal-based energy company with a market cap of 525.32B as of 2022. The company operates in both the production and sale of coal, railway transportation and power generation sectors. The company boasts a Return on Equity of 16.69%, indicating a strong performance and ability to generate returns from shareholders’ investments. China Shenhua Energy Co Ltd is one of the largest coal producers in China and is the world’s largest integrated coal-based energy company.

– Guizhou Panjiang Refined Coal Co Ltd ($SHSE:600395)

Guizhou Panjiang Refined Coal Co Ltd is a China-based company that produces and sells refined coal products in Mainland China. The company has an impressive market capitalization of 14.64 billion as of 2022, which reflects investor confidence in the company’s prospects and its ability to generate returns. Additionally, the company boasts an impressive Return on Equity (ROE) of 15.96%, which is indicative of the company’s ability to generate profits from its existing assets. The company has achieved considerable success in its operations, and is well-positioned to capitalize on future growth opportunities.

Summary

Whitehaven Coal is an Australian coal mining company with operations in New South Wales and Queensland. In March 2023, they will begin monitoring the Maules Creek site. Media coverage of the project has been mostly neutral thus far. For investors, the investment outlook for Whitehaven Coal is positive. The company has strong assets, an experienced management team, and low-cost production.

They are well-positioned to capitalize on expected growth in coal demand, especially from Asia. Furthermore, the company is actively pursuing a strategy of cost savings and efficiency improvements that should result in increased profitability. All these factors combined suggest that Whitehaven Coal could be a good investment for those looking for a long-term, reliable return.

Recent Posts