TERRACOM LIMITED Investors Rebound Despite Loss of AU$312k on AU$1.3m Investment

April 6, 2023

Trending News 🌧️

TERRACOM ($ASX:TER): TerraCom Limited (ASX: TER) is an Australian telecommunications company providing mobile, data and global satellite solutions to both domestic and international customers. Despite a recent loss of AU$312k on their AU$1.3m investment, investors of TerraCom Limited have continued to rebound, with the company’s value increasing by 11%. The loss on the AU$1.3m investment was attributed to the high costs of expansion and a low customer demand, which resulted in a decreased sales revenue. Despite this, TerraCom have seen a steady increase in revenue from their core mobile and domestic data services, leading to the 11% increase in value of the company. The investors of TerraCom Limited have remained confident, with the company taking a number of steps to ensure that the company remains profitable in the future.

These steps include increasing their customer base, improving customer service and expanding their products and services into international markets. Overall, despite their recent losses, TerraCom Limited investors have been able to rebound due to the company’s increased value and confidence in the future of the business. With the right strategy, TerraCom could be a profitable and successful company in the long-term.

Share Price

This was evidenced by the stock price opening at AU$0.6 and closing at AU$0.7, a 4.0% rise from the previous closing price of AU$0.6. This rebound indicates investor confidence in the company’s ability to recoup losses despite the setback. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Terracom Limited. More…

| Total Revenues | Net Income | Net Margin |

| 847.51 | 324.24 | 38.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Terracom Limited. More…

| Operations | Investing | Financing |

| 455.63 | 23.9 | -396.3 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Terracom Limited. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 412.42 | 246.91 | 0.21 |

Key Ratios Snapshot

Some of the financial key ratios for Terracom Limited are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 38.4% | 230.9% | 63.4% |

| FCF Margin | ROE | ROA |

| 52.8% | 215.7% | 81.4% |

Analysis

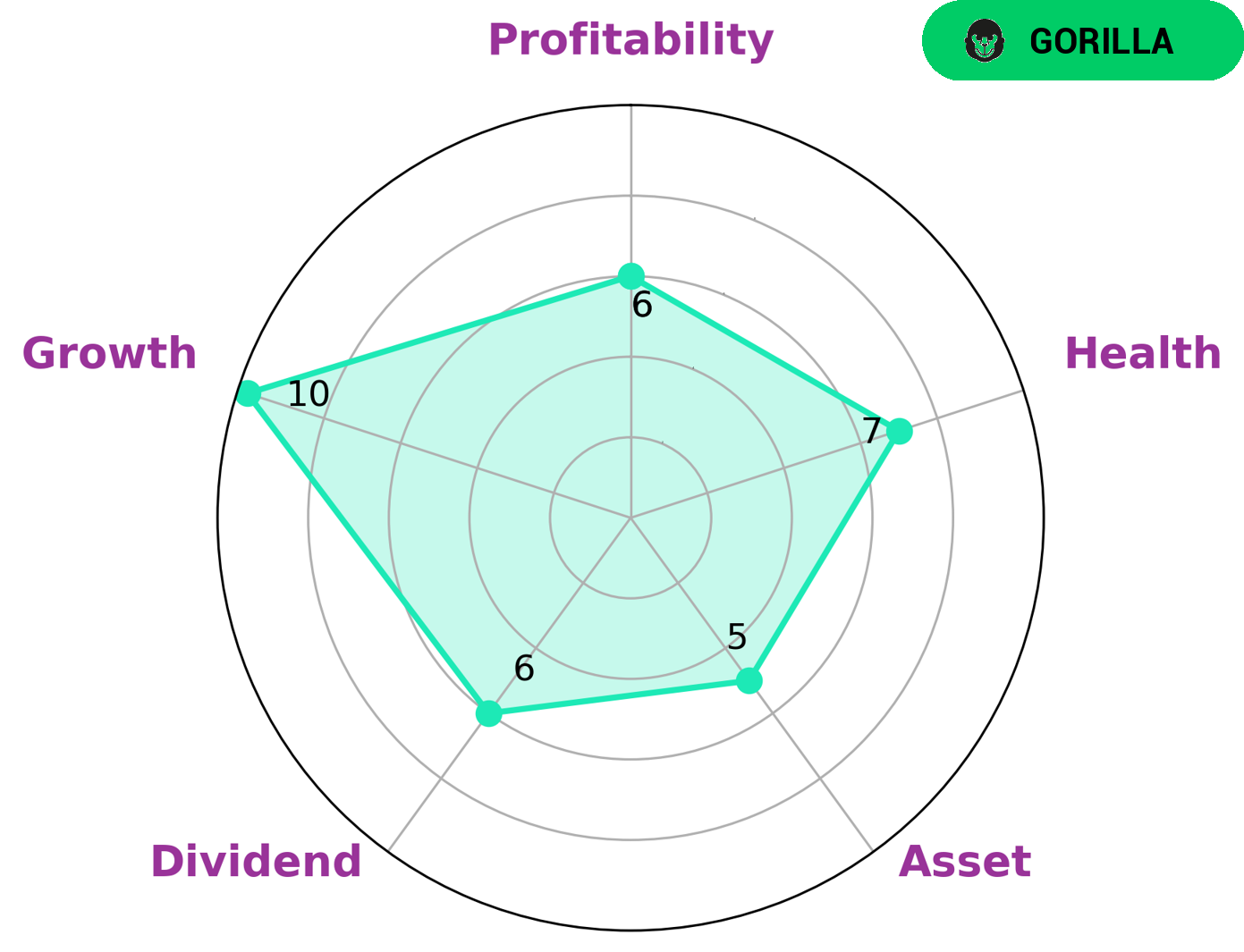

GoodWhale conducted an analysis of TERRACOM LIMITED‘s fundamentals and used a Star Chart to evaluate its performance. The results indicated that TERRACOM LIMITED is strong in growth and medium in asset, dividend, and profitability. It also received a high health score of 7/10 with regard to its cashflows and debt, indicating that it is capable of riding out any crisis without the risk of bankruptcy. We classified TERRACOM LIMITED as ‘gorilla’, a type of company that achieves stable and high revenue or earning growth due to its strong competitive advantage. Investors who are looking for long-term growth potential with minimal risk may find TERRACOM LIMITED to be an interesting investment opportunity. More…

Peers

The company operates the Blair Athol Mine in Central Queensland, one of Australia’s largest and most modern thermal coal mines. TerraCom also owns and operates the nearby Isaac Plains Mine. TerraCom’s main competitors are Yancoal Australia Ltd, White Energy Co Ltd, AustChina Holdings Ltd. All three companies are also listed on the ASX and are engaged in the business of mining and selling thermal coal.

– Yancoal Australia Ltd ($ASX:YAL)

Coal mining is the process of extracting coal from the ground. Coal is valued for its energy content and since the 1880s, has been widely used to generate electricity. Steel and cement industries use coal as a fuel for extraction of iron from iron ore and for cement production. In the United Kingdom and South Africa, a coal mine and its structures are a colliery, a coal mine is a ‘pit’, and the above-ground structures are a ‘pit head’. In Australia, “colliery” generally refers to an underground coal mine.

Yancoal Australia Ltd is an Australian coal mining company that is majority owned by the Chinese company Yanzhou Coal Mining Company Limited. The company operates mines in New South Wales, Queensland and Western Australia.

Yancoal Australia Ltd had a market capitalisation of A$7.33 billion as of May 2020. The company’s return on equity was 38.12% for the 2019 financial year.

– White Energy Co Ltd ($ASX:WEC)

White Energy Co Ltd is a coal company that operates primarily in Australia and the United States. The company has a market capitalization of 12.37 million as of 2022 and a return on equity of -411.54%. White Energy Co Ltd produces a range of thermal and metallurgical coal products. Its thermal coal is used in power generation, while its metallurgical coal is used in steelmaking. The company’s operations are focused on the production of high-quality, low-ash thermal coal and low- phosphorous, high-grade metallurgical coal. White Energy Co Ltd also owns and operates a coal-to-liquids plant in the United States.

– AustChina Holdings Ltd ($ASX:AUH)

AustChina Holdings Ltd is a holding company that operates in the financial sector. The company has a market capitalization of 13.24M as of 2022 and a return on equity of 0.62%. AustChina Holdings Ltd operates in the following segments: banking, insurance, asset management, and other financial services. The company offers a range of banking products and services to retail and corporate customers in China. These include savings accounts, time deposits, personal loans, credit cards, and foreign exchange services. The company also provides a range of insurance products, including life, health, and property and casualty insurance. In addition, AustChina Holdings Ltd offers asset management services to institutional and individual investors. The company was founded in 2006 and is headquartered in Beijing, China.

Summary

Terracom Limited (ASX:TER) is a mining and resources company based in Australia. Investors have been keeping an eye on the stock since the company reported positive news, causing the stock price to rise 11%. Despite the stock increasing, insiders are still reporting a loss of AU$312k on their AU$1.3m investment.

Analysts believe that the company has potential for growth in the future, but investors should also be wary of any risks associated with this stock. As such, investors should consider their individual financial goals and risk appetite before investing in Terracom Limited.

Recent Posts