Hallador Energy Company: Demand for ‘Black Gold’ Reaches Record Highs

May 25, 2023

Trending News ☀️

Hallador Energy ($NASDAQ:HNRG) Company is a coal-mining and energy production corporation that is based in Indiana. Hallador Energy has seen its demand for coal increase significantly over the last few years, as many countries look to coal to remain a key energy source. Hallador Energy’s stock has been steadily rising due to this increased demand, making it a great investment opportunity for those looking to benefit from the “black gold” boom. American Resources is another coal producer that is based in Kentucky. American Resources has long focused on clean coal production and renewable energy sources, which has helped them stand out from other coal producers. It is no surprise that its stock has also seen an increase in demand due to the rise in coal demand. When comparing Hallador Energy Company and American Resources, it is important to consider which company offers the most reliable source of this valuable commodity. Hallador Energy’s long-standing experience in the coal production industry makes them more reliable than American Resources, which is still relatively new to the industry.

Additionally, Hallador Energy is focusing on expansion, whereas American Resources is focusing on sustainability and innovation. Ultimately, both companies have seen an increase in demand for their stock due to the rise in coal production, but Hallador Energy Company offers more stability and reliability than American Resources.

Market Price

On Wednesday, HALLADOR ENERGY Company saw its stock open at $8.7 and close at $8.5, a 3.5% decrease from the previous closing price of 8.8. This drop in share value comes as demand for ‘black gold’ reaches record highs, despite the current market conditions. In recent years, HALLADOR ENERGY Company has made efforts to capitalize on the rising demand for oil and natural gases across the globe.

With the introduction of new technologies and processes to increase production, the company has been able to keep up with the rising demand. As such, despite the decrease in share value, HALLADOR ENERGY remains a leader in the industry and is well-positioned for success in the coming months. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Hallador Energy. More…

| Total Revenues | Net Income | Net Margin |

| 491.42 | 50.29 | 10.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Hallador Energy. More…

| Operations | Investing | Financing |

| 77.3 | -57.88 | -20.65 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Hallador Energy. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 616.63 | 379.44 | 7.16 |

Key Ratios Snapshot

Some of the financial key ratios for Hallador Energy are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 18.7% | 75.3% | 13.2% |

| FCF Margin | ROE | ROA |

| 3.8% | 17.9% | 6.6% |

Analysis

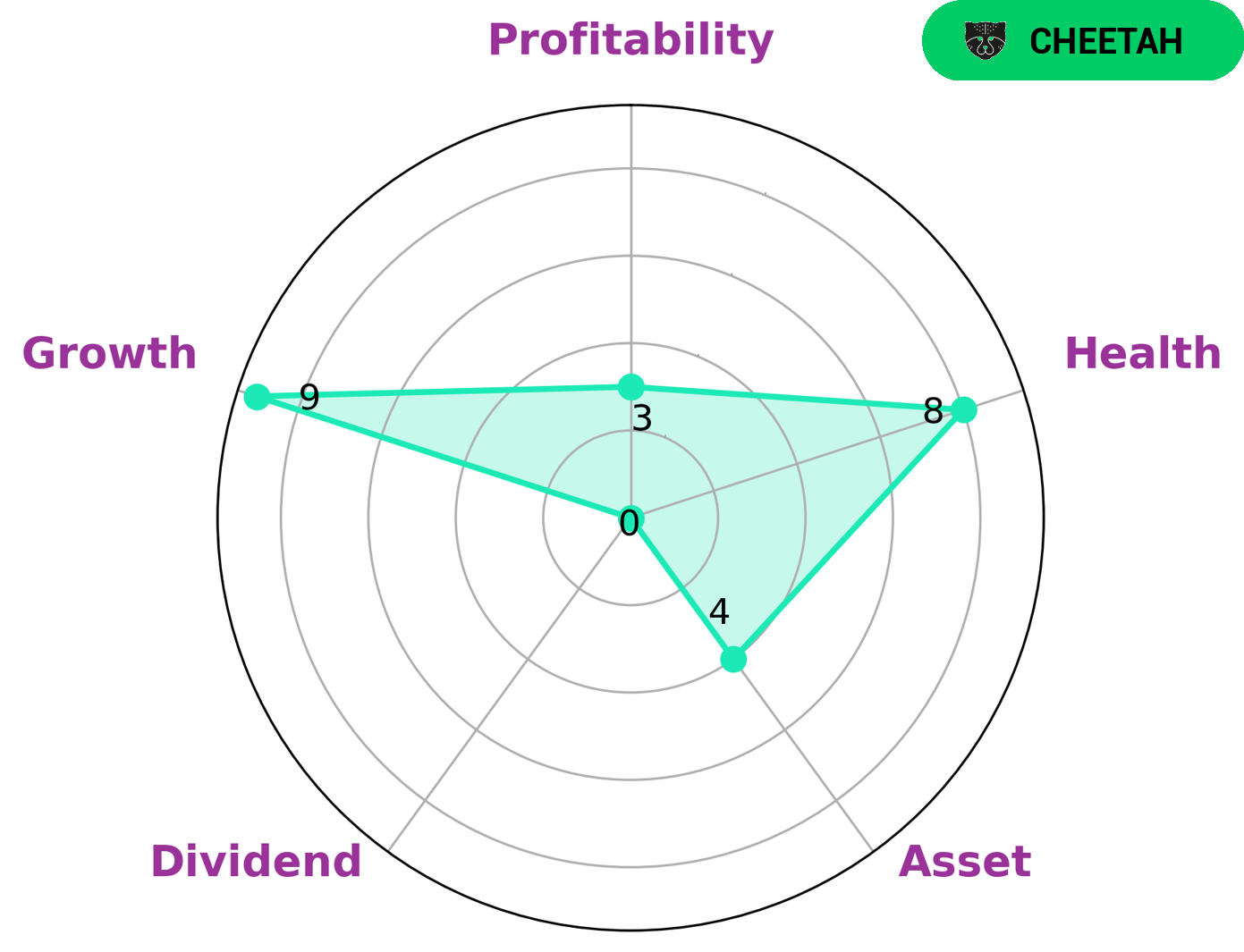

GoodWhale has assessed the wellbeing of HALLADOR ENERGY to be high, scoring 8/10 on our Star Chart. This indicates that HALLADOR ENERGY has strong cash flows and low debt, allowing the company to weather any crisis without the risk of bankruptcy. HALLADOR ENERGY is classified as a ‘cheetah’ type company, meaning it has achieved high revenue or earnings growth but has lower profitability compared to other companies. This type of company may be attractive to investors interested in a higher return on their investments. In terms of asset type, HALLADOR ENERGY is rated as medium, but is weak in dividend and profitability. Investors looking for a high return on their investments should take these factors into consideration when evaluating HALLADOR ENERGY’s potential. More…

Peers

In the coal industry, there is intense competition between Hallador Energy Co and its competitors: Semirara Mining and Power Corp, Inner Mongolia Dian Tou Energy Corp Ltd, Banpu PCL. All four companies are fighting for market share in the global coal industry. While Hallador Energy Co has a strong presence in the United States, the other three companies are based in Asia and have a large market share in Asia.

– Semirara Mining and Power Corp ($PSE:SCC)

As of 2022, Semirara Mining and Power Corp has a market cap of 130.49B and a Return on Equity of 38.96%. The company is engaged in mining and power generation. It is the largest coal producer in the Philippines and the only power producer in the country that uses coal as its primary fuel. The company operates the largest coal mine in the country, which is located in the province of Antique.

– Inner Mongolia Dian Tou Energy Corp Ltd ($SZSE:002128)

Inner Mongolia Dian Tou Energy Corp Ltd is a Chinese energy company with a market cap of 25.25B as of 2022. The company’s return on equity is 16.76%. Dian Tou Energy is engaged in the business of coal mining, washing, processing and sales, as well as power generation. The company has a coal reserve of 3.6 billion tons and a production capacity of 10 million tons per year.

– Banpu PCL ($SET:BANPU)

Banpu Public Company Limited is a Thai-based coal mining and power generation company. The Company’s business operations include coal mining and power generation. It operates coal mines in Thailand, Indonesia, Australia and China, and has coal-fired power plants in Thailand, China and Indonesia. The Company’s products include thermal coal, which is used in power generation, and coking coal, which is used in steel production. As of December 31, 2011, the Company had a total coal reserve of 1,046 million tons.

Summary

Hallador Energy is a coal producing company that has seen increasing demand for its product in recent years. Its stock price has been volatile in the face of changing market conditions. Investors should consider the macroeconomic factors driving demand and watch for potential catalysts such as new contracts and increased production to determine whether Hallador represents a good buying opportunity. Additionally, investors should compare Hallador to competitors and analyze the company’s financial statement to ensure it is financially sound.

Recent Posts