BlackRock Reduces Stake in CONSOL Energy, Holding 5.15MM Shares.

February 3, 2023

Trending News ☀️

CONSOL ($NYSE:CEIX) Energy Inc. is a leading energy producer and supplier in the United States, with operations in the Appalachian Basin and western states. The company operates coal mining and natural gas production assets and is one of the largest producers of coal in the U.S. In addition, it provides integrated energy services to its customers through its subsidiaries. Recently, Fintel reported that BlackRock has reduced its stake in CONSOL Energy Inc. by filing a 13G form with the SEC, which discloses its ownership of 5.15MM shares. Although BlackRock has reduced its stake in CONSOL Energy Inc., it still holds a significant amount of shares in the company. Analysts believe that the reduction of BlackRock’s stake could be due to a number of factors, such as changing market conditions or the company’s overall performance. It is also possible that BlackRock may be looking to invest in other companies or industries instead. Overall, BlackRock’s decision to reduce its stake in CONSOL Energy Inc. does not necessarily indicate any major changes for the company or its stock price.

However, it is important for investors to keep an eye on how the company performs in the near future, as well as any potential investment decisions from large institutional investors.

Share Price

On Thursday, BlackRock announced that it had reduced its stake in CONSOL ENERGY, holding 5.15MM shares at the time of writing. This news had a mostly positive media sentiment, and the CONSOL ENERGY stock opened at $56.9 and closed at $58.0, up by 2.7% from the prior closing price of 56.5. The increase in the stock price seems to indicate that investors are still confident about the company’s performance and potential for growth. CONSOL ENERGY is an energy company focused on natural gas production, coal mining, and oil and gas exploration. It has made several acquisitions and mergers over the years, and its current operations span across four continents. In recent years, it has been diversifying its operations and investments to include renewable energy sources such as wind and solar energy. The company has been investing in research and development to make its operations more efficient and sustainable. It has also been investing in new technologies that could help reduce costs and increase the efficiency of its operations.

Additionally, CONSOL ENERGY has been expanding its customer base, as well as its presence in new markets. Overall, the news of BlackRock reducing its stake in CONSOL ENERGY seems to be a positive sign for the company’s future prospects. Despite the reduction, investors still seem to have confidence in the company’s ability to perform well in the long-term. As such, CONSOL ENERGY may be well-positioned to capitalize on the growing demand for energy sources in the future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Consol Energy. More…

| Total Revenues | Net Income | Net Margin |

| 2.01k | 391.29 | 23.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Consol Energy. More…

| Operations | Investing | Financing |

| 552.11 | -152.07 | -291.7 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Consol Energy. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.72k | 1.81k | 26.28 |

Key Ratios Snapshot

Some of the financial key ratios for Consol Energy are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 12.2% | 52.9% | 27.5% |

| FCF Margin | ROE | ROA |

| 19.4% | 40.2% | 12.6% |

Analysis

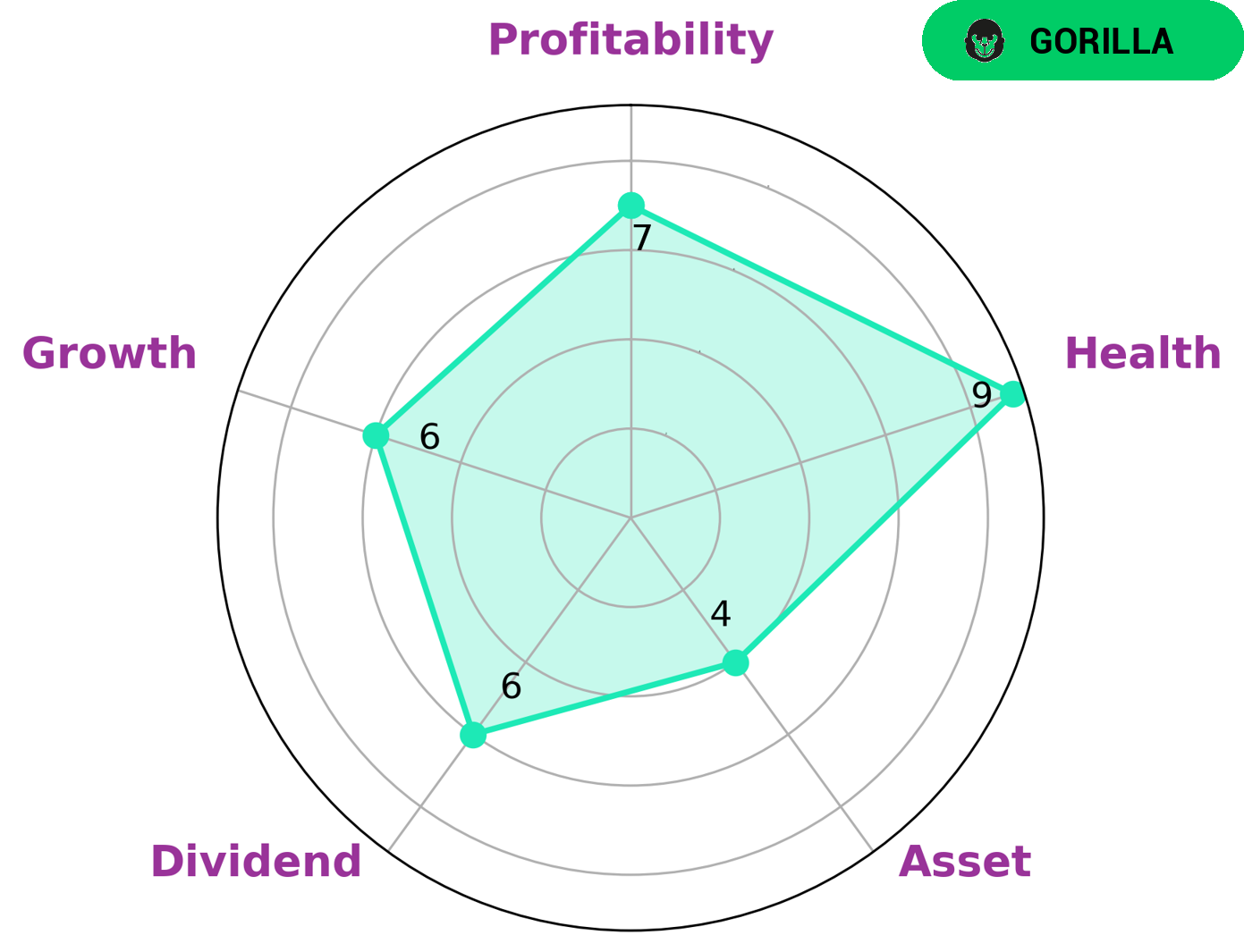

Investors who are looking for companies with strong competitive advantages and a history of stable and high revenue or earning growth may be interested in CONSOL ENERGY. GoodWhale’s analysis of the company reveals that it is classified as a ‘gorilla’, and has a high health score of 9/10. This score is based on its cashflows and debt and indicates that the company is capable to pay off debt and fund future operations. In terms of fundamentals, CONSOL ENERGY has a strong profitability rating, and medium ratings for asset, dividend, and growth. This indicates that the company has a competitive advantage in terms of profitability, and may have opportunities for growth in the future. Overall, CONSOL ENERGY is an attractive option for investors who are looking for companies with strong competitive advantages and a history of stable and high revenue or earning growth. The company also has strong fundamentals that suggest it has the ability to fund future operations and create value for shareholders. More…

Peers

The company’s competitors include PT Prima Andalan Mandiri Tbk, NACCO Industries Inc, and PT Delta Dunia Makmur Tbk.

– PT Prima Andalan Mandiri Tbk ($IDX:MCOL)

In 2022, PT Prima Andalan Mandiri Tbk had a market capitalization of 25.6 trillion rupiah and a return on equity of 66.4%. The company is a leading Indonesian provider of integrated logistics solutions. It offers a wide range of services, including transportation, warehousing, and distribution. The company has a strong focus on customer service and has a reputation for reliability and efficiency.

– NACCO Industries Inc ($NYSE:NC)

NACCO Industries, Inc. is a holding company, which engages in the mining, and consumer and industrial products businesses. It operates through the following segments: Mining, Consumer Products, and Industrial Products. The Mining segment comprises of coal mining operations. The Consumer Products segment consists of small appliances, specialty housewares, and gourmet cookware. The Industrial Products segment covers material handling products and other industrial equipment. The company was founded by Sherman Conger in 1919 and is headquartered in Cleveland, OH.

– PT Delta Dunia Makmur Tbk ($IDX:DOID)

Delta Dunia Makmur Tbk has a market cap of 3.18T as of 2022, a Return on Equity of 26.49%. The company is a leading provider of coal mining services in Indonesia. It is the largest producer of thermal coal in Indonesia and supplies coal to power plants and industrial customers in Indonesia and abroad.

Summary

This indicates that investors may be looking to capitalize on the positive sentiment surrounding CONSOL Energy, as media sources are generally optimistic about the company’s future. Investors should consider researching the company further, as CONSOL Energy has a portfolio of natural gas and coal assets that could offer attractive returns if it continues to perform well. Additionally, the company’s strategy of focusing on innovation and cost-cutting could be beneficial for investors in the long run. Ultimately, investors should weigh the potential risks and rewards before making an investment decision.

Recent Posts