Verizon Beats Q1 Earnings Estimates with Revenue of $32.9 Billion

April 26, 2023

Trending News 🌥️

Verizon Communications ($NYSE:VZ) Inc. is a global leader in delivering communications, information and entertainment for both consumers and businesses. This allowed Verizon to maintain a strong balance sheet, which will be key in the current economic climate.

Additionally, Verizon has recently made moves to cut costs and increase efficiencies, including workforce reductions and closing or consolidating its retail stores. Overall, these positive results show that Verizon continues to be a leader in the telecom industry. With its strong balance sheet and cost-cutting efforts in place, the company is well-positioned to weather the economic storm in the coming months.

Price History

VERIZON COMMUNICATIONS stock opened at $36.7 and closed at $37.3, up by 0.5% from its last closing price of 37.1. This is a promising sign for the company as it shows investors remain confident in the future prospects of the business. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Verizon Communications. More…

| Total Revenues | Net Income | Net Margin |

| 136.84k | 21.26k | 16.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Verizon Communications. More…

| Operations | Investing | Financing |

| 37.14k | -28.66k | -8.53k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Verizon Communications. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 379.68k | 287.22k | 20.83 |

Key Ratios Snapshot

Some of the financial key ratios for Verizon Communications are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 1.2% | -0.0% | 23.3% |

| FCF Margin | ROE | ROA |

| 7.6% | 22.3% | 5.2% |

Analysis

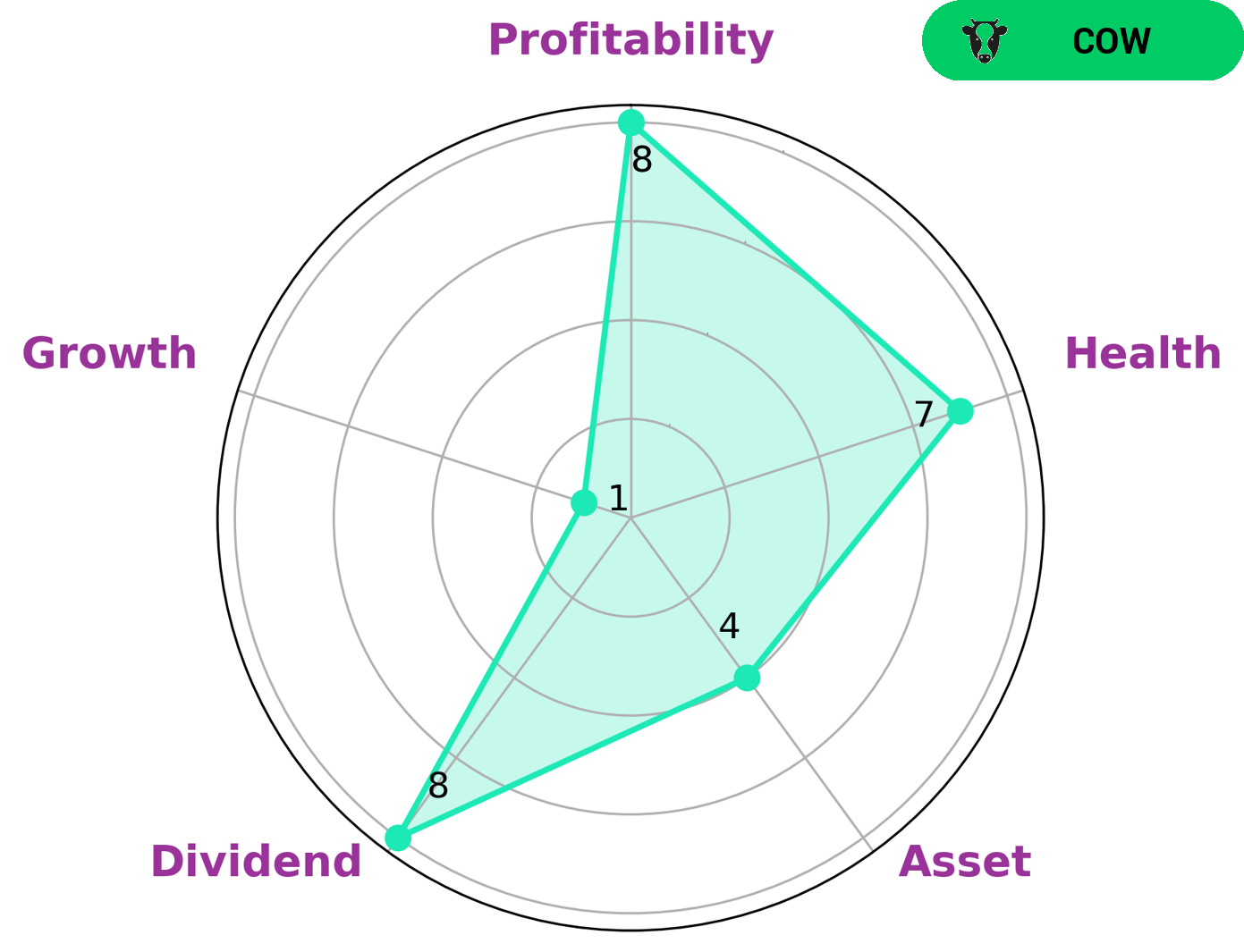

GoodWhale’s analysis of VERIZON COMMUNICATIONS‘s wellbeing classified the company as a ‘cow’, which is a type of company with a track record of paying out consistent and sustainable dividends. This makes it appealing to investors who are looking for reliable returns and dividend income. Our Star Chart analysis further revealed that VERIZON COMMUNICATIONS is strong in dividend, profitability, and medium in asset, while being weak in growth. Despite its weaknesses, VERIZON COMMUNICATIONS has a high health score of 7/10, indicating that it is capable to sustain future operations in times of crisis and has strong cashflows and debt. Therefore, investors looking for reliable returns and dividend income can invest in VERIZON COMMUNICATIONS with confidence. More…

Peers

Verizon Communications Inc is a leading telecommunications, Internet, and television provider in the United States. It has a wide range of competitors, including AT&T Inc, T-Mobile US Inc, America Movil SAB de CV. Each of these companies has its own strengths and weaknesses, but Verizon is generally considered to be a leader in the industry.

– AT&T Inc ($NYSE:T)

AT&T Inc. is an American multinational conglomerate holding company headquartered at Whitacre Tower in Downtown Dallas, Texas. It is the world’s largest telecommunications company, the second largest provider of mobile telephone services, and the largest provider of fixed telephone services in the United States through AT&T Communications. Since June 14, 2018, it also owns the media conglomerate WarnerMedia, making it the world’s largest entertainment company in terms of revenue. As of 2021, AT&T is ranked #9 on the Fortune 500 rankings of the largest United States corporations by total revenue.

AT&T Inc. has a market cap of 110.74B as of 2022 and a Return on Equity of 12.91%. AT&T is the world’s largest telecommunications company and the second largest provider of mobile telephone services. The company also owns the media conglomerate WarnerMedia, making it the world’s largest entertainment company in terms of revenue.

– T-Mobile US Inc ($NASDAQ:TMUS)

T-Mobile US, Inc., together with its subsidiaries, provides mobile communications services in the United States, Puerto Rico, and the U.S. Virgin Islands. The company offers voice, messaging, and data services to approximately 79 million customers as of the end of 2019. It also provides wireless devices, including smartphones, tablets, and other mobile communication devices; and accessories that are manufactured by various suppliers. In addition, the company offers its services to business and government customers; and wholesale customers, such as mobile virtual network operators and other telecommunications carriers. T-Mobile US, Inc. was founded in 1994 and is headquartered in Bellevue, Washington.

– America Movil SAB de CV ($OTCPK:AMXVF)

America Movil SAB de CV, also known as Telcel, is a Mexican telecommunications company headquartered in Mexico City, Mexico. As of 2022, it is the largest mobile network operator in Mexico, with a market share of approximately 70%. Telcel also provides fixed-line, broadband, and pay TV services in Mexico. The company was founded in 1972 and is a subsidiary of America Movil.

Summary

The Verizon Media segment also saw a 2% year-over-year increase in total revenues, driven by strong growth in advertising and content revenue. Overall, the company appears well positioned to benefit from the continued growth of its core businesses and the opportunities available in adjacent markets. Investors should consider Verizon Communications stock, as it may be well positioned to benefit from favorable industry trends and its strategic investments in new technology and services.

Recent Posts