T-Mobile Soars to Record High with Ninth Consecutive Gains

December 13, 2023

☀️Trending News

T-MOBILE ($NASDAQ:TMUS): T-Mobile US, Inc. is a leading mobile services provider in the United States that offers its customers innovative wireless products and services. Its stock has been soaring higher in recent weeks, with the company set to close at a record high for its ninth consecutive session of gains. This strong performance is based on a number of factors, including the company’s continued expansion of its 5G network, as well as the launch of new products and services. The company has made substantial investments in 5G technology, which has made it a leader in the wireless industry. This has allowed them to provide customers with access to faster speeds and lower latency, resulting in an improved user experience. In addition to their 5G network, T-Mobile has launched several new products and services that are designed to improve customer satisfaction.

These include the launch of their TVision home entertainment service, along with their unlimited home internet service and their T-Mobile Home Internet plan. The company also introduced a new prepaid option that allows customers to save money on their monthly bills. T-Mobile continues to make strides in the wireless industry, including the acquisition of Sprint earlier this year. This will allow the company to expand its network coverage even further, providing customers with even greater access to fast, reliable, and secure wireless services. All these efforts have resulted in strong performance for T-Mobile as its stock has soared to a record high close for its ninth consecutive session of gains.

Share Price

On Monday, T-MOBILE US stock opened at $158.0 and closed at $158.8, setting a new record high and marking its ninth consecutive gain. The increase in stock value is an optimistic outlook for investors, indicating that T-Mobile’s future may be even brighter than its current success. Analysts believe that the recent developments in 5G technology, including T-Mobile’s first 5G network in the United States, are largely responsible for the company’s positive stock performance. As T-Mobile continues to expand its presence in the 5G market, investors are expecting further increase in stock value over the coming weeks. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for T-mobile Us. More…

| Total Revenues | Net Income | Net Margin |

| 78.35k | 7.78k | 9.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for T-mobile Us. More…

| Operations | Investing | Financing |

| 18.04k | -6.76k | -13.06k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for T-mobile Us. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 208.58k | 143.88k | 55.94 |

Key Ratios Snapshot

Some of the financial key ratios for T-mobile Us are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 9.3% | 27.2% | 17.3% |

| FCF Margin | ROE | ROA |

| 7.9% | 13.0% | 4.1% |

Analysis

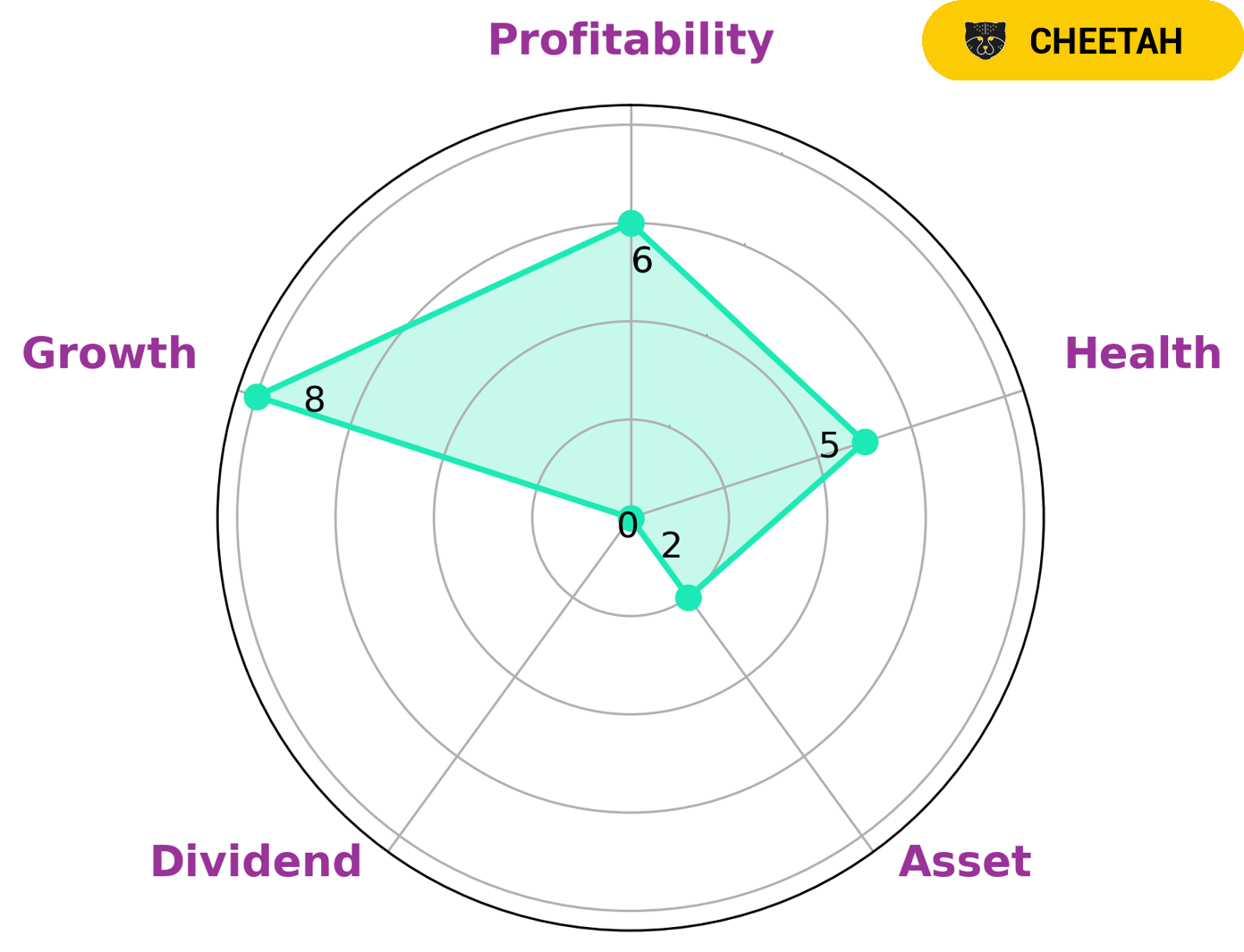

GoodWhale has performed an analysis of T-MOBILE US‘s financials, and based on the Star Chart classification of ‘cheetah’, we have concluded that this company has achieved high revenue or earnings growth but is considered less stable due to lower profitability. Investors who may be interested in such a company would likely be looking for growth opportunities but would be comfortable taking on more risk. T-MOBILE US is strong in growth, medium in profitability, and weak in asset and dividend, but has an intermediate health score of 5/10 with regard to its cashflows and debt, suggesting that it is likely to sustain future operations in times of crisis. More…

Peers

The competition between T-Mobile US Inc and its competitors is fierce. AT&T Inc, Verizon Communications Inc, and Lumen Technologies Inc are all trying to gain market share in the wireless carrier industry. T-Mobile US Inc has been able to gain some ground on its competitors by offering innovative plans and features that appeal to customers.

– AT&T Inc ($NYSE:T)

AT&T Inc. is an American multinational conglomerate holding company headquartered at Whitacre Tower in Downtown Dallas, Texas. It is the world’s largest telecommunications company, the second largest provider of mobile telephone services, and the largest provider of fixed telephone services in the United States through AT&T Communications. Since June 14, 2018, it is also the parent company of mass media conglomerate WarnerMedia, making it the world’s largest entertainment company in terms of revenue. As of 2019, AT&T is ranked #9 on the Fortune 500 rankings of the largest United States corporations by total revenue.

AT&T Inc. has a market capitalization of $129.91 billion as of 2022 and a return on equity of 17.05%. The company is the world’s largest telecommunications company and the second largest provider of mobile telephone services. AT&T Inc. is also the largest provider of fixed telephone services in the United States through AT&T Communications. The company’s mass media subsidiary, WarnerMedia, makes AT&T the world’s largest entertainment company in terms of revenue.

– Verizon Communications Inc ($NYSE:VZ)

Verizon Communications Inc. is an American multinational telecommunications conglomerate and a corporate component of the Dow Jones Industrial Average. The company has a market cap of 156.95B as of 2022 and a Return on Equity of 20.79%. Verizon is one of the largest telecommunications companies in the world, with operations in the United States, Canada, and Europe. The company offers a variety of services, including voice, data, and video. Verizon also provides a variety of other services, such as directory assistance, high-speed Internet, and long distance calling. In addition, Verizon offers a variety of wireless services, including voice, text, and data.

– Lumen Technologies Inc ($NYSE:LUMN)

Lumen Technologies is a leading provider of data, networking and communications services. The company has a market cap of 7.6 billion as of 2022 and a return on equity of 20.85%. The company’s products and services include data center and cloud services, enterprise networking, and communications and collaboration solutions. Lumen Technologies also provides managed services, professional services and support services. The company serves customers in more than 150 countries.

Summary

T-Mobile US has been on an impressive streak, having gained nine consecutive sessions and closing in on an all-time high. Analysts are bullish on the company’s stock, citing its successful marketing strategies and robust financial performance. Additionally, its 5G network rollout, which is expected to drive further growth, has been seen as a positive development. Analysts believe that T-Mobile US has the potential to continue to outperform the market, and recommend investors add the stock to their portfolio.

Recent Posts