Shenandoah Telecommunications Stock Sees 47% Discount

January 30, 2023

Trending News 🌥️

Shenandoah Telecommunications ($NASDAQ:SHEN) Company, commonly referred to as Shentel, is a publicly traded telecommunications company based in Edinburg, Virginia. Recently, the stock of Shenandoah Telecommunications has seen a 47% discount, leaving many investors wondering if this decline is warranted. The decline in Shentel’s stock price is due to several factors. Firstly, the industry is extremely competitive and Shentel is facing stiff competition from other large telecommunications companies.

Additionally, the company has seen significant revenue declines due to declines in landline subscribers and decreased demand for its products and services. Finally, the company has suffered from a weak balance sheet, with high levels of debt and a declining cash position. Despite the discount in Shentel’s stock price, the company is still a good long-term investment for investors looking for growth potential. Shentel’s competitive advantage lies in its ability to offer competitive pricing and high-quality services to its customers. Additionally, the company is well-positioned to benefit from the growth of the wireless telecommunications industry and the increased demand for broadband services. In conclusion, while Shenandoah Telecommunications Company’s stock has seen a 47% discount recently, investors should not be concerned about this decline. The company still presents an attractive opportunity for investors looking for long-term growth potential and should be considered as an investment option. Furthermore, the company’s investments in new technologies should help it remain competitive in the industry.

Share Price

Shenandoah Telecommunications (SHENANDOAH TELECOMMUNICATIONS) stock has seen an impressive 47% discount over the last few months. News coverage of the company has been mostly mixed, with some analysts praising its business strategy and others raising concerns about its financial standing. On Monday, SHENANDOAH TELECOMMUNICATIONS stock opened at $18.5 and closed at $19.0, up by 2.3% from its previous closing price of 18.6. This modest increase may indicate that the stock is stabilizing and investors are gaining confidence in its future prospects. The company’s recent performance has been a mixed bag, with some positive developments such as a successful merger with nTelos Wireless, as well as some worrisome signals such as a jump in customer cancellations. Despite these issues, the company is still well-positioned to capitalize on the growing demand for wireless and internet services in rural areas.

Its recent acquisition of ClearSky Technologies has given it a foothold in the lucrative small-cell market, and its investment in fiber-optic networks will help it meet the demands of an increasingly connected world. The long-term outlook for SHENANDOAH TELECOMMUNICATIONS appears to be positive. Its recent performance may have been volatile, but its strong position in the market and its commitment to innovation should help it weather any short-term storms. For investors looking for a bargain, SHENANDOAH TELECOMMUNICATIONS stock may be worth considering. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Shenandoah Telecommunications. More…

| Total Revenues | Net Income | Net Margin |

| 259.96 | -5.16 | 5.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Shenandoah Telecommunications. More…

| Operations | Investing | Financing |

| -347.37 | -171.75 | 19.61 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Shenandoah Telecommunications. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 922.46 | 279.95 | 12.83 |

Key Ratios Snapshot

Some of the financial key ratios for Shenandoah Telecommunications are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -25.7% | -61.6% | 2.2% |

| FCF Margin | ROE | ROA |

| -200.4% | -0.1% | -0.1% |

VI Analysis

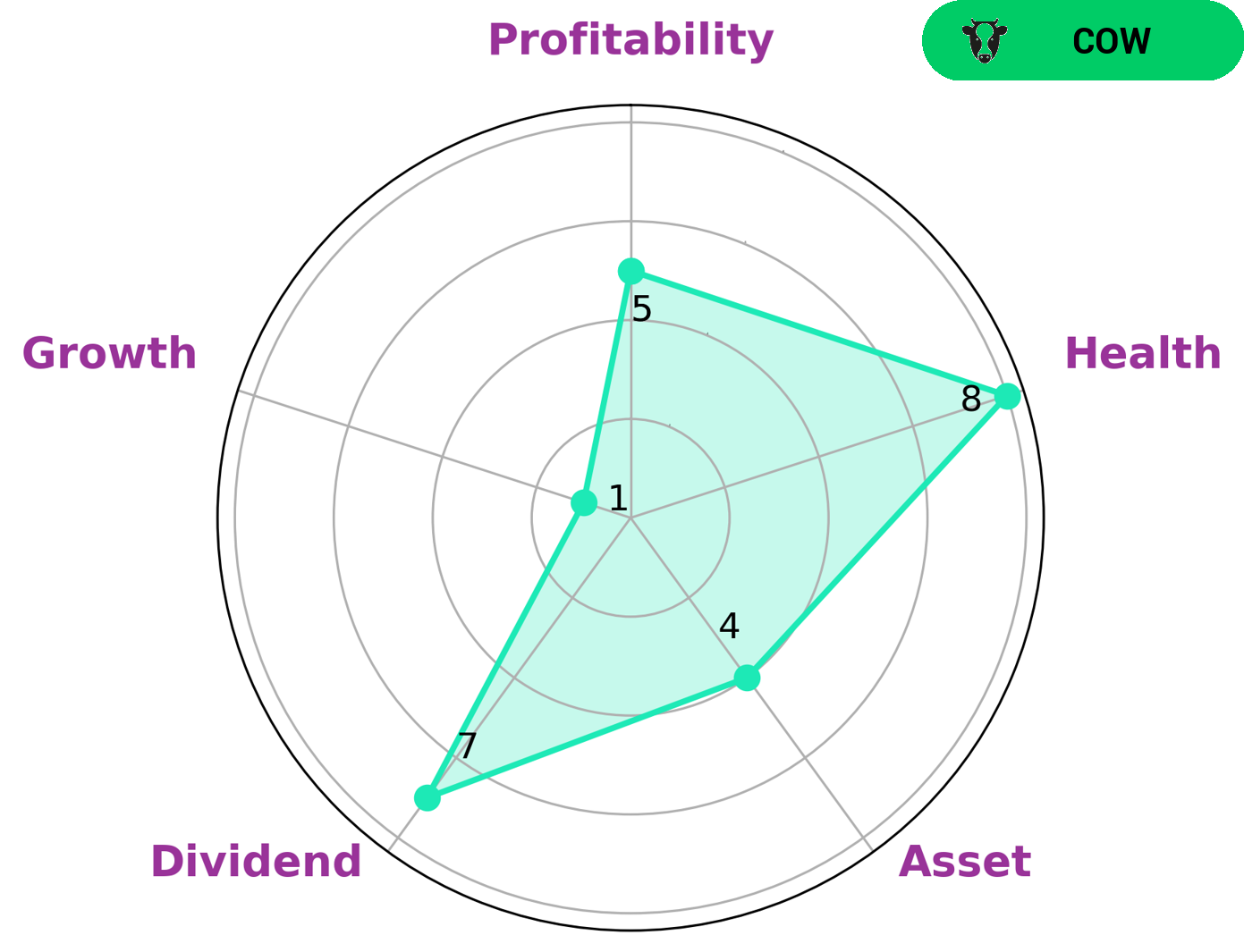

Shenandoah Telecommunications Company is an attractive investment option for those looking for a reliable and consistent dividend yield. Through the use of the VI Star Chart, it has been classified as a ‘cow’, representing a company with a solid track record of paying out dividends. Furthermore, Shenandoah Telecommunications Company has a high health score of 8 out of 10, indicating its ability to sustain future operations in times of crisis. When it comes to performance metrics, Shenandoah Telecommunications Company is strong in dividends, medium in assets, profitability and weak in growth. Investors that are looking for consistent returns with minimal risk would find Shenandoah Telecommunications Company as a strong candidate. Its fundamentals reflect its long-term potential, making it a secure option for investors seeking steady returns. Aside from its dividend yielding capabilities, Shenandoah Telecommunications Company is also a good choice for those looking for a low-risk option. With a high health score and a track record of consistent dividend payments, it is a safe investment option for those who want to minimize their risks. Its low-risk profile makes it an attractive option for investors who want to minimize their risks while still generating returns. Its high health score indicates that it is capable of sustaining operations even in times of crisis, making it an ideal choice for those looking for long-term stability and sustainability. More…

VI Peers

In the telecommunications industry, Shenandoah Telecommunications Co competes with Swoop Holdings Ltd, PT Link Net Tbk, and AT&T Inc. All four companies offer similar services, including wireless, Internet, and television.

However, each company has its own strengths and weaknesses. For example, Shenandoah Telecommunications Co has a strong presence in rural areas, while AT&T Inc has a strong presence in urban areas.

– Swoop Holdings Ltd ($ASX:SWP)

Swoop Holdings Ltd is a company that provides online marketing and advertising services. The company has a market cap of 74.47M as of 2022 and a Return on Equity of -13.81%. The company’s main business is providing online marketing and advertising services to businesses and individuals. The company also provides other services such as web design, web development, and social media marketing.

– PT Link Net Tbk ($IDX:LINK)

PT Link Net Tbk is an Indonesia-based company engaged in the provision of internet service provider (ISP) and pay television (TV) services. The Company offers its services under the brand names of First Media and Nexmedia. It operates in two segments: ISP and Pay TV. The Company’s ISP segment offers high speed internet access, while its Pay TV segment provides digital TV services. The Company offers its services to residential, small and medium enterprises and corporate customers. As of December 31, 2011, the Company operated in 33 provinces in Indonesia and served approximately 1.5 million subscribers.

– AT&T Inc ($NYSE:T)

AT&T Inc. is an American multinational conglomerate holding company headquartered at Whitacre Tower in Downtown Dallas, Texas. It is the world’s largest telecommunications company, the second largest provider of mobile telephone services, and the largest provider of fixed telephone services in the United States through AT&T Communications. Since June 14, 2018, it is also the parent company of mass media conglomerate WarnerMedia, making it the world’s largest entertainment company in terms of revenue. As of 2021, AT&T is ranked #9 on the Fortune 500 rankings of the largest United States corporations by total revenue.

AT&T Inc. has a market capitalization of 126.06 billion as of 2021 and a return on equity of 12.91%. The company is the world’s largest telecommunications company and the second largest provider of mobile telephone services. AT&T Inc. is also the largest provider of fixed telephone services in the United States. The company’s main business is providing telecommunications services, including wireless, data, and voice services. AT&T Inc. also provides pay TV services through its DirecTV and U-verse subsidiaries.

Summary

Investors looking to purchase Shenandoah Telecommunications stock may find a discounted rate of 47% at the time of writing. Analysts are unsure as to whether this discount presents an opportunity or a warning sign, with news coverage being mixed. Investors should do their own research and consider their own risk tolerance before investing in Shenandoah Telecommunications. It is important to look at the company’s financials, management, and competitive landscape before making any decisions.

Additionally, investors should consider the potential gains and risks associated with investing in this company. In order to make an informed decision, investors should review past performance, current trends, and future prospects. Ultimately, the decision to invest in Shenandoah Telecommunications is ultimately up to the individual investor.

Recent Posts