Invest in Comcast Stock for a Recession-Proof SWAN Bargain!

May 17, 2023

Trending News ☀️

Investing in Comcast Corporation ($NASDAQ:CMCSA) (COMCAST) stock is undoubtedly a smart move for investors looking for a recession-proof bargain. With a history of financial performance that continues to impress, COMCAST’s stock is one of the best SWAN (Sleep Well At Night) stocks available. COMCAST is a major provider of entertainment, media and communications products and services, including cable television, internet, home phone, and more. As the largest provider of these services in the United States, COMCAST is well-positioned to weather the storm of a potential recession, and its stock price is one of the strongest on the market. COMCAST’s strong financials and decades of experience in providing quality services make it an attractive stock for investors looking to buy and hold stock. Finally, COMCAST has been increasing its focus on new technologies such as internet of things (IoT) and artificial intelligence (AI).

This shift towards providing innovative solutions gives COMCAST a competitive edge and positions it for future growth. Moreover, as the demand for internet services continues to grow in the US, COMCAST stands to benefit from increased customer demand. In conclusion, investing in COMCAST stock is an excellent way to ensure your portfolio is recession-proof. With a long history of financial success and a proven track record of providing quality services, COMCAST’s stock is one of the best SWAN stocks available. Moreover, its focus on new technologies and its strong revenue make it an attractive stock for investors looking for long-term growth potential.

Market Price

On Tuesday, Comcast Corporation stock opened at $40.1 and closed at $39.7, down by 1.1% from prior closing price of 40.2. The stock has been on an upward trend in recent weeks, so this minor slip is not cause for concern.

Additionally, Comcast Corporation boasts a strong balance sheet, with sizable cash holdings and low debt levels that make it well-equipped to weather any potential downturns in the market. The company also has a history of delivering steady dividends, providing long-term investors with reliable income streams. All of these factors make investing in Comcast Corporation a SWAN (Sleep Well At Night) bargain that will remain relatively immune to any economic turbulence. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Comcast Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 120.11k | 5.66k | 9.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Comcast Corporation. More…

| Operations | Investing | Financing |

| 26.38k | -14.91k | -14.78k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Comcast Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 259.43k | 175.97k | 19.72 |

Key Ratios Snapshot

Some of the financial key ratios for Comcast Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 3.4% | 3.0% | 11.4% |

| FCF Margin | ROE | ROA |

| 9.7% | 10.5% | 3.3% |

Analysis

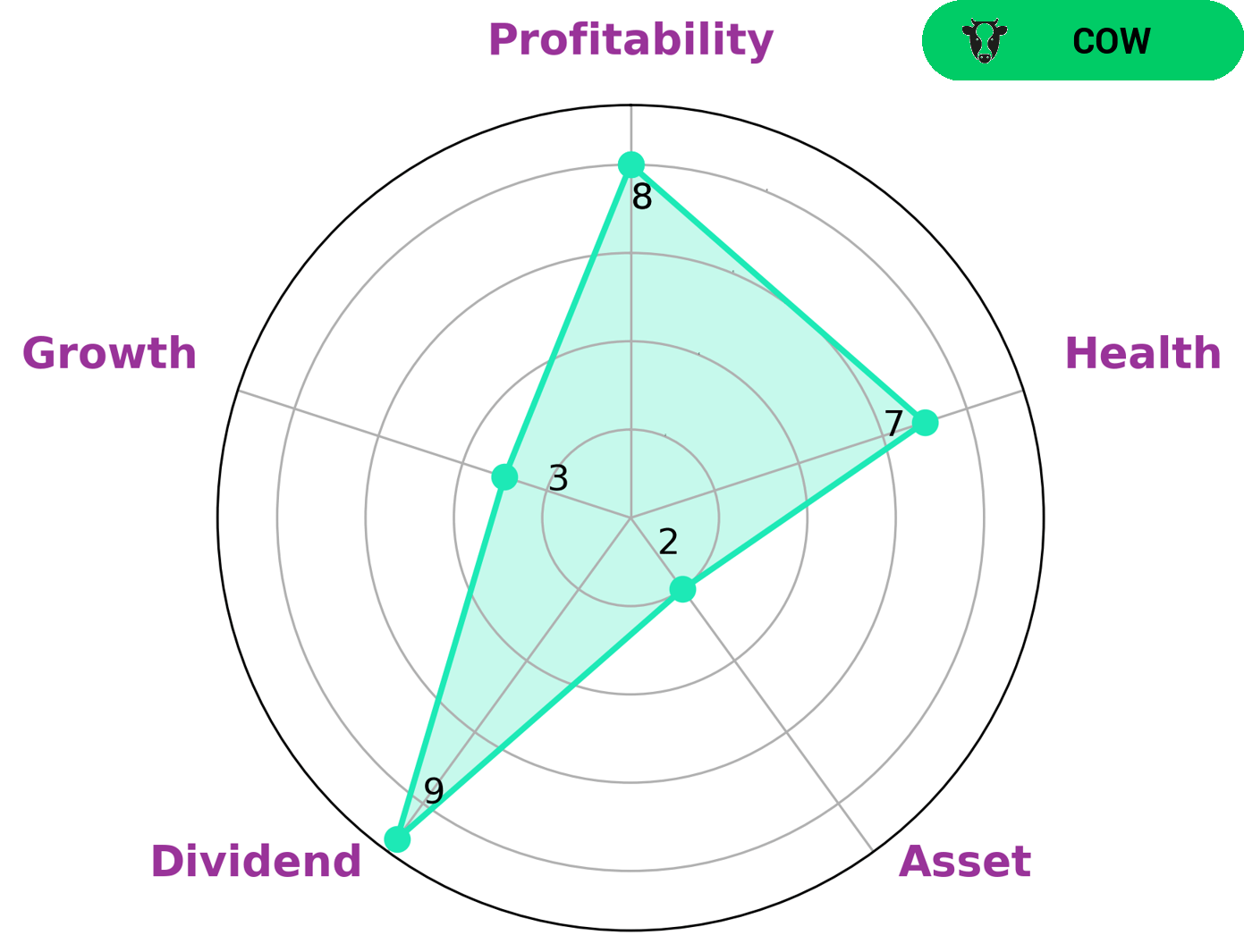

At GoodWhale, we have conducted an analysis of COMCAST CORPORATION‘s financials, and our Star Chart has given it a high health score of 7/10. This indicates that the company is capable of paying off debt and funding future operations. By classifying COMCAST CORPORATION as a ‘cow’, we have come to the conclusion that it has the track record of paying out consistent and sustainable dividends. These facts make COMCAST CORPORATION attractive to dividend investors, as well as those seeking solid long-term returns derived through capital appreciation. Moreover, our analysis shows that COMCAST CORPORATION is strong in dividend, profitability, and weak in asset, growth. Thus, investors who are looking for companies with strong profitability and strong dividends should definitely consider COMCAST CORPORATION for their portfolio. More…

Peers

Comcast Corporation is an American telecommunications conglomerate that is the largest broadcasting and cable television company in the world by revenue. It is the second-largest pay-TV company after AT&T, largest cable TV company and largest home Internet service provider in the United States, and the nation’s third-largest home telephone service provider. Comcast services U.S. residential and commercial customers in 40 states and in the District of Columbia. The company’s headquarters are located in Philadelphia, Pennsylvania. As of January 2016, Comcast is a Fortune 50 company. Globally, Comcast is one of the largest media and entertainment companies, with over 71 million subscribers.

– Megacable Holdings SAB de CV ($OTCPK:MHSDF)

Megacable Holdings SAB de CV is a Mexican provider of cable television, broadband Internet, and landline telephone services. It is the largest cable operator in Mexico in terms of number of subscribers and revenue. The company was founded in 1993 and is headquartered in Guadalajara, Mexico.

– Liberty Global PLC ($NASDAQ:LBTYA)

Liberty Global PLC is a holding company that provides broadband, video, and other communications services to residential and business customers in Europe, Latin America, and the Caribbean. The company has a market capitalization of 8.3 billion as of 2022 and a return on equity of 19.31%. Liberty Global is headquartered in London, the United Kingdom.

– Charter Communications Inc ($NASDAQ:CHTR)

Charter Communications Inc is a US cable operator that provides cable television, internet, and voice services to residential and commercial customers. As of 2022, it has a market capitalization of 52.16 billion dollars and a return on equity of 89.26%. The company is headquartered in Stamford, Connecticut, and employs around 94,000 people.

Summary

Comcast Corporation is an attractive investment opportunity due to its low valuation and relatively low risk. Furthermore, the company is well diversified, with exposure to different industries like media, cable, and internet, allowing it to better weather economic downturns. Overall, Comcast is a compelling buy and a safe bet for investors in this recession that could provide substantial returns in the long-run.

Recent Posts