FYBR Intrinsic Value Calculation – Frontier Communications Parent Reports GAAP EPS of $0.01, Revenue of $1.44B Beats Expectations by $10M

May 7, 2023

Trending News 🌥️

Frontier Communications Parent ($NASDAQ:FYBR), a publicly traded company, reported its quarterly earnings, with a GAAP Earnings Per Share of $0.01, missing analyst expectations by $0.08. The revenue of $1.44B, however, beat expectations by $10M. The company provides communications services to residential and business customers in the United States. It offers broadband, video, voice, and other services and products through its fiber-optic and copper networks. Frontier is also the largest provider of broadband services in rural areas in the United States. Frontier Communications Parent has taken several steps to improve its financial performance. The company has focused on expanding its fiber-optic network and providing new services to customers.

Additionally, it has implemented cost-cutting measures such as streamlining operations and consolidating its data centers. The company’s stock price rose on the news, indicating investor confidence in its ability to continue to turn a profit in the future.

Earnings

FRONTIER COMMUNICATIONS PARENT recently reported their fourth quarter earnings of FY2022, ending December 31 2022. This marks a 6.9% decrease in total revenue and an 18.0% decrease in net income compared to the same period a year ago.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for FYBR. More…

| Total Revenues | Net Income | Net Margin |

| 5.79k | 441 | 9.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for FYBR. More…

| Operations | Investing | Financing |

| 1.4k | -4.47k | 1.21k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for FYBR. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 18.62k | 13.49k | 20.95 |

Key Ratios Snapshot

Some of the financial key ratios for FYBR are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -10.6% | -22.2% | 18.9% |

| FCF Margin | ROE | ROA |

| -23.1% | 13.5% | 3.7% |

Stock Price

Friday was a mixed day for Frontier Communications Parent as the company reported GAAP earnings per share of $0.01 and revenue of $1.44 billion, beating expectations by $10 million. Despite the news, the stock opened at $19.9 and closed at $19.7, dropping 8.4% from the previous closing price of $21.5. Live Quote…

Analysis – FYBR Intrinsic Value Calculation

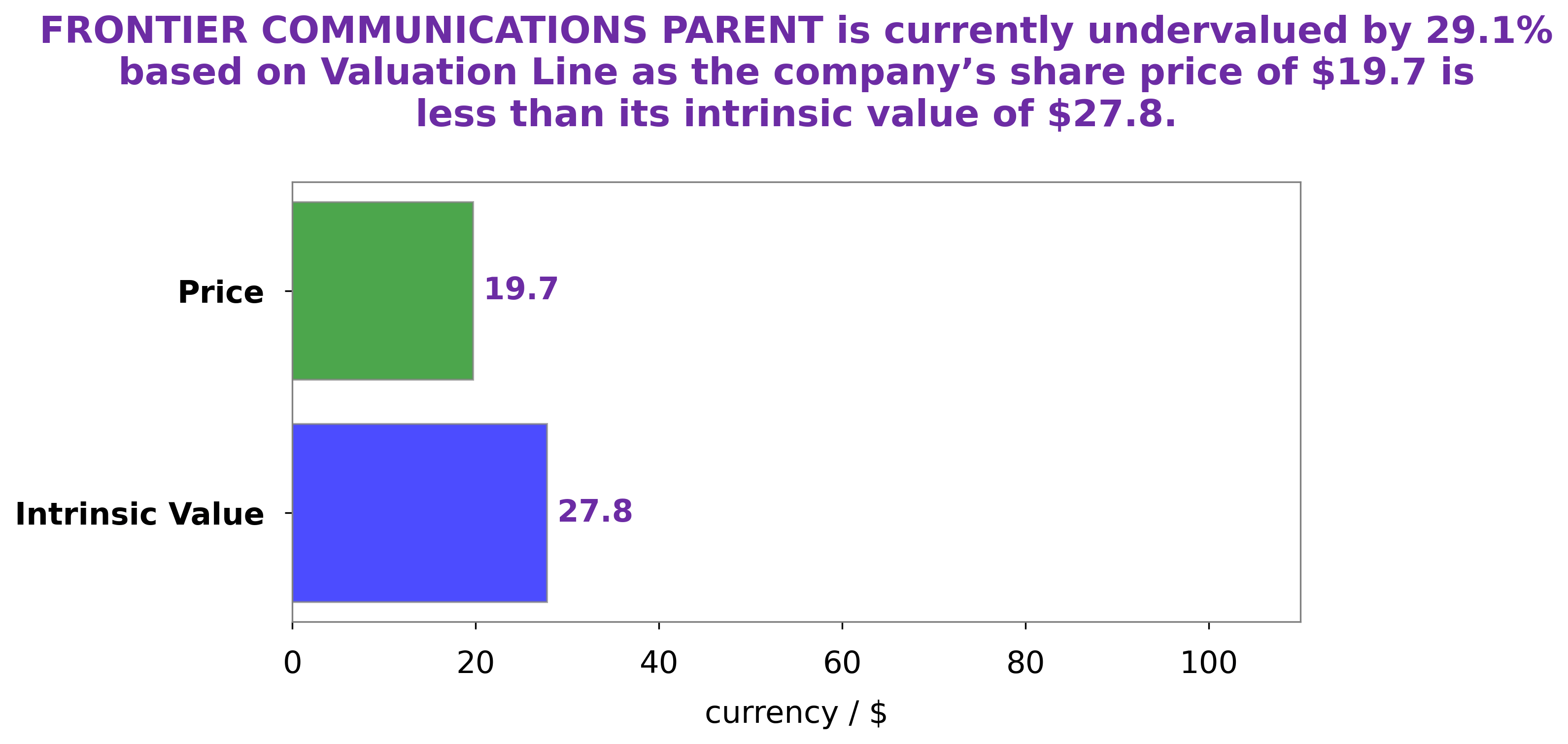

At GoodWhale, we have recently conducted an analysis of FRONTIER COMMUNICATIONS PARENT’s wellbeing. Our proprietary Valuation Line has calculated FRONTIER COMMUNICATIONS PARENT’s intrinsic value to be around $27.8. Currently, the stock is being traded at $19.7, which is a 29.1% undervaluation. This presents a great opportunity for potential investors to acquire shares of the company at a discounted rate. More…

Peers

It is a popular choice for internet, TV, and phone services, as well as providing customers with access to cutting-edge technology and features. While Frontier Communications Parent Inc is the largest provider in the field, there are other notable competitors such as Liberty Broadband Corp, LICT Corp, and Shenandoah Telecommunications Co which provide similar services and strive to keep up with the latest trends.

– Liberty Broadband Corp ($NASDAQ:LBRDA)

Liberty Broadband Corp is a large American telecommunications and entertainment company. It provides cable television, internet, voice and data services to consumers and businesses in the US, Canada and Caribbean. The company has a market cap of 13.47B as of 2022, which reflects its strong financial position and strong brand recognition. Liberty Broadband Corp’s return on equity (ROE) is 13.57%, which is higher than the industry average. This indicates that the company is able to generate high returns on its equity investments, making it an attractive investment for shareholders.

– LICT Corp ($OTCPK:LICT)

LICT Corp is a publicly-traded company that specializes in providing telecommunications, internet and IT services. As of 2022, the company has a market cap of 354.77M, indicating its overall size and value in the market. Additionally, its Return on Equity of 16.26% demonstrates that the company is able to effectively reinvest its profits and generate value for its shareholders.

– Shenandoah Telecommunications Co ($NASDAQ:SHEN)

Shenandoah Telecommunications Co is a publicly traded and diversified telecommunications holding company that provides a broad range of services to customers in the Mid-Atlantic and Midwestern United States. As of 2022, the company has a market capitalization of 904.27 million dollars and a return on equity of -0.14%. Market capitalization is a measure of a company’s total value, calculated by multiplying its stock price by the total number of outstanding shares. Return on equity is a measure of how well a company uses its capital to generate profits; it is calculated by dividing net income by shareholders’ equity. The negative return on equity indicates that Shenandoah Telecommunications Co is not efficiently utilizing its capital to generate returns for its shareholders.

Summary

Investors in Frontier Communications Parent were disappointed with the company’s fourth quarter earnings report. The reported GAAP EPS of $0.01 fell short of analyst expectations by $0.08. On the news, the stock price dropped, reflecting investor sentiment towards the earnings report. Going forward, investors should carefully assess the company’s financial performance and outlook as they decide whether to invest in the company or not.

Recent Posts