Oldfield Partners LLP Invests in Ternium S.A. to Strengthen its Position in the Steel Industry.

February 10, 2023

Trending News ☀️

Ternium ($NYSE:TX) S.A., a leading steel producer in Latin America, has recently received an investment from Oldfield Partners LLP. This investment strengthens Ternium’s position as a leader in the steel industry. The company produces and distributes hot-rolled, cold-rolled, and coated steel products for customers across the region. Ternium operates through its network of production facilities, distribution centers and warehouses, which span from Mexico to Argentina. It also provides its customers with solutions for their steel needs such as steel processing services, prefabricated structures, and tailored products. This investment will enable Ternium to capitalize on existing market opportunities and spur growth in additional markets.

It will also help to expand the range of products and services Ternium offers its customers. Oldfield Partners LLP is a London-based private equity fund that invests in companies across a wide range of industries, including metals and mining, energy, and infrastructure. With this new investment, Oldfield Partners is looking to capitalize on the opportunities that this leading steel producer has to offer. This new investment marks a significant milestone for both Ternium S.A. and Oldfield Partners LLP. At the same time, Oldfield Partners will enjoy a new avenue for growth and returns on its investments.

Stock Price

The news of the investment has been met with mostly positive media exposure. Ternium S.A. is a global leader in the steel industry, with operations in Mexico, Argentina, Colombia, Guatemala, United States, and Central America. The company’s products are used in construction, automotive manufacturing, domestic appliances, and other industries. On Thursday, Ternium S.A. stock opened at $39.6, but by the end of the trading session, it had dropped by 4.0%, closing at $37.7 compared to its prior closing price of $39.2.

This drop was attributed to a sharp decline in global steel prices due to weak demand and overcapacity. It remains to be seen whether or not the investment will pay off for both parties involved, but so far the media exposure has been mostly positive. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Ternium S.a. More…

| Total Revenues | Net Income | Net Margin |

| 17.2k | 2.73k | 16.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Ternium S.a. More…

| Operations | Investing | Financing |

| 2.86k | -1.34k | -968.31 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Ternium S.a. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 17.42k | 3.64k | 59.99 |

Key Ratios Snapshot

Some of the financial key ratios for Ternium S.a are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 17.9% | 51.7% | 23.9% |

| FCF Margin | ROE | ROA |

| 13.4% | 21.7% | 14.7% |

Analysis

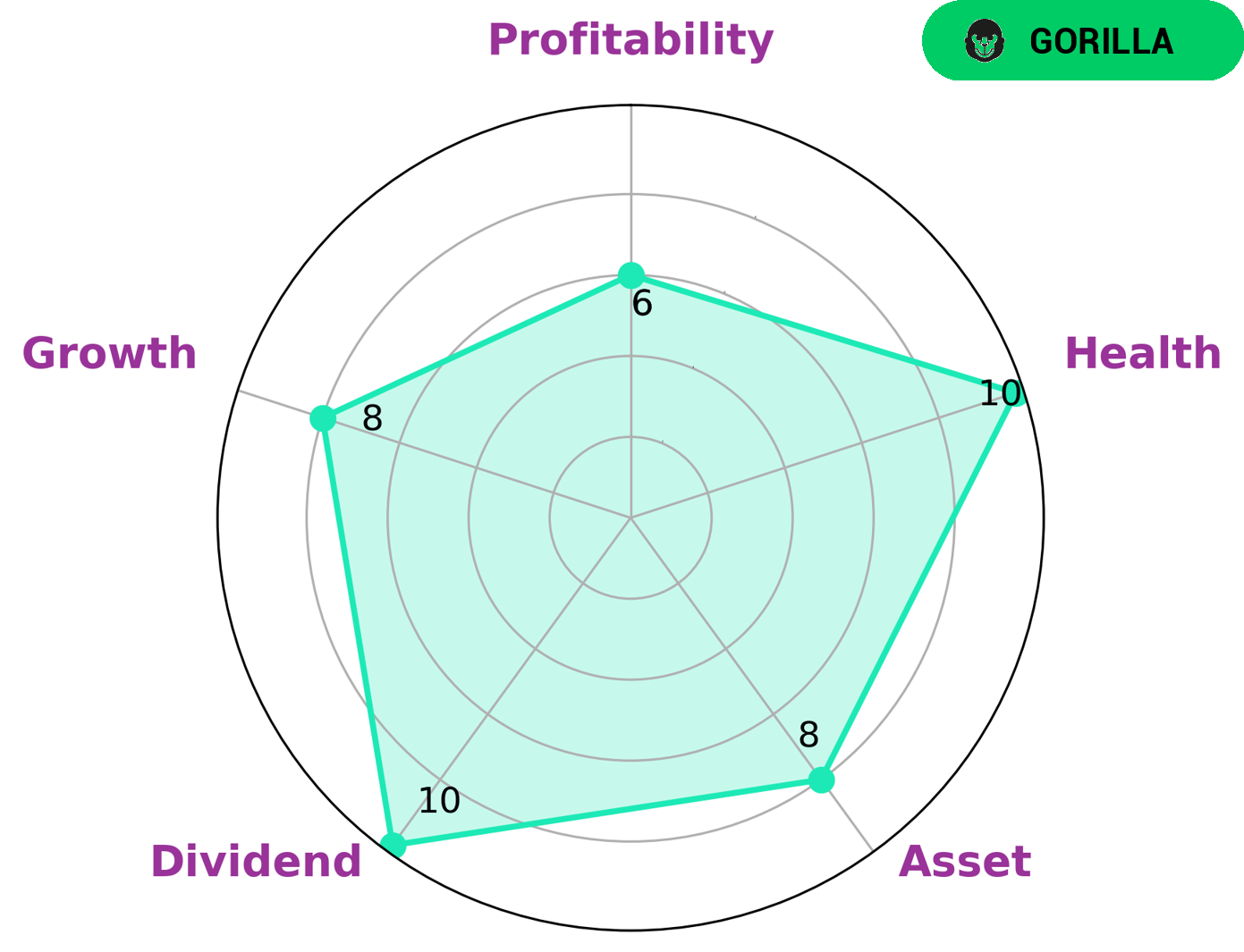

GoodWhale’s analysis of TERNIUM S.A. reveals that the company is a ‘gorilla’, a type of company that has attained a high degree of stability and growth in its revenue and earnings due to a strong competitive advantage. This type of company is often attractive to both value and growth investors, who seek companies with strong asset values, healthy dividend payouts, and high growth potential. The analysis of TERNIUM S.A. further reveals that the company has a strong balance sheet, with a health score of 10 out of 10 when it comes to cash flows and debt. This indicates the company’s ability to sustain future operations even during times of crisis. Moreover, the company has been rated as high in asset quality, dividend payouts, and growth potential, and medium in profitability. Overall, TERNIUM S.A. is an attractive investment opportunity for investors who are looking for companies with stable and high revenue and earnings growth. The company’s strong competitive advantage, high health score, and strong balance sheet are indicative of its potential to deliver strong returns over the long-term. More…

Peers

In recent years, the Chinese steel industry has been undergoing a period of intense competition, with a number of major players vying for market share. Among them, Ternium SA has emerged as a key competitor, particularly in the production of high-quality steel products. The company has invested heavily in research and development in order to maintain its position as a leading player in the industry, and this has paid off in terms of both market share and profitability. While Ternium faces stiff competition from a number of other major Chinese steel producers, it is well-positioned to continue its growth in the years ahead.

– Lingyuan Iron & Steel Co Ltd ($SHSE:600231)

Lingyuan Iron & Steel Co Ltd is a Chinese steel producer with a market cap of $5.88B as of 2022. The company has a Return on Equity of -2.8%. Lingyuan Iron & Steel Co Ltd produces a variety of steel products including pipes, plates, and coils. The company has over 3,500 employees and operates in China, Europe, and the United States.

– Daehan Steel Co Ltd ($KOSE:084010)

Daehan Steel Co Ltd is a South Korean steel manufacturer. The company has a market cap of 232.09B as of 2022 and a Return on Equity of 28.52%. Daehan Steel Co Ltd is a leading manufacturer of steel products in South Korea. The company produces a wide range of steel products, including hot rolled coils, cold rolled coils, galvanized steel coils, and pre-painted steel coils.

– Xinjiang Ba Yi Iron & Steel Co Ltd ($SHSE:600581)

Xinjiang Ba Yi Iron & Steel Co Ltd is a Chinese steel company with a market cap of 5.72 billion as of 2022. The company has a Return on Equity of -24.16%. The company is involved in the production of iron and steel products.

Summary

Ternium S.A. has recently received an investment from Oldfield Partners LLP, which is expected to help strengthen its position in the steel industry. So far, the media attention towards the investment has been positive, though the stock price dropped on the same day of the announcement. In order to make a proper investing analysis of Ternium S.A., one should consider their financials such as revenue, profit margin, and balance sheet.

Additionally, potential investors should review the company’s competitive advantages and future growth prospects. Finally, the current and future macroeconomic environment should be taken into account.

Recent Posts