TriNet Group Partners with TriNet Foundation to Further Corporate Social Responsibility Initiatives.

February 2, 2023

Trending News 🌥️

TRINET ($NYSE:TNET): TriNet Group, Inc. (NYSE: TNET) is a leading provider of comprehensive human resources solutions for small and medium size businesses. The company provides solutions that help companies manage their HR, payroll, employee benefits and risk management needs. TriNet’s solutions are designed to save businesses time, money and resources while improving employee engagement and satisfaction. TriNet Foundation, the philanthropic arm of TriNet Group, Inc., has recently announced a new partnership to further its corporate social responsibility initiatives. The partnership will focus on providing support for education and training programs that help people achieve economic self-sufficiency and find meaningful employment. The Foundation will also focus on community development projects that provide access to clean water, improved nutrition, and healthcare for underserved populations. This partnership is part of TriNet’s larger Corporate Social Responsibility Program, which is dedicated to making a positive impact in the communities in which it operates.

Through this program, the company has provided resources to support local businesses, educational initiatives, and job creation programs. The TriNet Foundation has also provided financial support to organizations that provide health care and job training to those in need. This partnership is an important part of TriNet Group’s commitment to making a positive impact in the world. By partnering with the TriNet Foundation, the company is able to further its mission of making a positive difference in the lives of its customers, employees, and communities. This partnership is an important step in the company’s journey toward corporate social responsibility and will ensure that TriNet Group remains committed to making a lasting and meaningful impact.

Market Price

The news has been well-received by the public, as the company’s stock opened at $74.5 and closed at $75.4, up 1.5% from its previous closing price of $74.4. Through this partnership, TriNet Group will donate to the Foundation and work with its team to create meaningful opportunities and drive social change. TriNet Group will also leverage its existing relationships with local organizations and businesses to support the Foundation’s mission. For example, the company will seek out collaborations with organizations that are focused on addressing economic inequality, providing educational opportunities and supporting underserved communities. TriNet Group’s CEO, Burton Goldfield, believes that partnering with the TriNet Foundation is critical in advancing its corporate social responsibility goals.

He commented that “the Foundation will be a catalyst for positive change in our communities and enable us to make a lasting impact on the lives of those we serve.” Overall, this new partnership is a strong step forward for TriNet Group in its corporate social responsibility efforts. The positive sentiment surrounding this news is reflected in the company’s stock performance, which rose 1.5% on Tuesday. It is clear that investors are optimistic about the company’s commitment to making a positive difference in the world. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Trinet Group. More…

| Total Revenues | Net Income | Net Margin |

| 4.89k | 376 | 7.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Trinet Group. More…

| Operations | Investing | Financing |

| 310 | -195 | -400 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Trinet Group. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.08k | 2.22k | 13.76 |

Key Ratios Snapshot

Some of the financial key ratios for Trinet Group are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 9.2% | 29.3% | 11.1% |

| FCF Margin | ROE | ROA |

| 5.3% | 41.8% | 11.0% |

Analysis

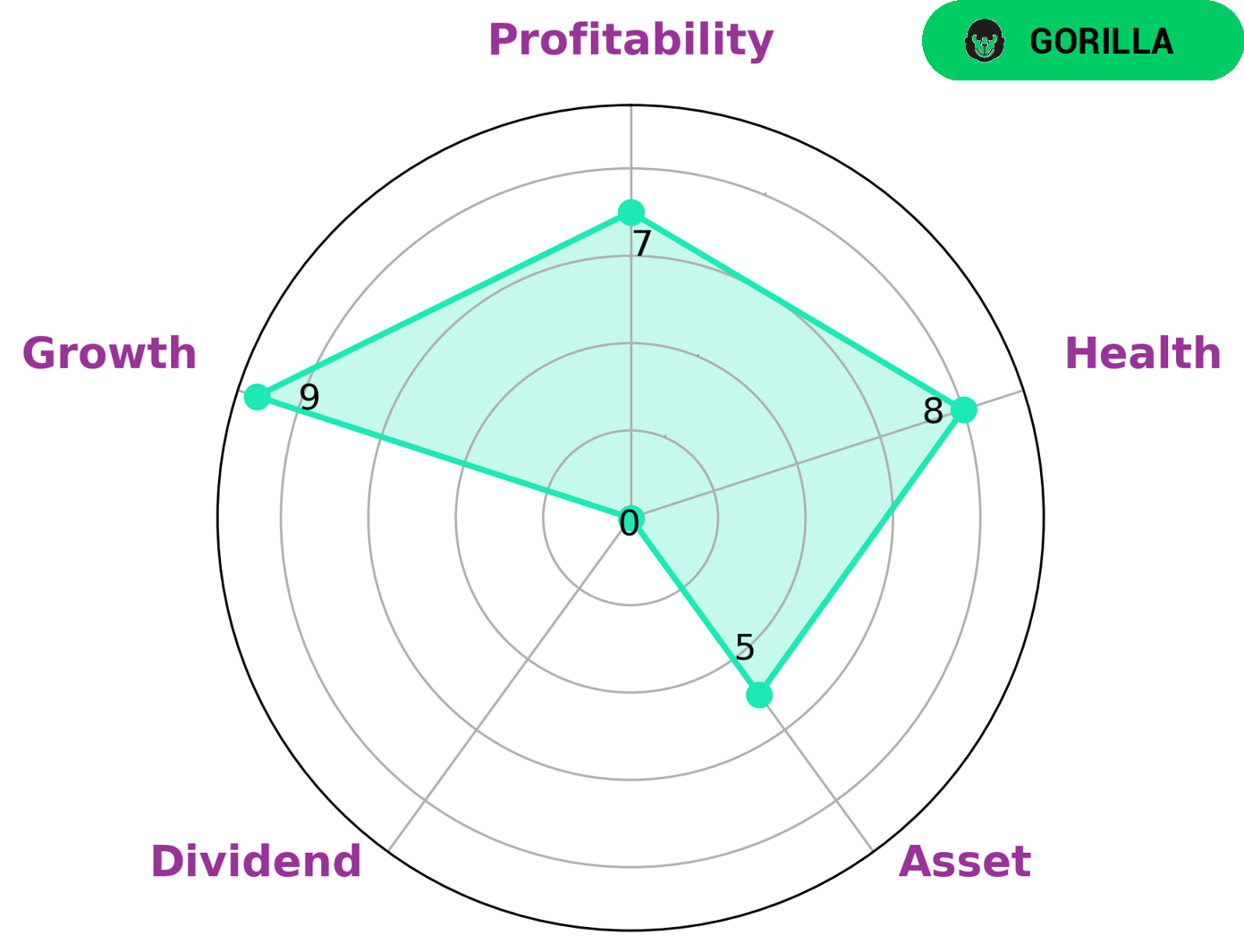

GoodWhale has conducted an analysis of TRINET GROUP‘s financials, finding it has a high health score of 8/10 based on its Star Chart. This means that the company is capable of paying off debt and funding future operations. Furthermore, the company is strong in growth and profitability, medium in assets and weak in dividend. This has placed TRINET GROUP in the ‘gorilla’ category – companies with stable and high revenue or earning growth due to their strong competitive advantage. Given the strong growth and health of TRINET GROUP, it is likely to be attractive to value investors who are looking for long-term returns. These investors are likely to look for companies with strong fundamentals and a good track record of profitability. Additionally, growth investors may be interested in TRINET GROUP due to its impressive growth and potential for capital appreciation. Finally, dividend investors may be interested in the company given its weak dividend performance, as this could provide an opportunity for them to benefit from the company’s strong financials. More…

Peers

Its competitors are Insperity Inc, Paychex Inc, and Trucept Inc.

– Insperity Inc ($NYSE:NSP)

Inspriety Inc is a business services provider headquartered in Texas. The company offers a suite of human resources and business solutions to small and medium-sized businesses. Inspriety’s products and services include payroll, benefits, HR and talent management, time and attendance, and insurance. The company serves over 100,000 businesses across the United States.

Inspriety has a market cap of 4.12B as of 2022 and a ROE of 366.51%. The company’s strong market position and financial performance are attributable to its focus on providing quality products and services to its customers. Inspriety is well-positioned to continue its growth trajectory in the coming years.

– Paychex Inc ($NASDAQ:PAYX)

Paychex Inc is a leading provider of payroll and human resource outsourcing solutions for small- to medium-sized businesses. The company has a market cap of 40.42B as of 2022 and a return on equity of 38.35%. Paychex has been in business for over 40 years and has a long track record of providing quality services to its clients. The company offers a wide range of payroll and human resource outsourcing solutions, including payroll processing, tax compliance, benefits administration, and talent management. Paychex is a publicly traded company listed on the New York Stock Exchange (NYSE: PAYX).

– Trucept Inc ($OTCPK:TREP)

Trucept Inc. is a publicly traded American corporation with a market capitalization of 221.15 thousand as of 2022. The company is headquartered in Tulsa, Oklahoma and provides software and technology solutions to small and medium businesses. The company’s products and services include accounting, human resources, and customer relationship management. The company has a return on equity of 42.12%.

Summary

Trinet Group is a leading provider of integrated human resource solutions for small and medium-sized businesses. The company has recently partnered with the TriNet Foundation to further its corporate social responsibility initiatives. Investors may find the partnership attractive as it demonstrates the company’s commitment to sustainability and long-term value creation.

Additionally, the financials of TriNet Group have proven to be strong, with consistent revenue growth year over year and strong margins. The company’s balance sheet is also healthy, with substantial cash reserves and low debt. With its strong fundamentals, TriNet Group is positioned to continue its growth trajectory in the coming years.

Recent Posts