TD Asset Management Unloads 18650 Shares of Upwork

February 13, 2023

Trending News ☀️

This technology platform acts as a bridge between businesses and independent professionals, allowing them to collaborate and make progress. UPWORK ($NASDAQ:UPWK) Inc. is a leading platform for businesses in the freelance industry, and it works with more than 2 million businesses on its platform. With this event, it is clear that UPWORK Inc. is continuing to build upon its successes and is committed to providing businesses with the best possible platform for them to find and work with freelance professionals.

Stock Price

This is the latest development in the stock market and has been met with mixed reactions. Prior to this move, Upwork Inc. had mostly positive media exposure, however, on Friday following the announcement, the company’s stock opened at $12.8 and closed at $12.5, down 4.3% from its last closing price of 13.1. This sharp decline in the stock price was indicative of the fact that many investors were not convinced by the decision taken by TD Asset Management Inc. Analysts have suggested that this move was a sign of profit-taking and is unlikely to have a long-term impact on the stock price. TD Asset Management Inc. may have sold the shares to take advantage of the current prices or to shift its focus from Upwork Inc. to other companies.

The decision has certainly caused some concern among investors, however, it is too soon to draw any major conclusions about the long-term performance of Upwork Inc.’s stock price in the market. It is also unclear as to why TD Asset Management Inc. decided to sell its shares in the first place, and until this is clear, investors should proceed with caution when investing in Upwork Inc. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Upwork Inc. More…

| Total Revenues | Net Income | Net Margin |

| 593.73 | -95.94 | -16.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Upwork Inc. More…

| Operations | Investing | Financing |

| -14.34 | -435.3 | 3.71 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Upwork Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.08k | 836.64 | 1.85 |

Key Ratios Snapshot

Some of the financial key ratios for Upwork Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 27.1% | – | -15.4% |

| FCF Margin | ROE | ROA |

| -3.7% | -23.3% | -5.3% |

Analysis

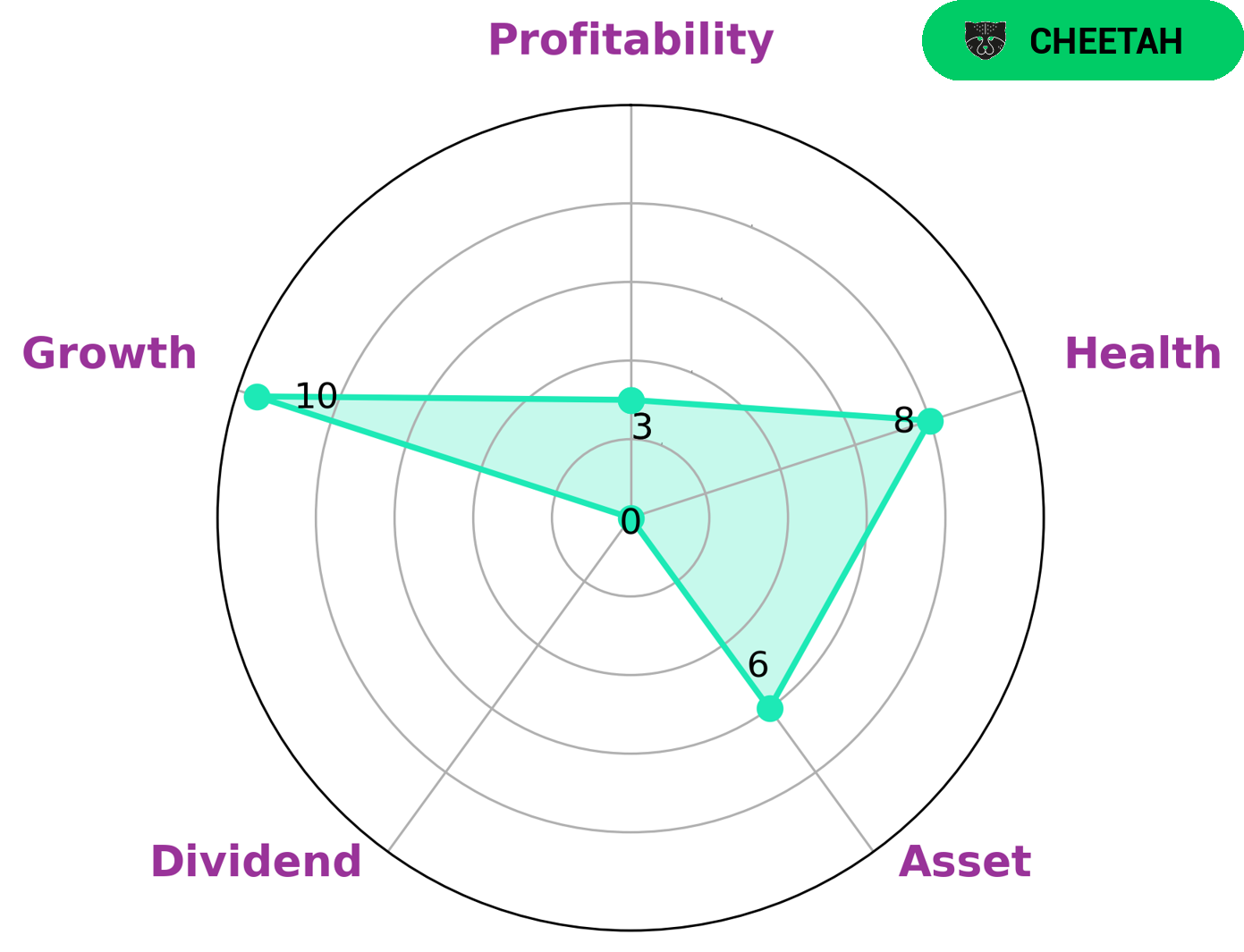

Analyzing UPWORK INC with GoodWhale reveals that the company is strong in growth, but medium in asset and weak in dividend and profitability. UPWORK INC has a high health score of 8/10, indicating that it is financially secure and can ride out any crisis without the risk of bankruptcy. UPWORK INC is classified as a “cheetah”, which represents a company that has achieved high revenue or earnings growth, but is considered less stable due to lower profitability. Such companies may be attractive to investors who are looking for short-term gains and are comfortable with taking on higher risks. These investors may be willing to forego long-term stability in exchange for the potential of high returns in the short term. Therefore, these investors may be willing to invest in UPWORK INC and take advantage of the promising growth opportunities it offers. Long-term investors, however, may be less interested in UPWORK INC due to its lower stability. These investors may prefer to invest in companies that have higher profitability, dividend stability, and assets, as these companies are more likely to generate consistent returns over a longer period of time. Therefore, while UPWORK INC may be attractive to those seeking short-term gains, it may not be the ideal choice for long-term investors. More…

Peers

Some of Upwork’s main competitors include Kanzhun Ltd, LegalZoom.com Inc, and DHI Group Inc. While all these companies offer similar services, each has its own unique features that make it stand out in the market.

– Kanzhun Ltd ($NASDAQ:BZ)

Kanzhun Ltd is a Chinese internet company that offers a variety of services, including online recruitment, information technology, and e-commerce. As of 2022, the company has a market cap of 5.43 billion US dollars and a return on equity of 3.6%. Founded in 2003, Kanzhun Ltd is headquartered in Beijing, China.

– LegalZoom.com Inc ($NASDAQ:LZ)

Founded in 2001, LegalZoom is the nation’s leading provider of online legal solutions for individuals and small businesses. Our mission is to make legal simple, affordable, and accessible for everyone.

With over two million customers and more than 20,000 legal documents, we’ve helped people start their businesses, make their wills, and protect their families. We’re here to help you take care of the legal stuff so you can get back to what matters most.

LegalZoom has a market cap of 1.7B as of 2022, a Return on Equity of -34.4%. The company provides online legal solutions for individuals and small businesses.

– DHI Group Inc ($NYSE:DHX)

DHI Group, Inc. (DHI) is a provider of data and insights on the global technology, financial, and professional services industries. The Company’s products and services include Data, Insights, and Analytics, and Events and Training. DHI Group, Inc. is headquartered in New York, New York.

Summary

Investing in Upwork Inc. is a risky proposition due to its volatile stock price. TD Asset Management Inc. recently unloaded 18650 shares, likely due to the stock price decline that same day despite mostly positive media exposure. Analyzing the data for Upwork Inc. is important for investors in order to understand the potential risks of investing in the company and make an informed decision on whether or not to purchase shares. Investors should research the company’s financials and news reports to get a better sense of their potential investment.

It’s also important to consider the company’s competitive landscape and its ability to remain competitive in the future. Ultimately, investors should weigh their options carefully before investing in Upwork Inc.

Recent Posts