Investors Take Note: Kforce is on the Move!

August 4, 2023

🌥️Trending News

Investors should take note: Kforce ($NASDAQ:KFRC), Inc. (KFORCE) is on the move! With a nearly fifty-year history as a professional staffing firm, the company has built a solid foundation in providing professional and technical staffing services for a wide range of businesses. Their services are tailored to address the specific needs of its clients, and their ability to match companies with highly qualified talent in various industries is unmatched. Not only does KFORCE offer staffing services, but they also provide professional advice, coaching, and training services to their clients. Furthermore, they provide technology-driven solutions that enable them to identify and address customer needs more quickly. KFORCE’s technology-driven solutions have enabled them to consistently outperform in the stock market.

Additionally, they have recently announced several acquisitions that will help to expand their services and offerings even further. All of these reasons make KFORCE a great stock to invest in and watch. With their innovative technology solutions, experienced management team, and increasing presence in the professional staffing industry, KFORCE is on the move and investors should take notice.

Stock Price

On Wednesday, KFORCE INC made a great leap in its stock price, with an opening price of $59.6 and a closing price of $60.7 – up 1.9% from the previous closing price of $59.5. This signifies a positive trend in the company’s financial performance, and investors should take note. With a strong position as an international professional staffing services provider, KFORCE INC could be poised for further growth and success in the near future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Kforce Inc. More…

| Total Revenues | Net Income | Net Margin |

| 1.7k | 72.46 | 4.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Kforce Inc. More…

| Operations | Investing | Financing |

| 71.12 | -9.12 | -178.45 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Kforce Inc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 385.15 | 199.43 | 8.89 |

Key Ratios Snapshot

Some of the financial key ratios for Kforce Inc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 7.8% | 13.5% | 6.6% |

| FCF Margin | ROE | ROA |

| 3.7% | 38.2% | 18.3% |

Analysis

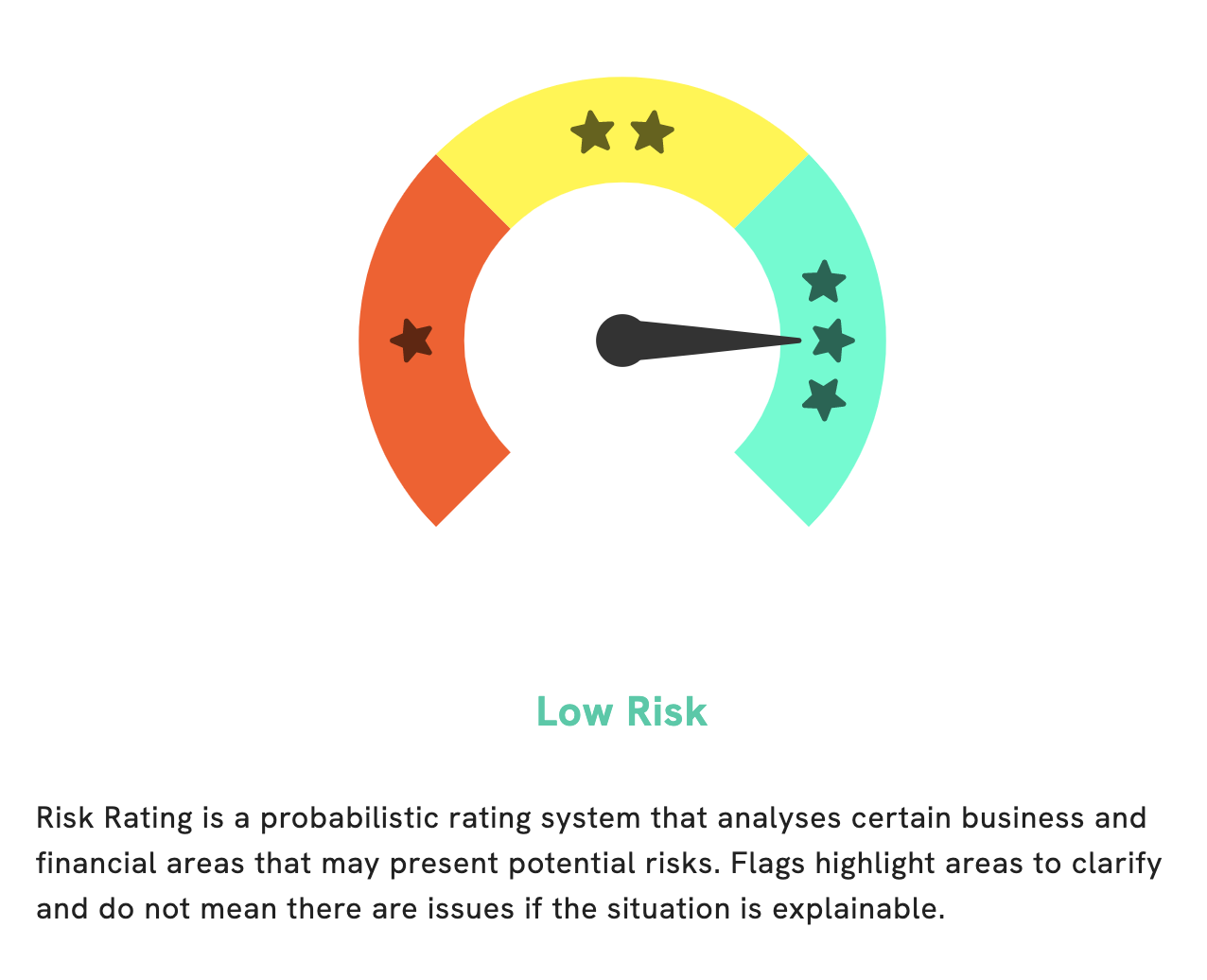

At GoodWhale, we have conducted an in-depth analysis of KFORCE INC‘s fundamentals. Our analysis has revealed that KFORCE INC is a low risk investment based on our Risk Rating. We have detected one risk warning in the balance sheet that could impact the company’s financial performance. If you’re interested in learning more about this risk warning, please register with us to access our detailed reports. More…

Peers

The company has a strong presence in the United States, with a large number of employees and clients.

However, Kforce Inc. is not the only staffing and recruiting company in the market. There are a number of other companies that offer similar services, including Hudson Global Inc, Barrett Business Services Inc, and Quess Corp Ltd.

– Hudson Global Inc ($NASDAQ:HSON)

Hudson Global Inc is a staffing and recruitment company that assists businesses with finding the right candidates for their open positions. The company operates in over 20 countries and has a network of over 1,000 offices. Hudson Global Inc has a market cap of 102.67M as of 2022, a Return on Equity of 16.43%. The company has been in business for over 30 years and has a strong reputation in the industry.

– Barrett Business Services Inc ($NASDAQ:BBSI)

Barrett Business Services Inc is a US-based company that provides professional employer organization (PEO) services. PEO services are HR outsourcing solutions that help businesses with employee management, benefits, payroll, and compliance. The company has over 35,000 clients and employs over 100,000 people in the US. Barrett Business Services Inc has a market cap of $622.88M as of 2022 and a Return on Equity of 21.11%. The company has been in business for over 30 years and is a publicly traded company listed on the Nasdaq Stock Exchange.

– Quess Corp Ltd ($BSE:539978)

Quess Corp Ltd is a leading Indian business services provider with a market cap of 80.67B as of 2022. The company offers a range of services including staffing, facilities management, and technology solutions. Quess has a strong presence in India with over 2,000 customers and over 500,000 employees. The company’s return on equity (ROE) is 11.08%, which is significantly higher than the industry average of 9.35%. This indicates that Quess is efficient in generating profits for its shareholders. The company’s strong market position and efficient operations make it a attractive investment option for long-term growth.

Summary

Kforce Inc. is a professional staffing services firm that provides investing analysis services to clients. Their services offer clients an in-depth look into potential investments with comprehensive financial and market analysis. Kforce Inc. utilizes experienced professionals who are knowledgeable in current market trends and provide data-driven analysis to assist clients in making the best decisions for their investments.

Their services include research and analysis of industry trends, financial data, market conditions, competitive landscape, and more. By leveraging data and their expertise, Kforce Inc. helps investors make sound decisions when investing in the stock market.

Recent Posts