Insperity Stock Clears 80 Relative Strength Rating Benchmark Thursday

June 9, 2023

☀️Trending News

Insperity ($NYSE:NSP) Inc. is a professional employer organization (PEO) that helps businesses manage human resources, payroll, benefits and other administrative tasks. On Thursday, the stock of Insperity cleared the 80 Relative Strength Rating (RSR) benchmark, rising from 78 to 81. The RSR is a metric used to measure the performance of a stock relative to all other stocks over a specific time period. It is considered an important indicator when looking at stocks, and a reading above 80 suggests that the stock has outperformed most others in the market. The surge in RSR for Insperity reflects the company’s strong performance recently.

In addition to its financial success, Insperity has also seen increasing recognition for its corporate culture and workplace practices, which has helped the company to attract and retain top talent. Insperity’s strong performance and commitment to its workforce have been rewarded with an RSR rating of 81, which is well above the 80 benchmark. This rating highlights the company’s financial stability and long-term growth potential, and serves as a testament to its success in today’s competitive business landscape.

Market Price

It opened at $123.8 and closed at a higher rate of $125.6, representing an increase of 1.4%, compared to its last closing price of $123.9. The news of INSPERITY’s stock clearing the 80 Relative Strength Rating benchmark was met with celebration by investors who have been closely watching the company’s progress in the stock market. Insperity_Stock_Clears_80_Relative_Strength_Rating_Benchmark_Thursday”>Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Insperity. More…

| Total Revenues | Net Income | Net Margin |

| 6.13k | 204.11 | 3.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Insperity. More…

| Operations | Investing | Financing |

| 328.2 | -35.18 | -144.11 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Insperity. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.04k | 1.91k | 2.15 |

Key Ratios Snapshot

Some of the financial key ratios for Insperity are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 11.8% | 13.5% | 4.7% |

| FCF Margin | ROE | ROA |

| 4.8% | 169.3% | 8.9% |

Analysis

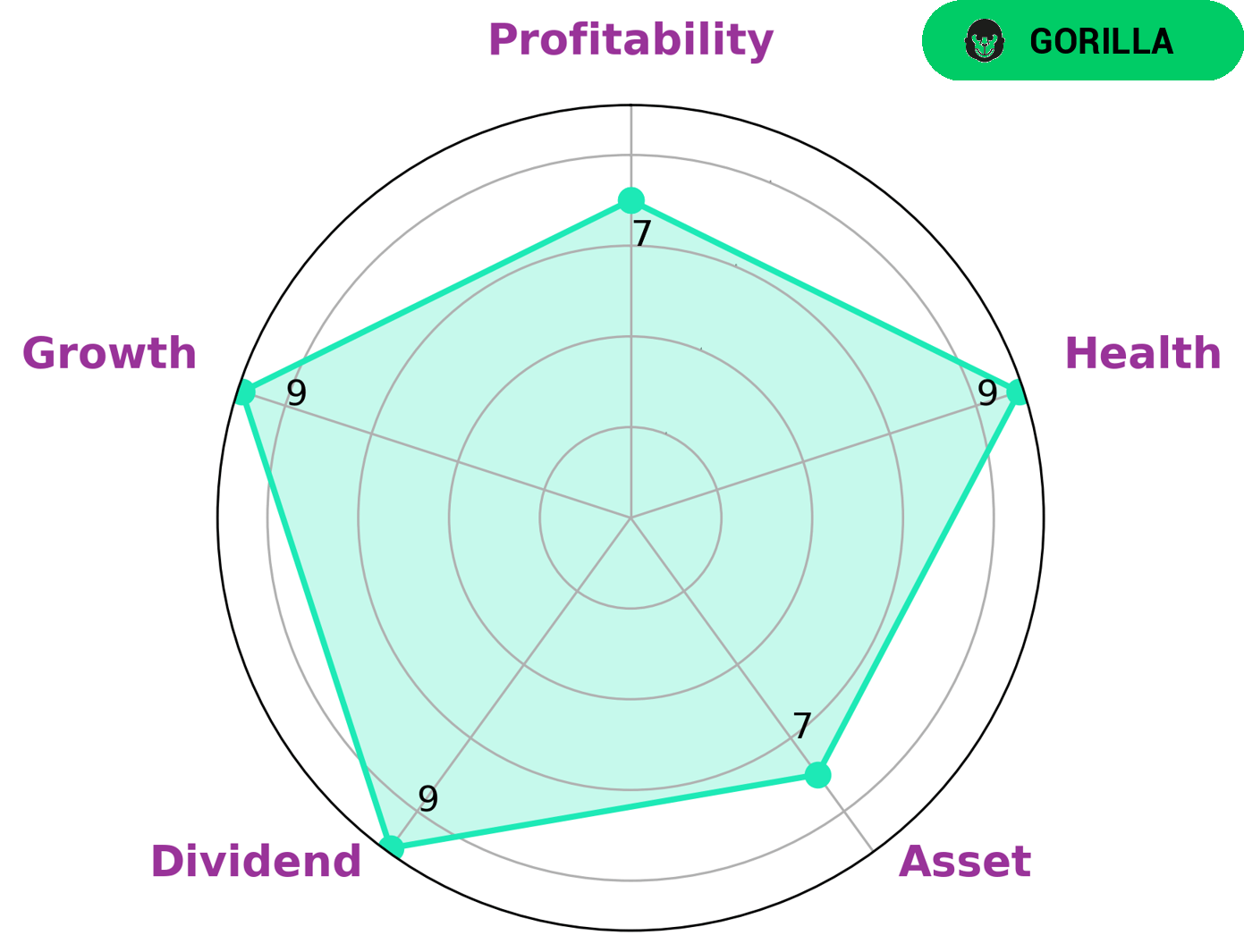

Our analysis of INSPERITY’s wellbeing shows that the company is strong in asset, dividend, growth, and profitability. The Star Chart reveals that INSPERITY has a high health score of 9/10, indicating its ability to sustain future operations even in times of crisis. We have classified INSPERITY as a ‘gorilla’, meaning that it has achieved stable and high revenue or earning growth due to its strong competitive advantage. Given its strong financial performance, INSPERITY is likely to be of interest to value investors, growth investors, and dividend investors. Value investors will be attracted to its strong fundamentals and attractive dividend yields. Growth investors will be drawn to the company’s history of steady growth and its ability to outperform rivals in its industry. Finally, dividend investors will be intrigued by the company’s record of consistent dividend payments and its healthy balance sheet. Insperity_Stock_Clears_80_Relative_Strength_Rating_Benchmark_Thursday”>More…

Peers

In the business world, competition is fierce. Companies are constantly striving to one-up their competitors in an effort to gain market share. This is especially true in the human resources outsourcing industry, where companies like Insperity Inc, Trinet Group Inc, Barrett Business Services Inc, and Hudson Global Inc are constantly vying for the top spot. All of these companies offer similar services, so they must differentiate themselves in order to stand out. Insperity Inc has done this by becoming a trusted partner to its clients and providing a comprehensive suite of services. Its competitors, while also offering quality services, have not been able to match Insperity Inc’s level of customer service and satisfaction.

– Trinet Group Inc ($NYSE:TNET)

Trinet Group Inc is a professional services firm that provides a comprehensive range of human resources solutions to businesses and organizations of all sizes. The company offers a wide range of services, including payroll and tax administration, benefits administration, risk and compliance management, human capital management, and other HR-related services. Trinet Group Inc has a market cap of 4.57B as of 2022, a Return on Equity of 45.01%. The company has a long history of providing high-quality human resources solutions to businesses across a wide range of industries. Trinet Group Inc is a publicly traded company listed on the New York Stock Exchange.

– Barrett Business Services Inc ($NASDAQ:BBSI)

Barrett Business Services Inc is a provider of professional employer organization services in the United States. The company has a market cap of 588.79M as of 2022 and a Return on Equity of 24.37%. The company offers a range of services including payroll processing, human resources management, employee benefits, and workers’ compensation insurance.

– Hudson Global Inc ($NASDAQ:HSON)

Hudson Global Inc., a professional staffing and solutions company, provides talent acquisition, management, and deployment services worldwide. It operates through two segments, North America and International. The company offers a range of professional staffing and talent management solutions, including permanent, temporary, and contract recruitment; managed staffing programs; executive search; outplacement; and professional consulting services. It serves clients in a range of industries, such as accounting and finance, banking and financial services, creative and digital media, engineering, healthcare, human resources, information technology, legal, life sciences, sales and marketing, and supply chain and logistics. The company was founded in 1991 and is headquartered in New York, New York.

Summary

Investing analysis of Insperity Inc. (INSP) reveals an overall positive outlook. The stock has an 80 or higher Relative Strength Rating, indicating a strong performance in recent trading. With these metrics, Insperity Inc. appears to be a sound investment for those seeking a profitable and well-performing stock.

Recent Posts