O’Reilly Automotive Q4 2023 Earnings Beat Expectations, Posting GAAP EPS of $8.37

February 9, 2023

Trending News 🌥️

O’REILLY ($NASDAQ:ORLY): The company’s strong performance was driven by its continued focus on innovation and customer service. O’Reilly Automotive has been investing in its digital presence and expanding its store network to better serve customers both online and in-store. Their investments in technology and customer service have allowed them to provide customers with a seamless shopping experience, which has been key to their success. O’Reilly Automotive’s strong fourth quarter performance is an indication that the company is in a strong position for continued success in the future.

The company has positioned itself to take advantage of the increasing demand for automotive parts and services, and its investments in technology will allow it to continue to meet customer needs. The company’s long-term strategy of focusing on customer service and innovation is sure to pay off in the future.

Share Price

On Wednesday, O’REILLY AUTOMOTIVE stock opened at $792.6 and closed at $787.4, down by 1.7% from prior closing price of 801.0. This strong performance is a result of O’REILLY AUTOMOTIVE’s continued focus on customer service and satisfaction, with the company’s dedication to offering quality products at competitive prices paying off. The company has also been increasing its online presence, which has allowed it to access a larger customer base. With the success of its online presence and customer-centric approach, O’REILLY AUTOMOTIVE is well-positioned to continue increasing its earnings and revenue in the coming quarters. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for O’reilly Automotive. More…

| Total Revenues | Net Income | Net Margin |

| 14.06k | 2.16k | 15.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for O’reilly Automotive. More…

| Operations | Investing | Financing |

| 3k | -661.59 | -2.72k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for O’reilly Automotive. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 12.24k | 13.44k | -19.2 |

Key Ratios Snapshot

Some of the financial key ratios for O’reilly Automotive are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 12.1% | 15.6% | 21.0% |

| FCF Margin | ROE | ROA |

| 17.8% | -159.3% | 15.0% |

Analysis

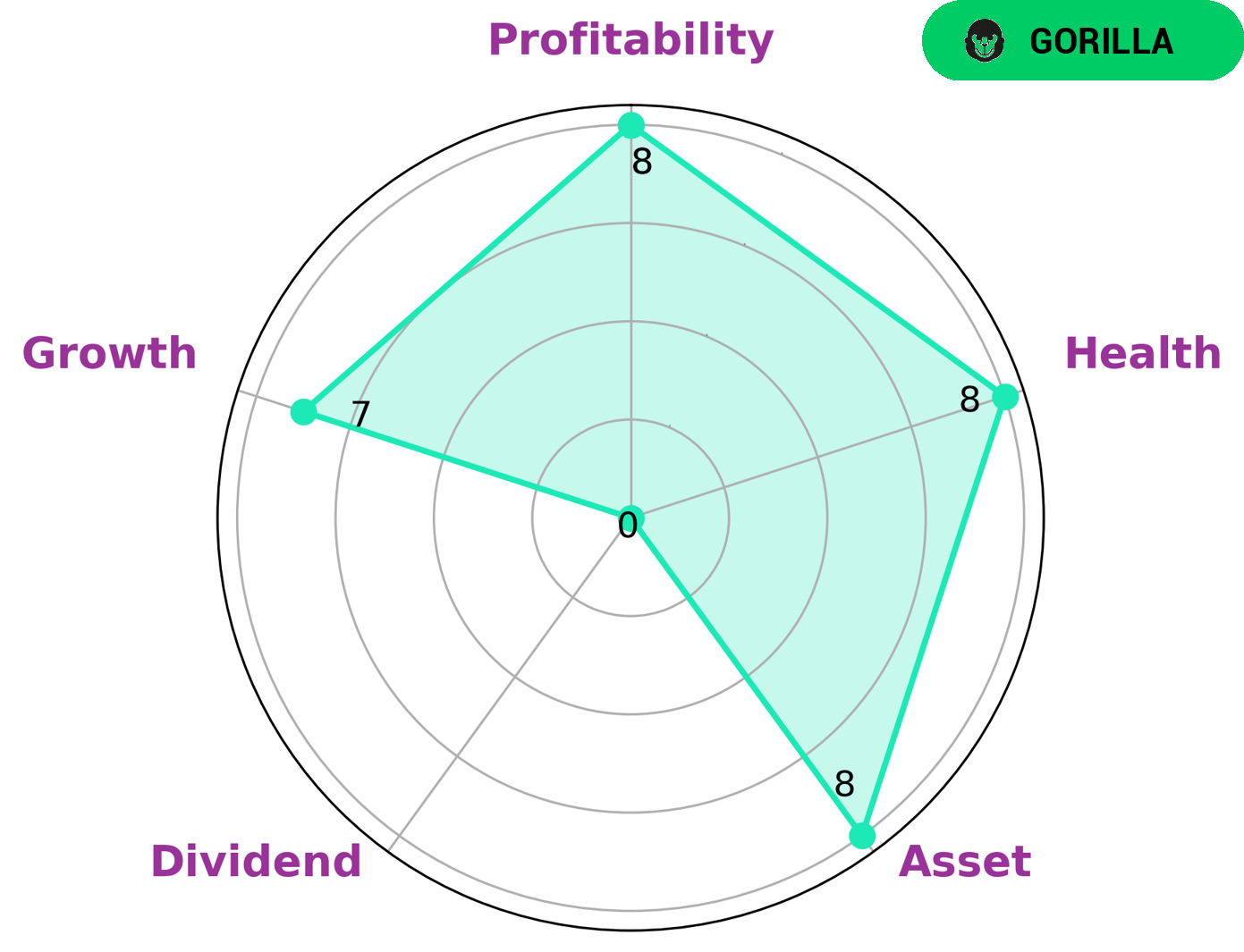

GoodWhale can be used to analyze the company’s fundamentals and its Star Chart suggests that O’REILLY AUTOMOTIVE is strong in asset, growth, and profitability and weak in dividend. This categorizes the company as a ‘gorilla’, meaning it has achieved stable and high revenue or earning growth due to its competitive advantage. Investors looking for companies with such a competitive advantage may be interested in O’REILLY AUTOMOTIVE. The company has a high health score of 8/10 with regard to its cashflows and debt, indicating it is capable to safely ride out any crisis without the risk of bankruptcy. This makes it an attractive option for investors who are looking for safe and stable investments. Furthermore, the company’s strong performance in asset, growth, and profitability indicate that it has a well-established competitive advantage and is likely to continue to perform well in the future. This makes it an attractive option for investors who are seeking long-term investments. In conclusion, O’REILLY AUTOMOTIVE is a strong option for investors looking for long-term investments with a competitive advantage. The company’s high health score and strong performance in growth, profitability, and assets make it an attractive option for those seeking stability and growth potential. More…

Peers

O’Reilly Automotive Inc is an American automotive parts retailer that provides automotive aftermarket parts, tools, supplies, equipment, and accessories in the United States. Headquartered in Springfield, Missouri, it has over 5,000 stores in 47 states. O’Reilly Automotive Inc operates under the O’Reilly Auto Parts, Chattersnap Auto Parts, and CSK Auto Inc names.

Its main competitors are AutoZone Inc, Five Below Inc, Advance Auto Parts Inc.

– AutoZone Inc ($NYSE:AZO)

AutoZone Inc is an American retailer of automotive parts and accessories, with over 6,000 stores across the United States. The company has a market cap of $43.79B as of 2022 and a Return on Equity of -61.62%. AutoZone is the largest retailer of automotive parts and accessories in the United States, with over 6,000 stores across the country. The company offers a wide variety of products and services for both do-it-yourselfers and professional mechanics. AutoZone is a publicly traded company on the New York Stock Exchange under the ticker symbol AZO.

– Five Below Inc ($NASDAQ:FIVE)

Five Below Inc is a publicly traded company with a market cap of 7.51B as of 2022. The company has a Return on Equity of 18.02%. Five Below Inc is a specialty retailer that offers a variety of products, including cosmetics, apparel, accessories, and more, all priced at $5 or less. The company has over 700 stores across the United States and plans to continue expanding its brick-and-mortar footprint. Five Below Inc is headquartered in Philadelphia, Pennsylvania.

– Advance Auto Parts Inc ($NYSE:AAP)

Advance Auto Parts is a leading retailer of automotive parts, accessories and maintenance items in the United States. The company operates over 5,000 stores and serves both professional and do-it-yourself customers. Advance Auto Parts has a market cap of 10.3B as of 2022 and a Return on Equity of 16.16%. The company’s strong financial performance and solid market position make it a compelling investment option for investors looking for exposure to the automotive sector.

Summary

O’Reilly Automotive, a leading auto parts retailer, recently reported its fourth quarter financial results of 2023, and beat expectations. The earnings beat is a positive sign for investors, as it suggests that O’Reilly is continuing to benefit from strong demand for its services. Investors may want to consider adding the stock to their portfolios as the company appears to be on a strong growth trajectory.

Recent Posts