NaaS Technology Sinks 2.6% Following $21M Direct Offering

June 1, 2023

🌥️Trending News

NAAS ($NASDAQ:NAAS): NaaS Technology has seen a decrease of 2.6% following their direct offering of $21 million. The company, which specializes in Network-as-a-Service solutions, had seen significant growth prior to the offering, however the recent dip in their stock price has thrown a wrinkle into their plans. NaaS Technology provides customers with on-demand access to a global network infrastructure that is secure, reliable, and cost-effective for businesses of all sizes. The company is committed to providing businesses with a secure and reliable solution that offers improved collaboration, scalability, and performance. As a leading provider of networking solutions, NaaS Technology offers a variety of cutting-edge solutions for businesses looking to keep their networks up and running.

The company’s focus on customer service and dedication to quality products have earned them an excellent reputation in the industry. Despite the recent dip in stock price, the company is continuing to focus on their core mission of providing customers with reliable networking solutions. With the dedication to this mission, NaaS Technology is confident that they will be able to turn the situation around and restore the company’s strong track record of success.

Analysis

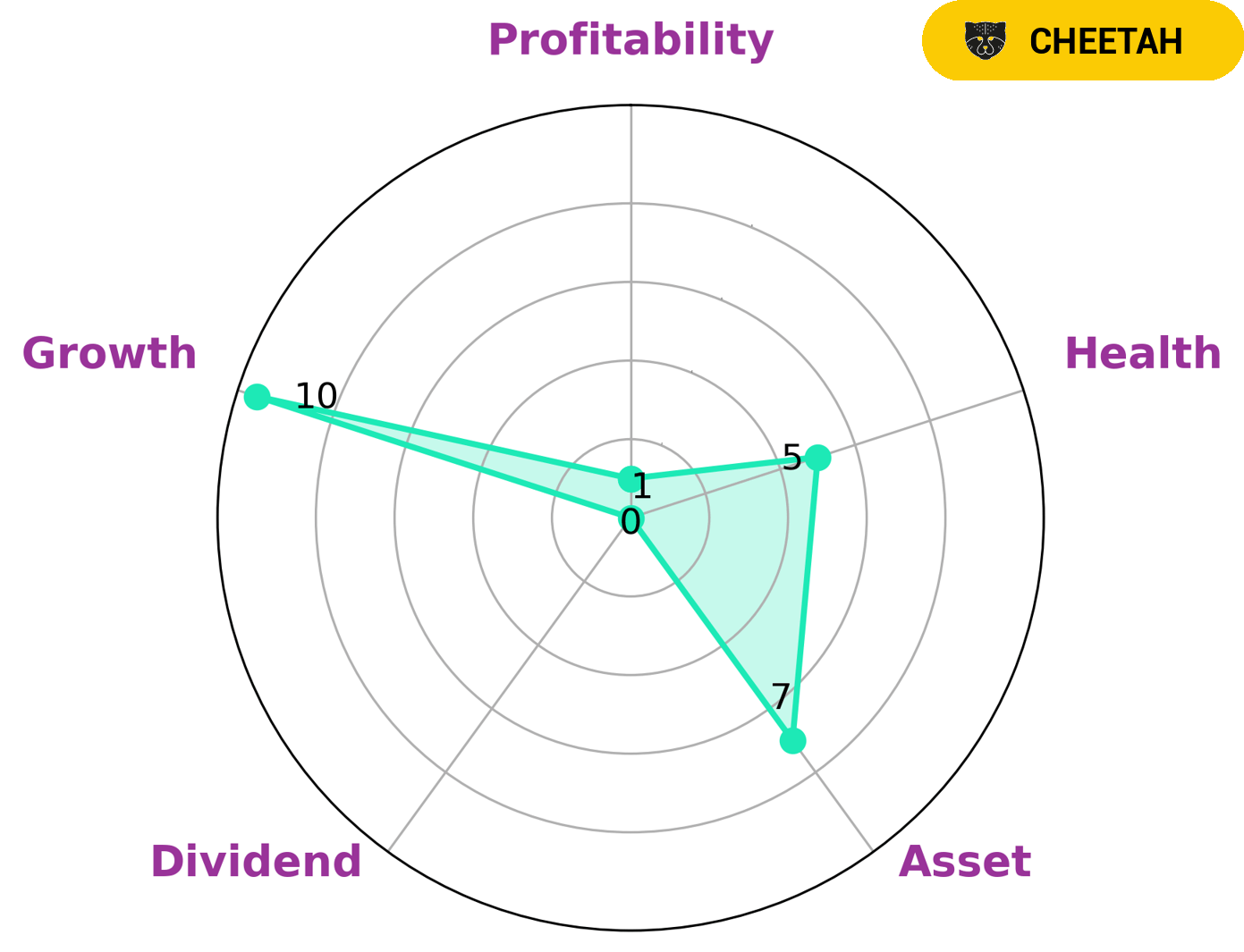

After performing a comprehensive analysis of NAAS TECHNOLOGY, we at GoodWhale have concluded that the company’s overall welfare is intermediate, scoring 5 out of 10 on our Star Chart. This means that the company appears to be able to weather any potential crisis without the risk of bankruptcy. We have determined that NAAS TECHNOLOGY is strong in terms of assets and growth, but weaker in dividends and profitability. As a result, we have classified the company as a ‘cheetah’, which entails high revenue or earnings growth while being considered slightly less stable due to lower profitability. The type of investors that would be interested in such a company would be those looking for high returns with a moderate to high risk tolerance. Cheetah companies bring a high potential for rewards, but also with a greater risk of volatility due to the lower profitability levels. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Naas Technology. More…

| Total Revenues | Net Income | Net Margin |

| 92.81 | -5.64k | -4033.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Naas Technology. More…

| Operations | Investing | Financing |

| -250.03 | -5.61 | 260.7 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Naas Technology. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.11k | 667.06 | 1.96 |

Key Ratios Snapshot

Some of the financial key ratios for Naas Technology are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | -6052.1% |

| FCF Margin | ROE | ROA |

| -270.0% | -818.1% | -317.4% |

Peers

They face stiff competition from other companies such as Volta Inc, Nuvve Holding Corp, and Zhejiang Supor Co Ltd, all of whom are at the forefront of the energy storage technology industry.

– Volta Inc ($NYSE:VLTA)

Volta Inc is a global energy and power technology company, primarily focused on pioneering innovative renewable energy solutions. It has a market cap of 149.46 million as of 2023, indicating the market value of its outstanding shares. Additionally, Volta Inc has a negative Return on Equity (ROE) of -82.46%, which means that the company is not generating wealth for its shareholders. This can be attributed to the high costs associated with pioneering new technologies and the fact that it is still a relatively new company.

– Nuvve Holding Corp ($NASDAQ:NVVE)

Nuvve Holding Corp is a publicly traded company on the NASDAQ stock exchange that provides energy storage and electric vehicle charging solutions. The company has a market capitalization of 46.04M as of 2023, indicating that it is a relatively small-cap stock. Its return on equity (ROE) is -74.73%, which means that its net income is negative relative to its shareholders’ equity. This suggests that the company has not been able to generate sufficient profits to cover its cost of capital and debt, leading to the negative return.

– Zhejiang Supor Co Ltd ($SZSE:002032)

Zhejiang Supor Co Ltd is a Chinese consumer goods manufacturing company based in Hangzhou, China. The company is primarily engaged in the production of cookware, kitchen appliances, and other small household goods. As of 2023, the company has a market cap of 42.58B and a Return on Equity of 22.45%, making it one of the largest companies in the consumer goods sector in China. Zhejiang Supor Co Ltd is a well-known brand in China with a high reputation and an extensive product line of kitchen appliances and cookware. The company’s strong financials and high ROE demonstrate its strong market position and profitability.

Summary

NaaS Technology has seen a decline of 2.6% following a direct offering of $21M. This offering may have been in response to current market conditions or to raise additional capital for the company. Investors will want to analyze the impacts of the offering and take into consideration the company’s overall performance before making any decision. They will want to look at the company’s financials, including its revenue, profits, and cash flow, to determine whether or not the stock is a good buy. They may also want to analyze the industry and competitive landscape to determine if NaaS Technology has a competitive edge and a clear growth path.

Additionally, investors should take into account the company’s current debt load and whether it is manageable. Finally, investors should examine the company’s management team to determine if they have the experience and leadership necessary for success. By evaluating all these factors, investors can make an informed decision about NaaS Technology.

Recent Posts