NaaS Technology Inc Shares Drop 3.6% Despite Positive Outlook.

February 6, 2023

Trending News 🌧️

NAAS ($NASDAQ:NAAS): NaaS Technology Inc. is a global technology company that provides a range of cloud-based services, such as cloud storage, data analytics, and software development services, to businesses and organizations.

However, despite its strong growth and positive outlook, the company’s stock has seen its share price decrease by 3.6%. The drop in NaaS Technology Inc. shares has been attributed to several factors. Firstly, the company recently announced a restructuring plan that included layoffs and salary cuts. This caused market jitters, leading to a decrease in the company’s stock price. Secondly, the company’s competitors have been increasingly gaining market share, putting pressure on NaaS Technology Inc. to keep up with its competitors. Finally, the company’s share price has been affected by the volatility in the tech sector, as investors are uncertain about the future of the industry. Despite the 3.6% drop in NaaS Technology Inc. stock, analysts believe that the company’s long-term outlook remains positive. The company has been steadily increasing its market share, and with its restructuring plan in place, it is well positioned to capitalize on the growing demand for cloud services. Furthermore, analysts believe that the company’s focus on innovation and customer service will continue to give it an edge over its competitors. In conclusion, although NaaS Technology Inc. shares have dropped by 3.6%, analysts remain optimistic about its long-term prospects. The company’s restructuring plan and focus on innovation will ensure that it remains competitive and profitable in the coming years. As such, investors should consider this dip in the company’s stock price an opportunity to invest in a promising technology company with a bright future ahead of it.

Market Price

Thursday saw a significant drop in share prices for NaaS Technology Inc, with the stock opening at $5.2 and closing at $5.4, a 3.6% drop from its previous closing price of $5.2. Despite this, analysts remain optimistic about the company’s future prospects. Its services enable customers to access secure and reliable computing resources, enabling them to scale quickly and efficiently. The company has been making significant investments in its technology, partnering with leading technology companies to develop new platforms and services. Despite the drop in share prices, analysts are still bullish on NaaS Technology Inc’s prospects going forward. They point to the company’s increasingly diverse product portfolio and its focus on innovation as signs of a healthy business model. The company is also making strides in developing its presence overseas, which could further increase its global reach.

NaaS Technology Inc’s management team is also confident that the company’s performance will continue to improve in the coming months. They are confident that their investments in technology and customer service will pay off, leading to increased market share and customer loyalty. The company is also taking steps to ensure that its financials remain strong, with a focus on efficiency and cost control. This should help the company maintain its financial stability, even in the face of market volatility. Overall, analysts remain positive about NaaS Technology Inc’s outlook for the future, despite the recent dip in share prices. With its strong technology and customer service, along with its plans for further expansion, NaaS Technology Inc is well positioned to capitalize on future growth opportunities. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Naas Technology. More…

| Total Revenues | Net Income | Net Margin |

| 32.58 | -793.21 | -2350.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Naas Technology. More…

| Operations | Investing | Financing |

| -250.03 | -5.61 | 260.7 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Naas Technology. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 595.95 | 173.65 | 1.97 |

Key Ratios Snapshot

Some of the financial key ratios for Naas Technology are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| – | – | -2271.7% |

| FCF Margin | ROE | ROA |

| -769.3% | -901.3% | -77.6% |

VI Analysis

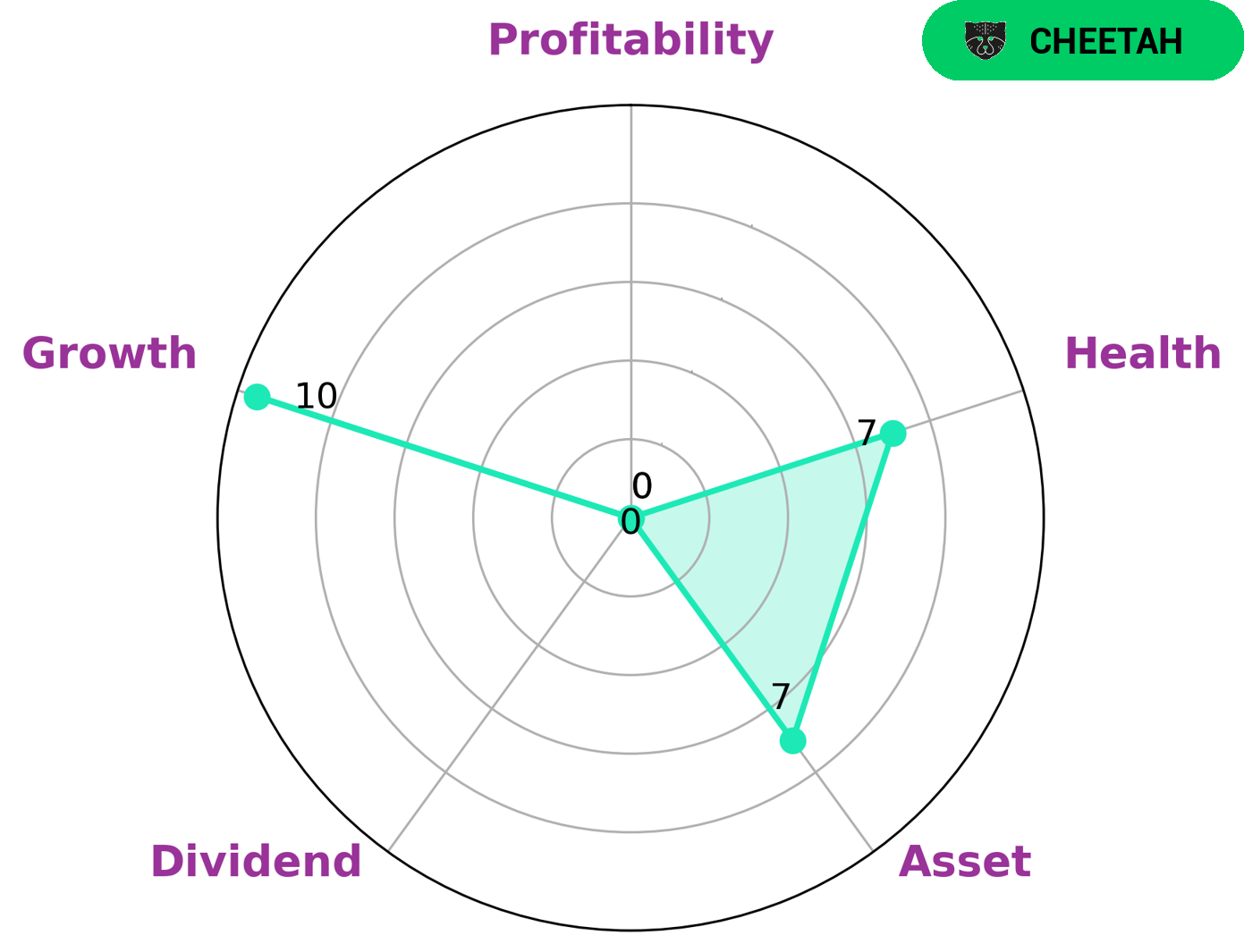

Investors looking for high growth potential may be interested in NAAS TECHNOLOGY, as indicated by its classification as a ‘cheetah’ in the VI Star Chart. A cheetah is a type of company that has achieved high revenue or earnings growth, but is considered less stable due to lower profitability. Despite its less than stellar profitability, the company has a strong health score of 7/10, signifying its ability to withstand any economic downturns without the risk of bankruptcy. The company’s assets and growth are considered strong, however its dividend and profitability are weak. It is likely that investors looking for a long-term investment may be more interested in NAAS TECHNOLOGY due to its potential for high growth over time.

The company’s stability also provides an important sense of security for those interested in investing for the long haul. Overall, NAAS TECHNOLOGY is an attractive option for investors looking for potential growth with a sense of security. The company’s robust cash flows and debt suggest that it will be able to ride out any crisis without the risk of bankruptcy. Although its dividend returns and profitability may be low, the potential for growth may make it an attractive option for investors looking to capitalize on long-term gains.

Peers

They face stiff competition from other companies such as Volta Inc, Nuvve Holding Corp, and Zhejiang Supor Co Ltd, all of whom are at the forefront of the energy storage technology industry.

– Volta Inc ($NYSE:VLTA)

Volta Inc is a global energy and power technology company, primarily focused on pioneering innovative renewable energy solutions. It has a market cap of 149.46 million as of 2023, indicating the market value of its outstanding shares. Additionally, Volta Inc has a negative Return on Equity (ROE) of -82.46%, which means that the company is not generating wealth for its shareholders. This can be attributed to the high costs associated with pioneering new technologies and the fact that it is still a relatively new company.

– Nuvve Holding Corp ($NASDAQ:NVVE)

Nuvve Holding Corp is a publicly traded company on the NASDAQ stock exchange that provides energy storage and electric vehicle charging solutions. The company has a market capitalization of 46.04M as of 2023, indicating that it is a relatively small-cap stock. Its return on equity (ROE) is -74.73%, which means that its net income is negative relative to its shareholders’ equity. This suggests that the company has not been able to generate sufficient profits to cover its cost of capital and debt, leading to the negative return.

– Zhejiang Supor Co Ltd ($SZSE:002032)

Zhejiang Supor Co Ltd is a Chinese consumer goods manufacturing company based in Hangzhou, China. The company is primarily engaged in the production of cookware, kitchen appliances, and other small household goods. As of 2023, the company has a market cap of 42.58B and a Return on Equity of 22.45%, making it one of the largest companies in the consumer goods sector in China. Zhejiang Supor Co Ltd is a well-known brand in China with a high reputation and an extensive product line of kitchen appliances and cookware. The company’s strong financials and high ROE demonstrate its strong market position and profitability.

Summary

Investing in NaaS Technology Inc can be a potentially lucrative endeavor, as the company’s shares have recently dropped 3.6% despite a positive outlook.

However, the stock price moved up the same day, indicating that investors remain optimistic about the company’s future. NaaS Technology Inc has a strong presence in the global market and is well-positioned to capitalize on emerging opportunities. Its innovative products and services have positioned it as a leader in its industry, and its financials are sound. With a focus on research and development, NaaS Technology Inc has a competitive advantage that could lead to future growth and increased profitability. Investors should carefully consider all of the factors when making an investment decision.

Recent Posts