MURPHY USA Receives Relative Strength Rating Upgrade to 81 Monday

June 7, 2023

☀️Trending News

The company is a subsidiary of Murphy ($NYSE:MUSA) Oil Corporation and supplies gasoline and convenience store items. On Monday, the Relative Strength Rating for Murphy USA‘s stock had an upgrade from 78 to 81. This is an important factor to consider when deciding on which stocks to buy and watch. The Relative Strength Rating is a measure of price performance which reveals how a stock has performed relative to other stocks on the market over a certain period of time.

An upgrade in rating indicates that the stock has done better than other stocks on the market in the past few weeks or months. The upgraded rating of Murphy USA’s stock implies that the stock is performing better than most of its competitors on the market, which makes it a strong investment option for those looking to purchase stocks and make profitable investments. With the upgraded rating, investors can be confident in the potential of Murphy USA’s stock to succeed and make them a healthy return on their investments.

Price History

This upgrade came after the stock opened at $289.0 and closed at $286.1, representing a decrease of 1.1% from the prior closing price of 289.2. Despite the slight drop in price, investors saw this upgrade as a sign of confidence in the company’s financial strength. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Murphy Usa. More…

| Total Revenues | Net Income | Net Margin |

| 23.4k | 626.8 | 2.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Murphy Usa. More…

| Operations | Investing | Financing |

| 805.2 | -323.9 | -735.4 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Murphy Usa. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.12k | 3.4k | 32.91 |

Key Ratios Snapshot

Some of the financial key ratios for Murphy Usa are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 18.4% | 33.7% | 3.9% |

| FCF Margin | ROE | ROA |

| 2.1% | 84.1% | 13.9% |

Analysis

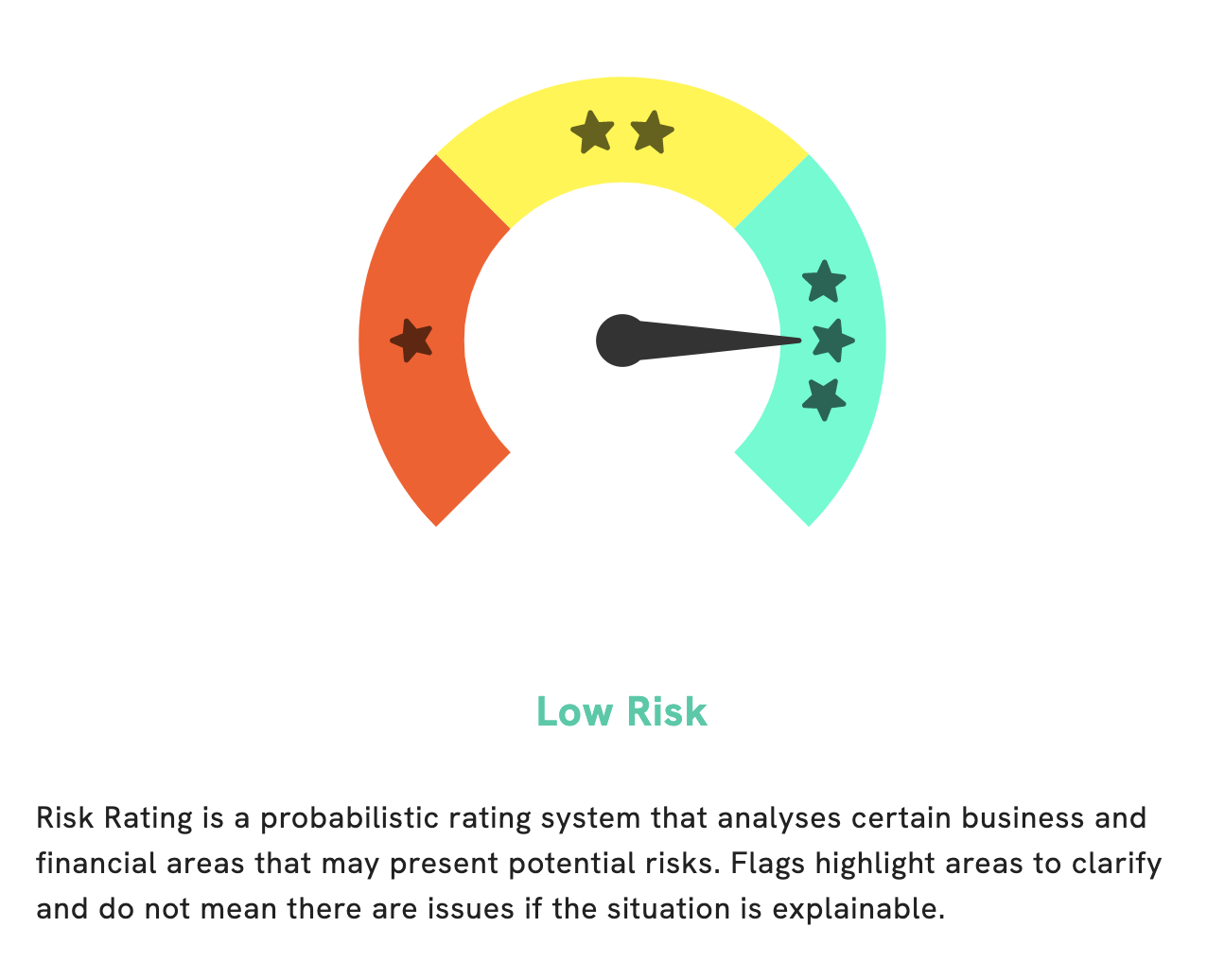

GoodWhale has conducted an in-depth analysis of MURPHY USA‘s fundamentals and has concluded that it is a low-risk investment. After reviewing its risk rating, we found the company to be performing well in terms of financial and business aspects. However, our analysis of MURPHY USA’s income sheet, balance sheet, and cashflow statement identified 3 risk warnings that investors might want to take note of. To give you more detail on these potential risks, become a registered user with GoodWhale to access our insights. More…

Peers

Its competitors are Casey’s General Stores, Tractor Supply Co, and Bed Bath & Beyond. Murphy USA has a significant presence in the southeastern United States, with over 1,400 stores in 28 states. The company is headquartered in El Dorado, Arkansas.

– Casey’s General Stores Inc ($NASDAQ:CASY)

Casey’s General Stores Inc is a publicly traded company with a market capitalization of 8.47 billion as of 2022. The company operates convenience stores in the United States and offers a variety of products and services including gasoline, prepared food, and other merchandise. Casey’s General Stores Inc has a return on equity of 14.75% as of 2022.

– Tractor Supply Co ($NASDAQ:TSCO)

Tractor Supply Co is a publicly traded company with a market capitalization of $23.47 billion as of 2022. The company has a return on equity of 44.38%, meaning that it has generated a significant amount of shareholder value over the years. Tractor Supply Co is a retailer of agricultural and construction equipment, supplies, and tools. The company operates over 2,000 stores across the United States and offers an extensive product selection online.

– Bed Bath & Beyond Inc ($NASDAQ:BBBY)

Bath & Beyond Inc. is a home furnishings retailer that sells a variety of products for the home, including kitchen and dining items, bedding, bathroom accessories, and home decor. The company has a market capitalization of $356.11 million and a return on equity of 146.77%. Bath & Beyond operates through a network of stores in the United States and Canada.

Summary

Investment analysis on Murphy USA is bullish, with the Relative Strength Rating upgraded from 78 to 81 Monday. This suggests the stock has good potential for growth and a favorable outlook for performance. Investing in Murphy USA can offer investors growth and capital appreciation potential in the long-term. Fundamentals such as earnings growth, revenue, market share, industry trends, and competitive advantage should be considered when making an investment decision.

Investors should also watch for any positive news about Murphy USA that could influence the stock’s performance. Ultimately, careful research and analysis should be done before investing in any stock.

Recent Posts