Leslie’s Misses Q1 Earnings Expectations by a Penny

February 4, 2023

Trending News 🌧️

Leslie’s ($NASDAQ:LESL), Inc., is a leading operator of pool and spa superstores in the United States. The company is committed to providing customers with reliable pool and spa supplies, services, and solutions to enable them to enjoy their pool and spa. Recently, Leslie’s press release announced its first quarter earnings, revealing that it had missed analysts’ expectations by a penny. The company attributed the miss to higher-than-expected operating expenses, which were driven by an increase in advertising, payroll, and distribution costs. This was partially offset by a decrease in bad debt expenses, as well as an increase in cost savings initiatives. Despite the miss, Leslie’s still remains optimistic about the future. They are confident that the cost savings initiatives they are implementing will continue to drive higher profits in the upcoming quarters. Additionally, the company believes that its strategic investments in marketing and technology will help them remain competitive and capitalize on growth opportunities in the future. Overall, Leslie’s first quarter earnings result was a disappointment for investors and analysts alike.

However, the company is confident that their strategic cost-saving initiatives will lead to better results in the coming quarters.

Price History

On Thursday, Leslie’s missed their quarterly earnings expectations by a penny and the media sentiment is mostly negative. Despite the news, the stock opened at $16.5 and closed at $16.7, up by 3.4% from prior closing price of 16.2. The news raises questions about the company’s outlook for the rest of the year and whether investors should be concerned. The company has yet to provide further details on what caused the miss in earnings, but analysts are speculating that it could be related to an unfavorable shift in the market or a decrease in demand for their products. Given the current situation, investors may want to take a more cautious approach to their investments in Leslie’s.

It’s important to consider how this news could affect the company’s stock price in the future and whether or not it will be a good long-term investment. At this point, the best strategy may be to wait and see how the company responds to this news. If they can address the issues that led to the miss in earnings, it could provide a boost for the stock and attract new investments. On the other hand, if they are unable to turn things around, investors may want to consider other options in order to protect their investments. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Leslie’s. More…

| Total Revenues | Net Income | Net Margin |

| 1.57k | 143.22 | 9.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Leslie’s. More…

| Operations | Investing | Financing |

| 7.79 | -142.2 | 83.76 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Leslie’s. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.08k | 1.3k | -1.23 |

Key Ratios Snapshot

Some of the financial key ratios for Leslie’s are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 18.9% | 25.2% | 14.3% |

| FCF Margin | ROE | ROA |

| -1.5% | -66.2% | 13.0% |

Analysis

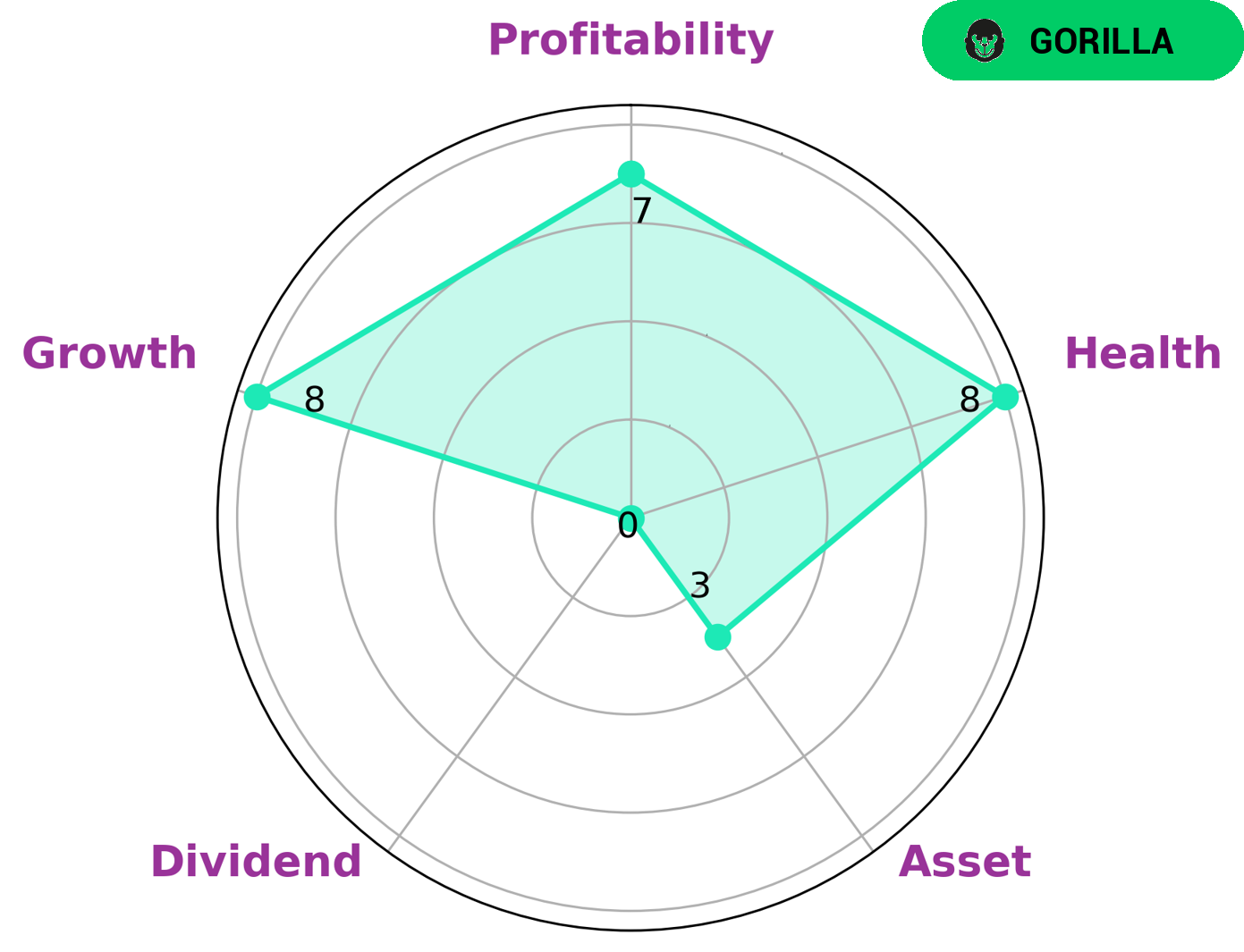

GoodWhale has conducted an analysis of Leslie’s wellbeing and determined that the company is in a good financial position. Based on the Star Chart, Leslie’s has a high health score of 8/10 and is capable of safely riding out any crisis without the risk of bankruptcy. The company is strong in growth and profitability, but weak in asset and dividend. Furthermore, Leslie’s is classified as a ‘gorilla’, a type of company that achieved stable and high revenue or earning growth due to its strong competitive advantage. These characteristics make Leslie’s an attractive investment for a wide range of investors. Those looking for strong growth potential may be drawn to the company’s attractive prospects for expansion. Investors who prioritize stability may be reassured by the company’s healthy cashflows and debt and its ability to survive any economic downturns. Dividend investors may, however, be disappointed by the company’s weak dividend yield. Overall, Leslie’s is an attractive option for investors of all types. Its strong competitive advantage makes it a great long-term investment, while its healthy financial position and strong growth potential make it an ideal choice for short-term investors. With a combination of growth and stability, Leslie’s is sure to appeal to many investors. More…

Peers

Leslie’s is the world’s largest retailer of swimming pool supplies. Headquartered in Phoenix, Arizona, the company operates over 900 retail stores in the United States and Canada. Leslie’s also operates an e-commerce website and direct mail catalog business. The company was founded in 1963 by brothers John and Bill Leslie. Pool Corp is the world’s largest wholesale distributor of swimming pool supplies and equipment. Headquartered in Covington, Louisiana, the company operates over 360 distribution centers in North America, Europe, South America, and Australia. Pool Corp was founded in 1993. Tandem Group PLC is a leading designer, manufacturer, and distributor of swimming pool and spa products. Headquartered in the United Kingdom, the company operates in over 30 countries worldwide. Tandem Group PLC was founded in 1981. Real American Capital Corp is a leading provider of financing solutions for the swimming pool and spa industry. Headquartered in Boca Raton, Florida, the company operates in the United States, Canada, and Europe. Real American Capital Corp was founded in 2008.

– Pool Corp ($NASDAQ:POOL)

Pentair plc, through its subsidiaries, provides water and fluid solutions worldwide. The company operates in two segments, Industrial and Residential & Commercial. The Industrial segment offers a range of products and services that meet the needs of customers in the water and fluid solutions industry, including filtration, separation, fluid control, fluid movement, fluid management, and heat transfer. The Residential & Commercial segment provides products and services that meet the needs of customers in the residential and commercial water markets. Pentair plc was founded in 1966 and is headquartered in London, the United Kingdom.

– Tandem Group PLC ($LSE:TND)

The Tandem Group plc is a holding company that engages in the design, development, manufacture, and distribution of bicycles and bicycle products under the Raleigh, Diamondback, and Redline brands. The company operates through two segments, Bicycles and Accessories, and Pools. The Bicycles and Accessories segment offers bicycles, bicycle parts, and bicycle accessories. The Pools segment provides above-ground and in-ground swimming pools, related equipment, and chemicals. The company was founded in 1887 and is headquartered in Kent, the United Kingdom.

Summary

Despite this, their stock price rose the same day, likely due to investors interpreting the results as better than expected. Media sentiment on the company is mostly negative, however investors seem to be taking a more optimistic view of the results. In order to gain an accurate understanding of the company’s prospects, investors should look beyond the headlines and analyze the company’s financials in detail.

Recent Posts