Container Store Intrinsic Value Calculator – The Container Store Reports Non-GAAP EPS Beat, Revenue Miss

May 17, 2023

Trending News 🌧️

The Container Store ($NYSE:TCS) Group, Inc. is a specialty retailer of storage and organization products in the United States. It operates through two segments, The Container Store and Elfa. It offers products to organize kitchens, closets, bathrooms, bedrooms, offices, mudrooms, laundry rooms, and garages.

Price History

On Tuesday, The Container Store (CONTAINER STORE) reported a Non-GAAP earnings per share (EPS) beat, but a revenue miss for the quarter. The company’s stock opened at $2.8 and closed at $2.7, down by 4.9% from its previous closing price of $2.8. Despite the slight dip, The Container Store was still able to post better than expected earnings for the quarter. Overall, the company’s Non-GAAP EPS beat was a bright spot in its quarterly report, but the revenue miss was a drag on its stock price, bringing it down 4.9 percent on Tuesday. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Container Store. More…

| Total Revenues | Net Income | Net Margin |

| 1.09k | 53.55 | 4.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Container Store. More…

| Operations | Investing | Financing |

| 60.26 | -56.06 | -17.03 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Container Store. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.21k | 759.51 | 9.14 |

Key Ratios Snapshot

Some of the financial key ratios for Container Store are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 5.6% | 23.6% | 8.3% |

| FCF Margin | ROE | ROA |

| 0.4% | 12.7% | 4.7% |

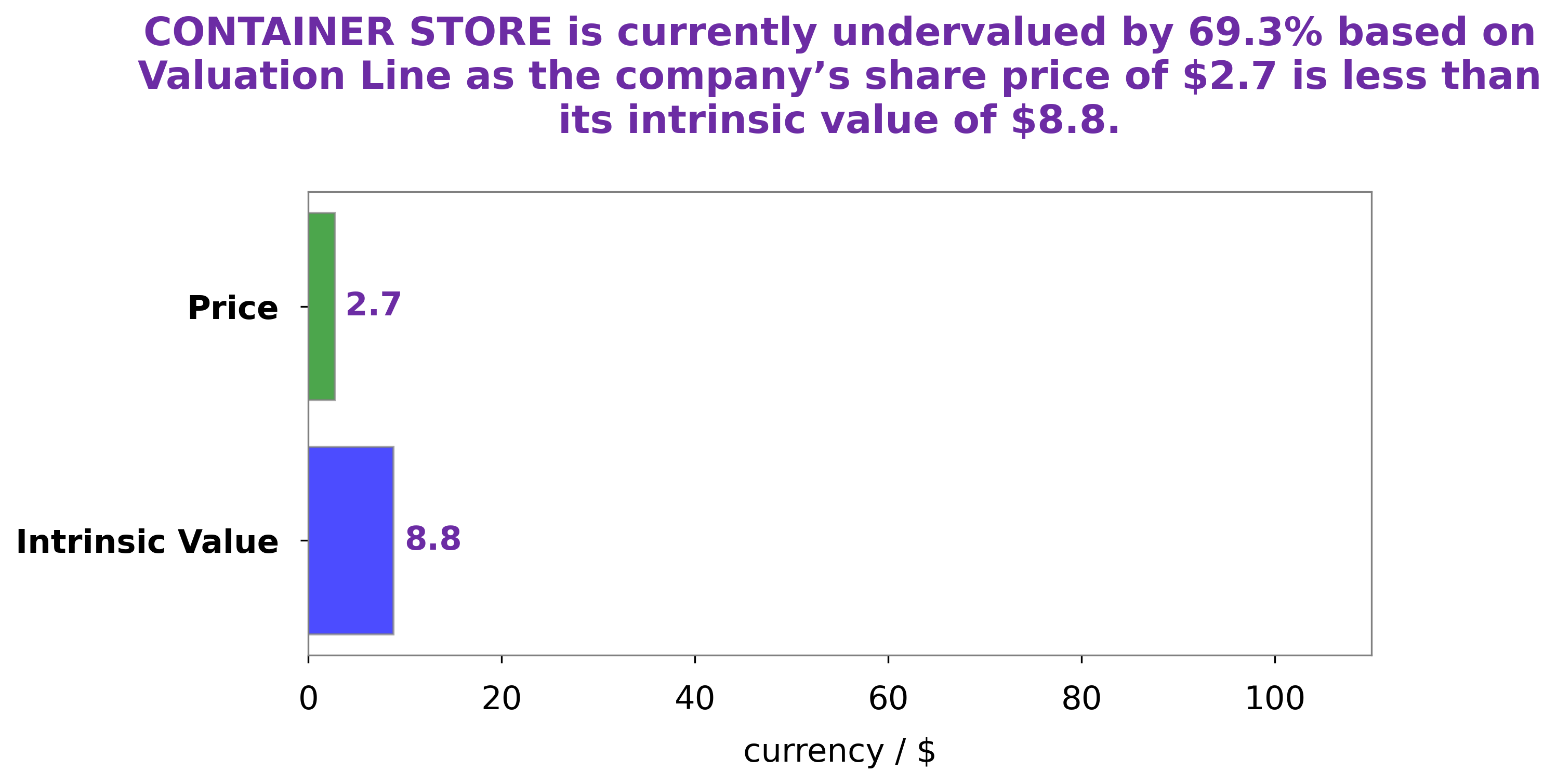

Analysis – Container Store Intrinsic Value Calculator

At GoodWhale, we conducted an analysis of CONTAINER STORE‘s financials and have determined that the intrinsic value of the company’s shares is currently around $8.8. This figure is based on our proprietary Valuation Line, which takes into account a number of key financial metrics and applies a unique methodology to accurately determine the intrinsic value of a company’s stocks. Currently, CONTAINER STORE’s stock is traded at $2.7, a figure that is significantly lower than what our Valuation Line has determined as its true value. This means that CONTAINER STORE shares are currently undervalued by 69.2%. This presents an excellent opportunity for shrewd investors who are looking to capitalize on the current market mispricing of the company’s stock. More…

Peers

The Container Store Group Inc is a leading retailer in the United States. The company offers a wide variety of products and services, including storage and organization, kitchen and bath, and home. The company operates through a network of retail stores and online channels. The Container Store Group Inc competes with Century Ginwa Retail Holdings Ltd, Grand Ocean Retail Group Ltd, Shirble Department Store Holdings (China) Ltd, and other retailers in the United States and internationally.

– Century Ginwa Retail Holdings Ltd ($SEHK:00162)

Century Ginwa Retail Holdings Ltd is a retail company that operates in China. The company has a market cap of 158.66M as of 2022 and a Return on Equity of -9.06%. The company operates in the retail sector and is involved in the sale of general merchandise, including clothing, footwear, household items, and other consumer goods. The company operates through a network of retail stores and has a presence in the Chinese market. The company has a strong growth potential in the Chinese retail market.

– Grand Ocean Retail Group Ltd ($TWSE:5907)

Ocean Retail Group is a leading retailer in China with over 2,500 stores across the country. The company offers a wide range of products and services, including food, clothing, and home goods. Ocean Retail Group has a market cap of 2.58B as of 2022 and a return on equity of 2.84%. The company has a strong presence in China’s retail market and is well-positioned to continue growing its business in the future.

– Shirble Department Store Holdings (China) Ltd ($SEHK:00312)

Shirble Department Store Holdings (China) Ltd is a department store chain in China. The company operates stores in Beijing, Shanghai, and Guangzhou. It offers a wide range of merchandise, including apparel, cosmetics, home furnishings, and electronics. The company also operates an online store.

Shirble Department Store Holdings (China) Ltd has a market cap of 224.55M as of 2022. The company has a Return on Equity of -11.94%. The company’s market cap and ROE are both below the industry average. This may be due to the company’s high debt levels. The company’s debt-to-equity ratio is 0.61, which is higher than the industry average of 0.54.

The company’s market cap and ROE may improve in the future as the company expands its store base and online presence.

Summary

The Container Store recently reported its Non-GAAP EPS of $0.18, beating market expectations by $0.02. However its revenue of $259.72M missed estimates by $6M. Following the report, the stock price moved down the same day. Analysts have suggested that investors should watch for any changes in the company’s future outlook and performance.

In the short-term, investors should assess any current macroeconomic and geopolitical factors that may affect the stock price. In the long-term, they should monitor the company’s financials and identify potential growth opportunities or key weakness in order to make an informed investment decision.

Recent Posts