2023 Yearly Returns for Genuine Parts Company Fall in Line with Earnings Growth, Shares Drop by 5.1%.

March 20, 2023

Trending News ☀️

The news of Genuine Parts ($NYSE:GPC) Company’s stock dropping by 5.1% this week and 10% in the past week has caused some concern among shareholders as the yearly returns are now closer line with the earnings growth. This decrease has been felt more drastically in the past week and has caused the stock to drop below its pre-monthly earnings announcement of two weeks ago. The company’s earnings growth over the past year has been modest, with total revenue increasing by 3% compared to the previous year. This was below the market expectations, however, as analysts were expecting a 5% year-over-year increase in revenue. The modest earnings growth and the resulting share price drop could be attributed to the competitive landscape in the automotive aftermarket industry. Customer demand for genuine parts has been decreasing, thanks to increasing competition from third-party OEMs and aftermarket suppliers. This has caused Genuine Parts Company to focus on cost-cutting measures to maintain their profitability, which has ultimately weighed on their bottom line and earnings growth. Despite the share price drop, there is still potential for growth in the stock over the next quarter. If the company can continue to focus on cost reduction, as well as increase their market share, they could potentially see a rebound in stock prices.

Additionally, if customer demand increases and pricing power returns, Genuine Parts Company could benefit from higher share prices.

Share Price

At the time of writing the media coverage on GENUINE PARTS Company’s stock had mostly been positive, however its yearly returns for 2023 have fallen in line with their earnings growth. On Monday, the stock opened at $161.2 and closed at $162.5, being 0.3% lower from its last closing price of $163.0. This resulted in a 5.1% drop for GENUINE PARTS’ shares in spite of the positive coverage, showing that investors are still not completely convinced of the company’s future prospects. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Genuine Parts. More…

| Total Revenues | Net Income | Net Margin |

| 22.1k | 1.18k | 5.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Genuine Parts. More…

| Operations | Investing | Financing |

| 1.47k | -1.68k | 205.1 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Genuine Parts. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 16.5k | 12.69k | 26.89 |

Key Ratios Snapshot

Some of the financial key ratios for Genuine Parts are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 4.4% | 13.7% | 7.5% |

| FCF Margin | ROE | ROA |

| 5.1% | 27.6% | 6.2% |

Analysis

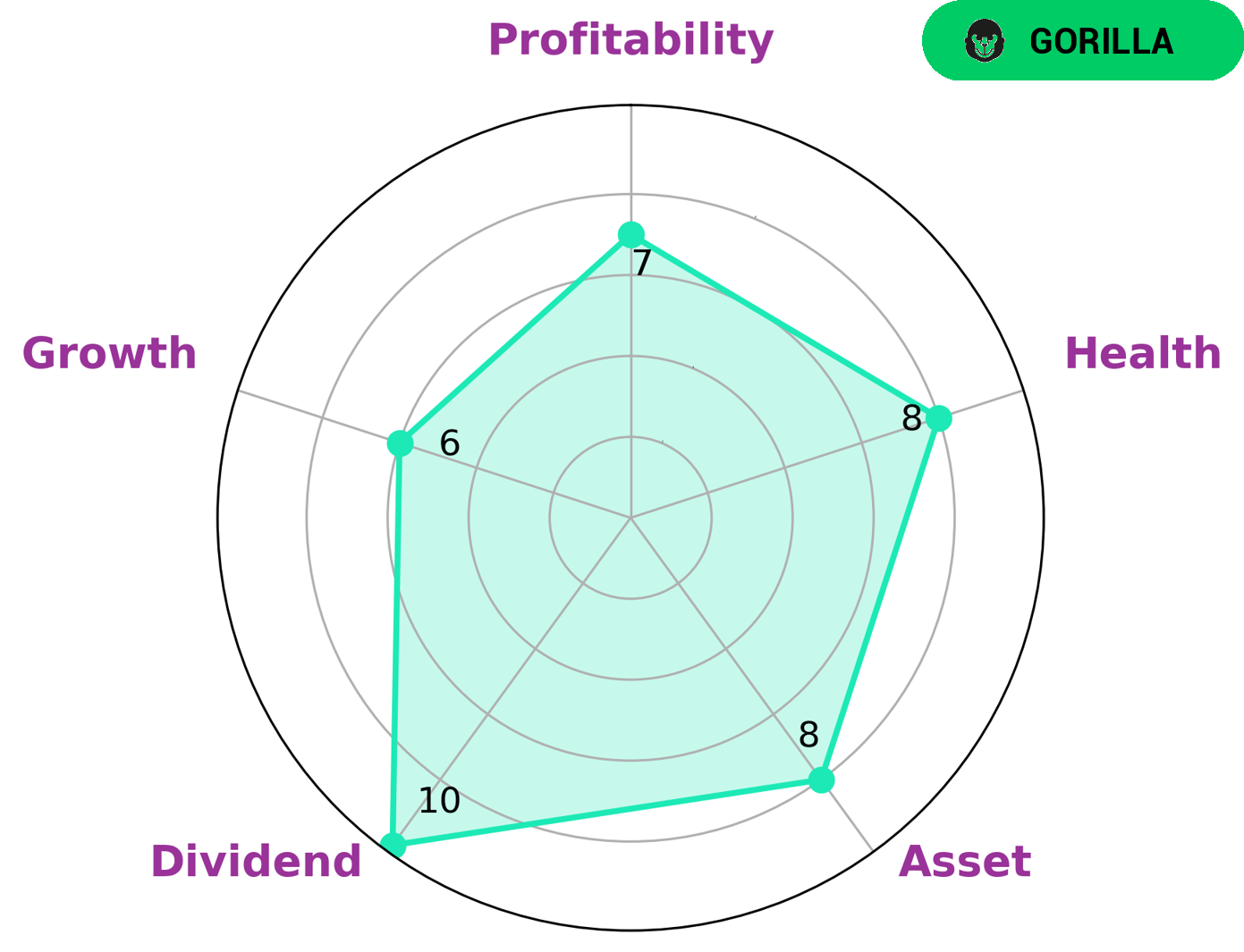

GoodWhale has conducted an analysis on GENUINE PARTS‘s fundamentals, and based on our Star Chart, GENUINE PARTS is classified as ‘gorilla’, a type of company that has achieved a stable and high revenue or earning growth due to its strong competitive advantage. For investors that are interested in long-term and stable investments, GENUINE PARTS may be a good choice. GENUINE PARTS has strong fundamentals in asset, dividend and profitability, and is medium in growth. In terms of health score, GENUINE PARTS scored 8 out of 10, indicating that it is capable to safely ride out any crisis without the risk of bankruptcy. More…

Peers

The automotive aftermarket is a highly competitive industry with a few large players and many small regional players. The three largest companies in the industry are Genuine Parts Co, Advance Auto Parts Inc, and O’Reilly Automotive Inc. These companies compete against each other for market share, customers, and suppliers.

– Advance Auto Parts Inc ($NYSE:AAP)

Advance Auto Parts is one of the largest automotive aftermarket parts providers in North America, operating over 5,000 stores across the United States, Puerto Rico, and the Virgin Islands. The company also operates e-commerce sites under the names AdvanceAutoParts.com, Carquest.com, and Worldpac.com. Advance Auto Parts serves both professional installer and do-it-yourself customers.

– Aishida Co Ltd ($SZSE:002403)

Aishida Co Ltd is a Japanese company that manufactures and sells industrial machinery. The company has a market cap of 2.87B as of 2022 and a Return on Equity of -1.16%.

– O’Reilly Automotive Inc ($NASDAQ:ORLY)

Based in Springfield, Missouri, O’Reilly Automotive, Inc. is a publicly traded retailer of automotive aftermarket parts, tools, supplies, equipment, and accessories in the United States. As of 2021, the company operated 5,374 stores in 47 states.

The company has a market cap of 51.62B as of 2022 and a return on equity of -159.26%. The company’s revenue for 2020 was $11.4 billion.

Summary

Investing in Genuine Parts Company (GPC) has been profitable in the past year, with the company’s earnings growing steadily.

However, the company’s share price has recently dropped by 5.1%, despite the positive media coverage. This suggests investors may be cautious about the company’s future prospects. Analysts suggest that the drop may be attributed to increasing competition in the market and slower-than-expected growth in the automotive industry. In order to continue to yield positive returns, GPC needs to ensure that their services remain competitive and their growth strategy remains in line with industry trends.

Recent Posts