Van ECK Associates Corp. Sells Shares of A. O. Smith Co.

May 17, 2023

Trending News ☀️

Van ECK Associates Corp. recently sold shares of A. O. Smith ($NYSE:AOS) Co. This is a manufacturer of residential and commercial water heaters and boilers, among other products. They provide residential products for families, including water heaters, boilers, water softeners, and air purifiers. In addition, they offer commercial solutions for small business owners, such as large water heaters and boilers for commercial use.

Market Price

At the same time, the A. O. SMITH Co. stock opened at $67.2 and closed at $68.2, up by 1.4% from its prior closing price of 67.2. With the sale of the shares, Van ECK Associates Corp. has taken a step towards diversifying its portfolio and reinvesting for growth. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for AOS. More…

| Total Revenues | Net Income | Net Margin |

| 3.74k | 242.8 | 6.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for AOS. More…

| Operations | Investing | Financing |

| 494.8 | -3.8 | -472.2 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for AOS. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.34k | 1.55k | 11.09 |

Key Ratios Snapshot

Some of the financial key ratios for AOS are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 9.1% | 17.4% | 6.7% |

| FCF Margin | ROE | ROA |

| 11.4% | 9.0% | 4.7% |

Analysis

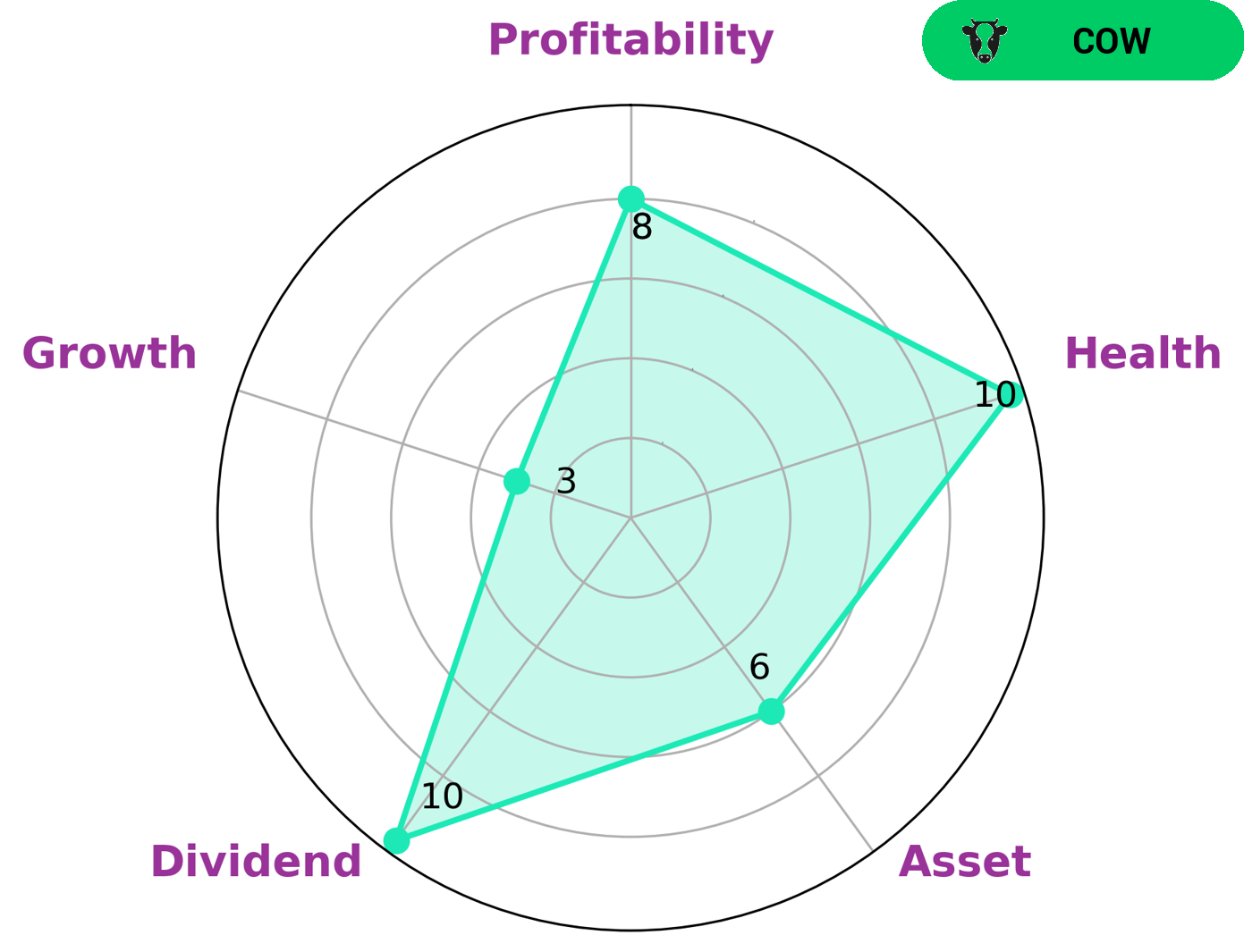

At GoodWhale, we conducted a fundamental analysis of A. O. SMITH. Our Star Chart classified the company as a ‘cow’, meaning that it has a track record of paying out consistent and sustainable dividends. This type of company would be of interest to investors who are looking for steady income with a lower risk profile. In terms of financial health, A. O. SMITH scored an impressive 10/10, which indicates that the company is in a strong position and is capable to sustain future operations even in times of crisis. We have found that A. O. SMITH is strong in dividend, profitability, and medium in asset, but weak in growth. This makes it suitable for investors who are looking for steady income without too much focus on capital appreciation. More…

Peers

Some of its competitors include Kyung Dong Navien Co Ltd, Watts Water Technologies Inc, Guangzhou Goaland Energy Conservation Tech Co Ltd.

– Kyung Dong Navien Co Ltd ($KOSE:009450)

Kyung Dong Navien Co Ltd is a South Korean company that manufactures and sells combi boilers, heat pumps, and other heating and hot water products. The company has a market cap of 489.23B as of 2022 and a ROE of 32.93%. Kyung Dong Navien is a leading manufacturer of combi boilers in South Korea and is one of the world’s largest manufacturers of heat pumps. The company’s products are used in residential, commercial, and industrial applications.

– Watts Water Technologies Inc ($NYSE:WTS)

Watts Water Technologies, Inc. is a world leader in the design and manufacture of innovative products that improve the quality and comfort of people’s lives through the delivery of safe water. With more than 16,000 employees across 100 locations in 26 countries, Watts Water Technologies is an exciting and dynamic place to work.

Watts Water Technologies has a market cap of $4.2 billion as of 2022 and a return on equity of 15.67%. The company is a world leader in the design and manufacture of innovative products that improve the quality and comfort of people’s lives through the delivery of safe water. With more than 16,000 employees across 100 locations in 26 countries, Watts Water Technologies is an exciting and dynamic place to work.

– Guangzhou Goaland Energy Conservation Tech Co Ltd ($SZSE:300499)

Guangzhou Goaland Energy Conservation Tech Co Ltd is a publicly traded company with a market cap of 3.3 billion as of 2022. The company has a return on equity of 8.08%. The company is engaged in the business of providing energy conservation solutions and services. The company has a strong presence in the Chinese market and is expanding its operations globally. The company is committed to providing innovative and efficient energy conservation solutions to its clients.

Summary

Investing in A. O. Smith (AOS) has been a successful strategy for many investors. Analysts have been positive on the company’s fundamentals and outlook, citing its strong balance sheet and steady cash flow from its diverse portfolio of businesses. Van Eck Associates Corp. recently sold its entire stake in AOS, citing a downgrade of the stock’s prospects.

However, analysts note that AOS still offers a favorable risk/reward profile and that its business segments remain solidly profitable. Analysts point to the company’s solid dividend history, which has provided consistent income to shareholders, as well as its positive outlook for organic growth. While Van Eck’s decision indicates a bearish outlook on AOS, analysts believe that the stock remains attractive for long-term investors.

Recent Posts