Rockwell Automation Crushing Earnings Expectations with Record Highs

April 28, 2023

Trending News 🌧️

Their Non-GAAP Earnings Per Share of $3.01 exceeded expectations by $0.41, while their revenue of $2.28 billion beat estimates by $190 million. This marks a six percent increase in Earnings Per Share from the same period last year. Rockwell Automation ($NYSE:ROK) works with organizations around the world to provide automation solutions that improve productivity, increase profitability, and deliver a faster return on investment. This quarter’s record highs demonstrate that their solutions are in demand and helping clients succeed. Rockwell Automation’s stock price has risen significantly since the release of these results, and analysts expect that the company will continue its upward trend.

Investors have taken notice of their success and are now considering the stock as an attractive long-term investment opportunity. With the stock currently priced at all-time highs, it remains to be seen how it will react to future earnings releases.

Price History

ROCKWELL AUTOMATION has once again exceeded expectations by closing on Thursday with a record high of $283.6, up by 4.8% from its previous closing price of $270.6. This is the highest stock price close yet for Rockwell Automation and demonstrates the company’s continuous growth despite the challenging economic climate. The opening price of $283.8 also marked a new high, showing that investor confidence in Rockwell Automation is strong.

These results are indicative of Rockwell Automation’s ability to pivot and make strategic decisions in response to changing market conditions. Moreover, the steady growth of its stock demonstrates its ability to remain competitive and profitable in the long-term. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Rockwell Automation. More…

| Total Revenues | Net Income | Net Margin |

| 7.88k | 1.07k | 13.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Rockwell Automation. More…

| Operations | Investing | Financing |

| 901.4 | 22.6 | -987.5 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Rockwell Automation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 11.15k | 7.95k | 25.39 |

Key Ratios Snapshot

Some of the financial key ratios for Rockwell Automation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 5.4% | 1.7% | 17.6% |

| FCF Margin | ROE | ROA |

| 9.8% | 30.7% | 7.8% |

Analysis

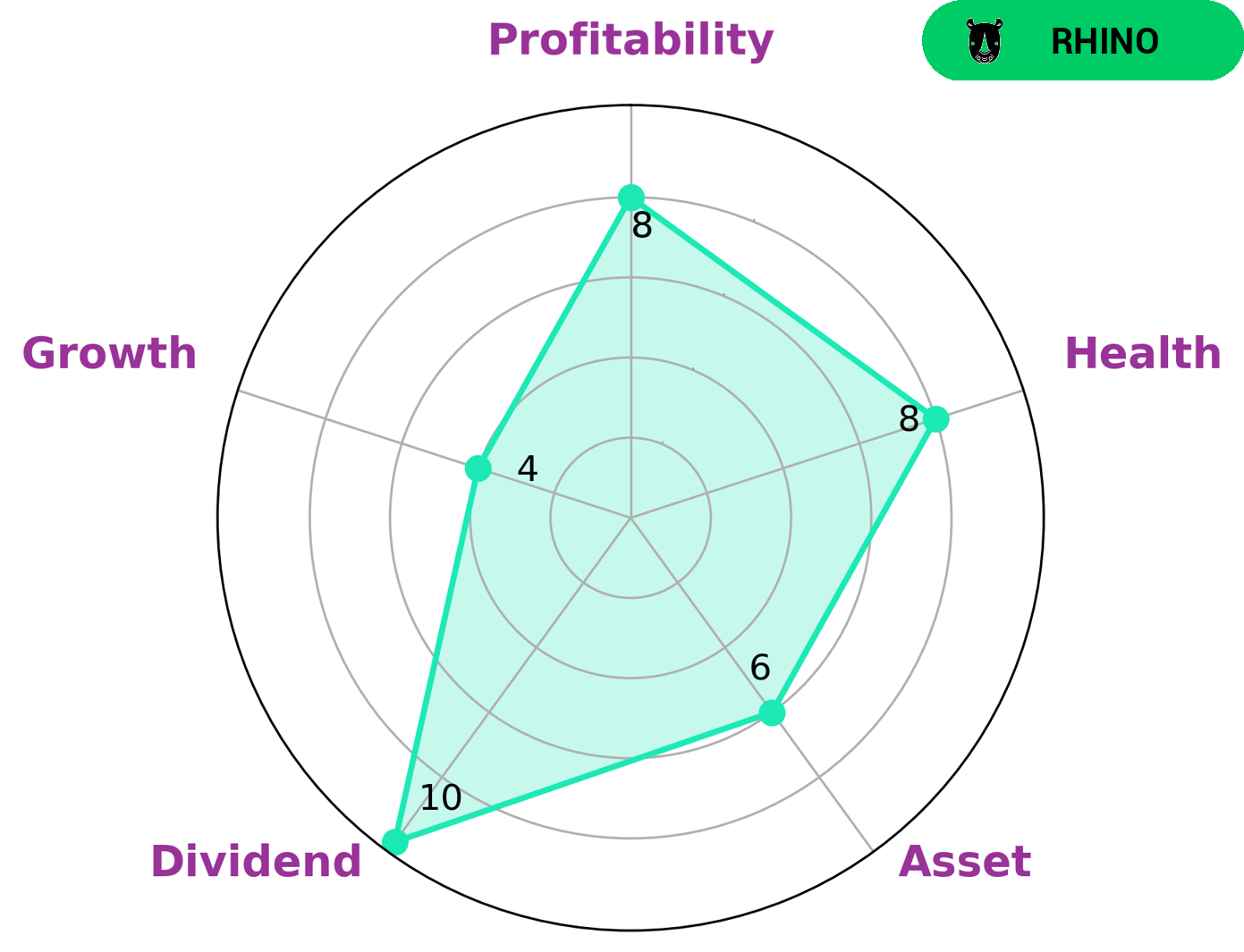

The purpose of our analysis of ROCKWELL AUTOMATION‘s wellbeing was to evaluate the company’s overall performance. After reviewing the Star Chart, we found that ROCKWELL AUTOMATION had strong performance in dividend and profitability and medium performance in asset and growth. According to our classification system, ROCKWELL AUTOMATION is classified as a ‘rhino’, which indicates that the company has achieved moderate revenue or earnings growth. Considering its cashflows and debt, ROCKWELL AUTOMATION has earned a health score of 8/10, indicating that the company is in a strong financial position and is capable of sustaining operations in the future. This makes ROCKWELL AUTOMATION an attractive option for value investors looking for a steady stream of returns. Furthermore, those investors looking for growth opportunities may also find the company attractive given its medium asset and growth ratings. More…

Peers

The competition among Rockwell Automation Inc and its competitors is fierce. Each company is trying to gain market share and improve their products. Rockwell Automation Inc is a leading provider of industrial automation products and services. The company has a strong presence in North America, Europe, and Asia.

– Castles Technology Co Ltd ($TWSE:5258)

Castles Technology Co Ltd is a provider of payment solutions. The company offers a range of products and services, including point-of-sale terminals, mobile point-of-sale terminals, and e-commerce payment solutions. Castles Technology Co Ltd has a market cap of 5.82B as of 2022 and a return on equity of 21.59%. The company’s products are used by businesses of all sizes, from small businesses to large enterprises.

– Das Technology Co Ltd ($TPEX:6648)

Das Technology Co Ltd is a technology company that focuses on the research, development, and production of semiconductor products. The company has a market cap of 902.65M and a ROE of 13.38%. Das Technology Co Ltd’s products are used in a variety of industries including automotive, telecommunications, and consumer electronics. The company’s products are known for their high quality and reliability.

– Synthesis Electronic Technology Co Ltd ($SZSE:300479)

As of 2022, Synthesis Electronic Technology Co Ltd has a market cap of 3.64B and a Return on Equity of -14.82%. The company is engaged in the research, development, production and sale of electronic products. It has a wide range of products, including mobile phones, digital cameras, MP3 players, USB flash drives, memory cards and other electronic products. The company has a strong research and development team and a modern production facility. It has a wide customer base in China and overseas.

Summary

Rockwell Automation recently released its Non-GAAP earnings per share (EPS) of $3.01, which exceeded analysts’ estimates by $0.41. Revenue of $2.28B also exceeded expectations by $190M. On the same day, Rockwell Automation’s stock price rose, indicating that investors were pleased with the company’s results.

Generally, analysts have indicated that Rockwell Automation is a good long-term investment, with many citing its strong balance sheet and product diversification as key factors. Despite its strong performance, investors should exercise caution in the near term as the market remains volatile.

Recent Posts