Regal Rexnord Closes Slightly Lower Despite Positive Performance, Analysts Remain Pessimistic

January 8, 2023

Trending News 🌧️

Regal Rexnord ($NYSE:RRX) Corporation is one of the largest publicly traded conglomerates in the world, with a wide portfolio of products and services in various industries. Recently, Regal Rexnord has been performing well, with its stock price rising steadily.

However, analysts remain pessimistic despite this positive performance. In their latest session, Regal Rexnord closed at $119.98, a decrease of -0.13% from its previous closing price of $120.14. This slight drop in the stock price has caused analysts to remain pessimistic about the company’s future performance. Some analysts have pointed to the company’s large debt load and its lack of profitable investments as potential risks for the company’s future prospects. However, there are some analysts that remain optimistic about Regal Rexnord’s long-term prospects. They point to the company’s diversified portfolio, solid management team and strong balance sheet as reasons why it may be able to turn around its current performance. They also cite the current economic environment as a potential opportunity for the company to increase its market share and profitability. The company’s stock price closing slightly lower than its previous closing price of $120.14 has further fueled the pessimism of some analysts. However, there are still those who remain optimistic and believe that the company will be able to turn around its current performance in the near future.

Stock Price

The opening price of $121.5 dropped to $120.7 by the market close, a 0.6% decrease from the previous day’s closing price of 120.0. It enjoys a strong customer base in the US and Canada, and is expanding into Europe and Asia. Despite the company’s success, analysts are not optimistic about its stock performance. Analysts cite several factors for their pessimism. The company recently announced a major restructuring effort, which could lead to job losses and decreased profits. Additionally, Regal Rexnord faces increasing competition from other manufacturers, and some analysts fear that the company may not be able to keep up with the changing market. Its stock has been on an upward trajectory since it opened at $121.5 on Tuesday.

However, analysts remain wary of its future prospects, and it remains to be seen how the company will respond to the changing market conditions. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Regal Rexnord. More…

| Total Revenues | Net Income | Net Margin |

| 5.19k | 364.2 | 7.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Regal Rexnord. More…

| Operations | Investing | Financing |

| 337.6 | -222.3 | 341.8 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Regal Rexnord. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 10.25k | 4.08k | 92.89 |

Key Ratios Snapshot

Some of the financial key ratios for Regal Rexnord are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 15.3% | 18.1% | 10.5% |

| FCF Margin | ROE | ROA |

| 5.1% | 5.5% | 3.3% |

VI Analysis

Company fundamentals are a crucial indicator of long-term potential and the VI app makes this analysis simple for REGAL REXNORD. The VI Star Chart shows that the company is strong in assets, dividends, and growth. It has a medium score in profitability. This means that REGAL REXNORD is classified as a “cheetah” type of company, which is one that has achieved high revenue or earnings growth but is considered less stable due to lower profitability. Investors who are looking for fast-paced growth may be interested in investing in REGAL REXNORD. The company’s health score is 8/10 with regard to its cashflows and debt, indicating its ability to sustain future operations even in times of crisis. REGAL REXNORD’s strength in assets, dividends, and growth make it an attractive investment for those seeking to maximize their returns over the long term. Its medium score in profitability, however, means that investors must be aware of the risk involved when investing in the company. Nevertheless, REGAL REXNORD’s strong health score indicates that it is capable of weathering any economic storm that may come its way. More…

VI Peers

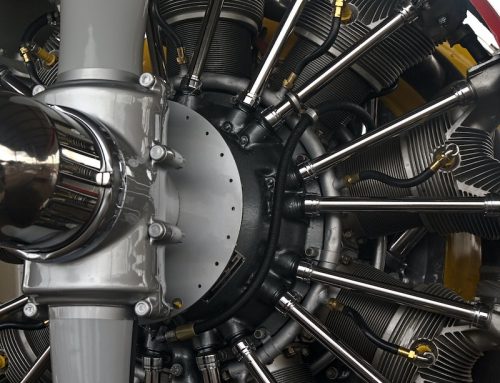

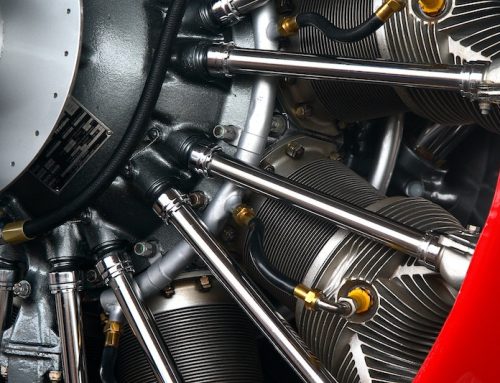

The company’s products are used in a variety of industries, including aerospace, defense, transportation, and industrial. Rexnord is a publicly traded company, and its shares are listed on the New York Stock Exchange. The company has a market capitalization of approximately $3 billion. Rexnord’s competitors include Estun Automation Co Ltd, Parker Hannifin Corp, and R Stahl AG.

– Estun Automation Co Ltd ($SZSE:002747)

Estun Automation Co Ltd is a company that manufactures and sells automation equipment. The company has a market cap of 17.8B as of 2022 and a return on equity of 6.3%. The company’s products are used in a variety of industries, including automotive, aerospace, and electronics. Estun Automation Co Ltd is a publicly traded company listed on the Shenzhen Stock Exchange.

– Parker Hannifin Corp ($NYSE:PH)

Parker Hannifin Corp is a manufacturer of motion and control technologies. Its products include hydraulic, pneumatic, and electromechanical systems and components. The company has a market cap of $33.39 billion and a return on equity of 13.12%.

– R Stahl AG ($LTS:0Q9C)

Founded in 1883, thyssenkrupp AG is a German multinational conglomerate with businesses in a wide range of sectors, including automotive, elevators, industrial services, materials, and shipbuilding. The company has a market capitalization of €70.2 billion as of 2022 and a return on equity of -1.36%. thyssenkrupp AG is headquartered in Essen, Germany.

Summary

Regal Rexnord has seen a slight decline in its share prices despite positive performance, leaving some analysts pessimistic. The company has seen increased media coverage recently, with the majority of it being positive. Investors should take into consideration the company’s fundamentals, including its financial performance, competitive landscape, and management team, when analyzing Regal Rexnord as a potential investment. Ultimately, investors should conduct their own due diligence and research before making any investment decisions.

Recent Posts