Pentair PLC Beats Q4 Earnings Estimates by $0.03 with Non-GAAP EPS of $0.82

February 2, 2023

Trending News 🌥️

Pentair ($NYSE:PNR) PLC is a multinational engineering company that specializes in water, fluid, and energy management. Operating through two main business segments, it provides solutions to customers in the industrial, commercial, residential and agricultural sectors. In its fourth quarter earnings report, Pentair PLC beat analysts’ estimates by $0.03 with a Non-GAAP EPS of $0.82. The company attributed the strong earnings performance to various cost-saving initiatives and improved operational efficiencies. Pentair also reported strong growth in its water segment, which was due to higher sales of pumps and filtration products.

The company also benefited from a boost in orders from North America and Asia Pacific regions. The company also plans to continue focusing on cost-saving initiatives and improving operational efficiency to drive higher earnings. Overall, Pentair PLC reported impressive fourth quarter earnings that exceeded analysts’ expectations.

Price History

As a result, the stock opened at $52.0 and closed at $55.4, a 9.2% increase from the previous closing price of $50.7. This was driven by increased demand for the company’s water filtration and pumping systems. This was mainly due to improved working capital management and higher sales volume. Looking ahead, Pentair expects to continue to benefit from increased demand for water filtration and pumping systems.

The company is focusing on organic growth, as well as making strategic investments in order to expand its business. With a strong balance sheet and cash flow, Pentair is well positioned to continue its growth in the coming quarters. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Pentair Plc. More…

| Total Revenues | Net Income | Net Margin |

| 4.11k | 534.6 | 13.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Pentair Plc. More…

| Operations | Investing | Financing |

| 343.6 | -1.92k | 1.51k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Pentair Plc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 6.51k | 3.87k | 16.04 |

Key Ratios Snapshot

Some of the financial key ratios for Pentair Plc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 11.8% | 14.4% | 15.5% |

| FCF Margin | ROE | ROA |

| 6.3% | 15.3% | 6.1% |

VI Analysis

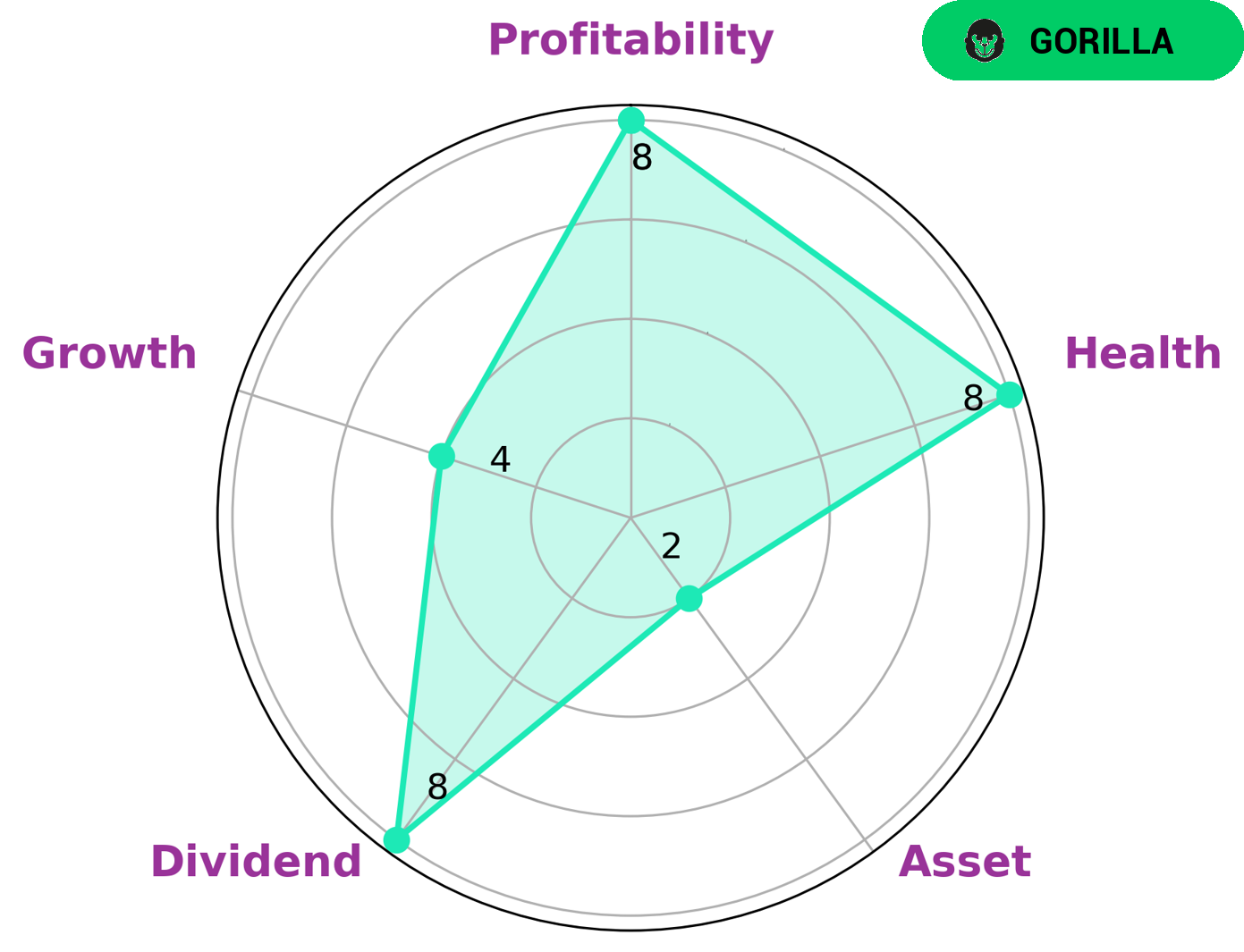

The VI app simplifies the analysis of PENTAIR PLC‘s long-term potential by highlighting the company’s fundamentals. The VI Star Chart assigns a health score of 8 out of 10 to the company, indicating that it has strong cashflows and debt management, making it capable of funding future operations and paying off debt. Moreover, PENTAIR PLC is classified as a ‘gorilla’, a type of company that has achieved stable and high revenue or earning growth due to its strong competitive advantage. Given these characteristics, PENTAIR PLC may appeal to a variety of investors. For instance, income investors may be attracted to the strong dividend yield, and value investors may be enticed by the profitability of the company.

Growth investors may be drawn to the potential for medium growth, and asset investors may be interested in the weak asset performance. Overall, the VI app provides a useful summary of PENTAIR PLC’s long-term potential, making it easier for investors to make informed decisions. With a high health score and strong competitive advantage, PENTAIR PLC may prove to be an attractive investment for a wide range of investors.

Peers

The market for water treatment equipment is highly competitive with many large and small companies vying for market share. The four largest companies in the market are Pentair PLC, Xylem Inc, Watts Water Technologies Inc, and Evoqua Water Technologies Corp. These companies compete on a variety of factors including product innovation, price, and distribution.

– Xylem Inc ($NYSE:XYL)

Xylem Inc. is a leading global water technology company that provides innovative solutions to the world’s water challenges. Its products and services are used in more than 150 countries to help manage water resources, protect public health and enhance water quality for people and businesses. Xylem has a market cap of 16.4 billion as of 2022 and a return on equity of 10.79%. The company’s products and services are used in a variety of applications, including residential, commercial, industrial, municipal and agricultural.

– Watts Water Technologies Inc ($NYSE:WTS)

Watts Water Technologies is a leading provider of water solutions for the residential, commercial, and industrial markets. The company’s products include plumbing, heating, and water treatment products. Watts Water Technologies has a market cap of 4.2 billion as of 2022 and a return on equity of 15.67%. The company’s products are used in a variety of applications, including residential and commercial plumbing, heating, and water treatment.

– Evoqua Water Technologies Corp ($NYSE:AQUA)

Evoqua Water Technologies Corp is a publicly traded water treatment company headquartered in Warrendale, Pennsylvania. The company has a market capitalization of $4.11 billion and a return on equity of 9.96%. Evoqua Water Technologies provides water treatment solutions for industrial and municipal customers across the globe. The company’s products and services are used in a variety of applications, including water and wastewater treatment, desalination, and water reuse.

Summary

Pentair PLC is a diversified industrial company with operations in multiple industries. Its fourth-quarter earnings beat analyst estimates by $0.03, with non-GAAP earnings per share of $0.82. This news has had a positive effect on the company’s stock price, which moved up on the same day.

Additionally, its diverse portfolio of products and services ensures that its performance is not overly dependent on one industry or segment. With a solid balance sheet, promising financials, and a diversified business model, Pentair PLC is an attractive option for investors.

Recent Posts