Numis Securities Gives “Buy” Rating to Melrose Industries

January 30, 2023

Trending News ☀️

Melrose Industries ($LSE:MRO) is a British investment firm specializing in the acquisition and improvement of industrial and engineering businesses. Recently, Numis Securities, an independent, award-winning investment banking and asset management company, has awarded Melrose Industries a “Buy” rating. Numis Securities’ analysts have noted that Melrose Industries’ portfolio of businesses is full of potential, with a wide range of opportunities for growth. They cite Melrose’s expertise in identifying and successfully acquiring undervalued companies as a major factor in their decision to give the company a “Buy” rating.

Additionally, they mention that Melrose Industries’ ongoing commitment to innovation and improvement means that it is well-positioned to capitalize on any new opportunities that may arise. Numis Securities’ analysts are also enthusiastic about Melrose Industries’ financial performance. They note that the company has generated strong returns for investors over the past year, with strong profit margins and rising share prices. Furthermore, Melrose Industries boasts a robust balance sheet, with cash reserves that are stronger than many of its peers. With its experienced management team and commitment to innovation, Melrose Industries is well-placed to capitalize on the opportunities available in the current market. As such, investors who are looking for a reliable and well-managed investment should consider adding Melrose Industries to their portfolios.

Market Price

On Monday, Numis Securities gave a “Buy” rating to Melrose Industries, resulting in a positive media exposure for the company. The stock opened at £1.4 on Monday and closed at the same price, signifying an increase of 1.0% from its previous closing price. This “Buy” rating from Numis Securities has created a positive outlook towards Melrose Industries and its stock performance. The company’s shares have become more attractive as investors are likely to be keen to capitalize on the potential growth opportunities provided by the company. The stock performance of Melrose Industries has been relatively stable since the beginning of this year and it is expected to remain so in the near future. The market sentiment towards the company has been largely positive and the stock has been trading close to its all-time high since January.

The “Buy” rating from Numis Securities has further reinforced the positive sentiment surrounding Melrose Industries. The company is well-positioned to benefit from a recovery in the global economy and is expected to deliver robust returns in the near future. Overall, the “Buy” rating from Numis Securities is likely to further strengthen investors’ confidence in Melrose Industries and its stock performance. The company is expected to continue its impressive run and deliver solid returns in the foreseeable future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Melrose Industries. More…

| Total Revenues | Net Income | Net Margin |

| 7.05k | -693 | -8.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Melrose Industries. More…

| Operations | Investing | Financing |

| 49 | 22 | -1.17k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Melrose Industries. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 14.77k | 7.44k | 1.71 |

Key Ratios Snapshot

Some of the financial key ratios for Melrose Industries are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -15.0% | -66.2% | -8.8% |

| FCF Margin | ROE | ROA |

| -2.7% | -5.2% | -2.6% |

VI Analysis

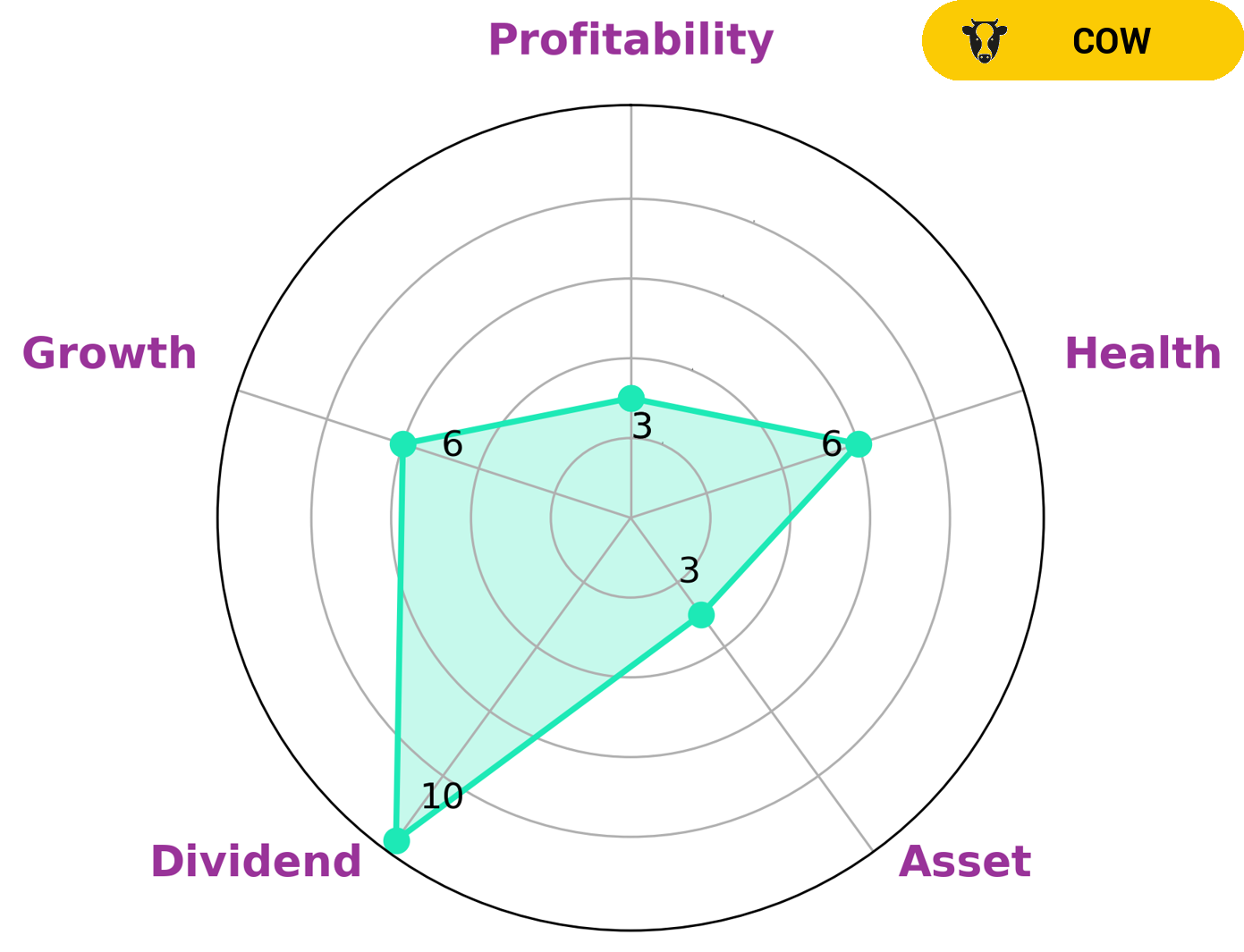

MELROSE INDUSTRIES is a company that has strong fundamentals, which reflect its long-term potential. VI Star Chart shows that this company is strong in dividend, medium in growth, and weak in asset and profitability. MELROSE INDUSTRIES is classified as ‘cow’, which means it has the track record of paying out consistent and sustainable dividends. This makes it attractive for dividend investors who are looking for regular income and are willing to accept some volatility in their investment. Other investors who may be interested in such a company are those who are seeking long-term capital appreciation. They may be willing to accept lower dividends in exchange for potential capital gains. The company’s intermediate health score of 6/10 with regard to its cashflows and debt indicates that it is likely to pay off debt and fund future operations. Therefore, investors who are looking for a reliable, stable, and growing company should consider investing in MELROSE INDUSTRIES. Overall, the company’s strong fundamentals, consistent dividend payments, and moderate risk profile make it an attractive investment for a variety of investors. More…

VI Peers

The company operates in four segments: Machinery, Components, Materials, and Energy. Melrose Industries PLC is headquartered in the United Kingdom and has operations in Europe, Asia, and North America. The company’s shares are listed on the London Stock Exchange. Melrose Industries PLC is a leading global supplier of advanced engineering products and services. The company operates in four segments: Machinery, Components, Materials, and Energy. Melrose Industries PLC is headquartered in the United Kingdom and has operations in Europe, Asia, and North America. The company’s shares are listed on the London Stock Exchange. Zhejiang Fenglong Electric Co Ltd is a leading manufacturer of electrical equipment in China. The company’s products are used in a wide range of industries, including power generation, distribution, and transmission. Fenglong Electric Co Ltd is headquartered in Hangzhou, China. The company’s shares are listed on the Shenzhen Stock Exchange. Sansera Engineering Ltd is a leading global provider of engineering solutions. The company provides a broad range of engineering services, including design, manufacturing, testing, and validation. Sansera Engineering Ltd is headquartered in India and has operations in Europe, Asia, and North America. The company’s shares are listed on the Bombay Stock Exchange. Liquidmetal Technologies Inc is a leading global supplier of advanced engineering materials. The company’s products are used in a wide range of industries, including aerospace, automotive, and medical. Liquidmetal Technologies Inc is headquartered in the United States and has operations in Europe, Asia, and North America. The company’s shares are listed on the Nasdaq Stock Market.

– Zhejiang Fenglong Electric Co Ltd ($SZSE:002931)

Zhejiang Fenglong Electric Co Ltd is a publicly traded company with a market capitalization of 2.28 billion as of 2022. The company has a return on equity of 5.67%. Fenglong Electric is engaged in the research, development, manufacture and sale of high and low voltage electrical equipment. The company’s products include switchgear, transformers, circuit breakers, cables and other electrical products. Fenglong Electric is headquartered in Zhejiang Province, China.

– Sansera Engineering Ltd ($BSE:543358)

Sansera Engineering Ltd is an Indian multinational engineering company headquartered in Bangalore, Karnataka. The company provides engineering solutions and services to the automotive, aerospace, and other industrial sectors. As of March 31, 2021, Sansera Engineering had a market capitalization of Rs. 283.47 billion (US$3.9 billion) and a return on equity of 14.76%.

– Liquidmetal Technologies Inc ($OTCPK:LQMT)

As of 2022, Liquidmetal Technologies Inc has a market cap of 64.21M and a Return on Equity of -5.92%. The company produces amorphous metal alloys and products using those alloys. Liquidmetal Technologies Inc’s products are used in a variety of industries, including medical, aerospace, and automotive. The company has a history of losses, and its negative ROE indicates that it is not generating enough income to cover its expenses.

Summary

Melrose Industries is a British engineering company that specializes in industrial and engineering operations. Recently, the company has been given a “Buy” rating by Numis Securities, indicating that investors should consider investing in the company. The media exposure of the company has been generally positive, with analysts expecting future growth and potential returns.

Investing in Melrose Industries could provide investors with a great opportunity to gain exposure to an engineering company that is well-positioned for future growth. Investing in Melrose Industries is seen as a sound investment decision with potential for returns in the near future.

Recent Posts