IDEX Corporation: A Great Investment Opportunity for 2024!

December 28, 2023

☀️Trending News

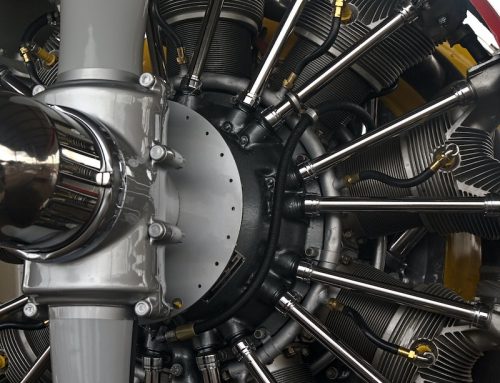

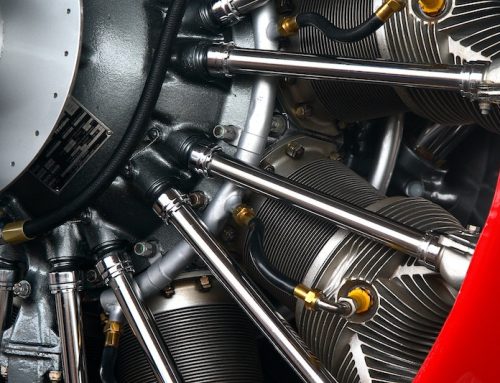

IDEX ($NYSE:IEX) Corporation is a great investment opportunity for 2024. They design, develop, and manufacture pumps, valves, and other fluid handling solutions for a wide range of industrial applications. Their products are used by industries ranging from aerospace to oil and gas to food processing. In addition to their renowned products, IDEX also offers a wide range of services, including repair and maintenance, calibration, and technical consulting. The company has an impressive track record of success and has consistently paid out dividends to shareholders for over 10 years.

Furthermore, the company has an excellent financial position with low debt levels and high liquidity. IDEX Corporation is also well-positioned to benefit from the growth in the industrial sector in the coming years. As demand for industrial pumps and valves increases, IDEX will be well placed to take advantage of this trend. With a strong financial position and a large customer base, IDEX Corporation is an attractive investment option for investors who want to capitalize on the industrial sector’s growth potential. In 2024, investors should look to IDEX as a great option for their portfolio.

Price History

On Wednesday, IDEX CORPORATION stock opened at $214.8 and closed at $215.8, representing a rise of 0.5% from the prior closing price. This steady growth in its stock prices is indicative of the company’s strong financial performance and its commitment to making strategic investments. Moreover, the company’s diverse product portfolio, which includes sensors, valves, pumps, and more, makes it a great long-term investment due to its ability to remain competitive and relevant in the ever-changing market. As such, investors should strongly consider IDEX Corporation as a potential option for their portfolio. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Idex Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 3.3k | 617.5 | 16.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Idex Corporation. More…

| Operations | Investing | Financing |

| 683 | -782.8 | -49.9 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Idex Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 5.67k | 2.28k | 44.79 |

Key Ratios Snapshot

Some of the financial key ratios for Idex Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 12.0% | 12.6% | 25.4% |

| FCF Margin | ROE | ROA |

| 18.0% | 15.7% | 9.2% |

Analysis

GoodWhale has conducted an analysis of IDEX CORPORATION‘s wellbeing. According to our Star Chart, IDEX CORPORATION is strong in dividend and profitability, and medium in asset and growth. This places them at a high health score of 9/10 with regard to cashflows and debt, making them capable to safely ride out any crisis without the risk of bankruptcy. IDEX CORPORATION is also classified as a ‘gorilla’, meaning they have achieved stable and high revenue or earnings growth due to a strong competitive advantage. Given these characteristics, we believe that IDEX CORPORATION would be an attractive option for investors looking for long-term investments with reliable returns. Investors with a more short-term mindset could also find value in this company, as IDEX CORPORATION has historically demonstrated consistent growth and profitability. More…

Peers

Its competitors include Crane Co, Evoqua Water Technologies Corp, Pentair PLC. IDEX Corp has a strong portfolio of products and services and is constantly innovating to stay ahead of the competition.

– Crane Co ($NYSE:CR)

Crane Co is a diversified industrial manufacturing company. It has a market cap of 5.58B as of 2022 and a ROE of 25.73%. The company operates in four segments: Aerospace & Electronics, Engineered Materials, Merchandising Systems, and Fluid Handling. Crane Co’s products are used in a variety of industries, including aerospace, defense, infrastructure, and industrial end markets.

– Evoqua Water Technologies Corp ($NYSE:AQUA)

Evoqua Water Technologies Corp is a water treatment company that provides solutions for water and wastewater treatment, desalination, and water reuse. It has a market cap of 4.24B as of 2022 and a Return on Equity of 9.96%. The company serves a variety of industries, including municipal, industrial, commercial, and institutional.

– Pentair PLC ($NYSE:PNR)

Pentair PLC is a diversified industrial company with a market cap of $6.52 billion as of 2022. The company has a return on equity of 16.22%. Pentair PLC is involved in the design, manufacture, and distribution of products and solutions for the global water and fluid management industries. The company’s products include pumps, valves, filters, and controls for residential, commercial, and industrial applications. Pentair PLC also provides water and wastewater treatment solutions for municipalities and industries.

Summary

IDEX Corporation is a great investment for 2024 as a compounder. It has consistently increased revenue and earnings over the last few years, with a low debt-to-equity ratio and strong cash flow. The company also pays a healthy dividend, which has increased year over year. Its products and services have been successful in numerous markets, and it is well diversified across different industries.

Additionally, its balance sheet is in good condition, with solid assets and efficient capital structure.

Recent Posts