GE’s Aerospace Segment Expected to Outshine Q1 Y/Y Results

April 25, 2023

Trending News 🌥️

GENERAL ELECTRIC ($NYSE:GE) (GE) is a global conglomerate based in Boston, Massachusetts. It operates in multiple industries, including aerospace, healthcare, energy, and finance. GE is traded on the New York Stock Exchange and is one of the world’s largest companies.

However, despite this overall decline in results, the aerospace segment of GE is anticipated to be a bright spot. This is due to increasing demand from the air travel sector, which is slowly recovering from the pandemic’s effects. GE also benefits from its long-term contracts with major airlines and governments for aviation parts and services. This could result in some positive news for shareholders and investors, who may be expecting the worst from GE’s overall results.

Stock Price

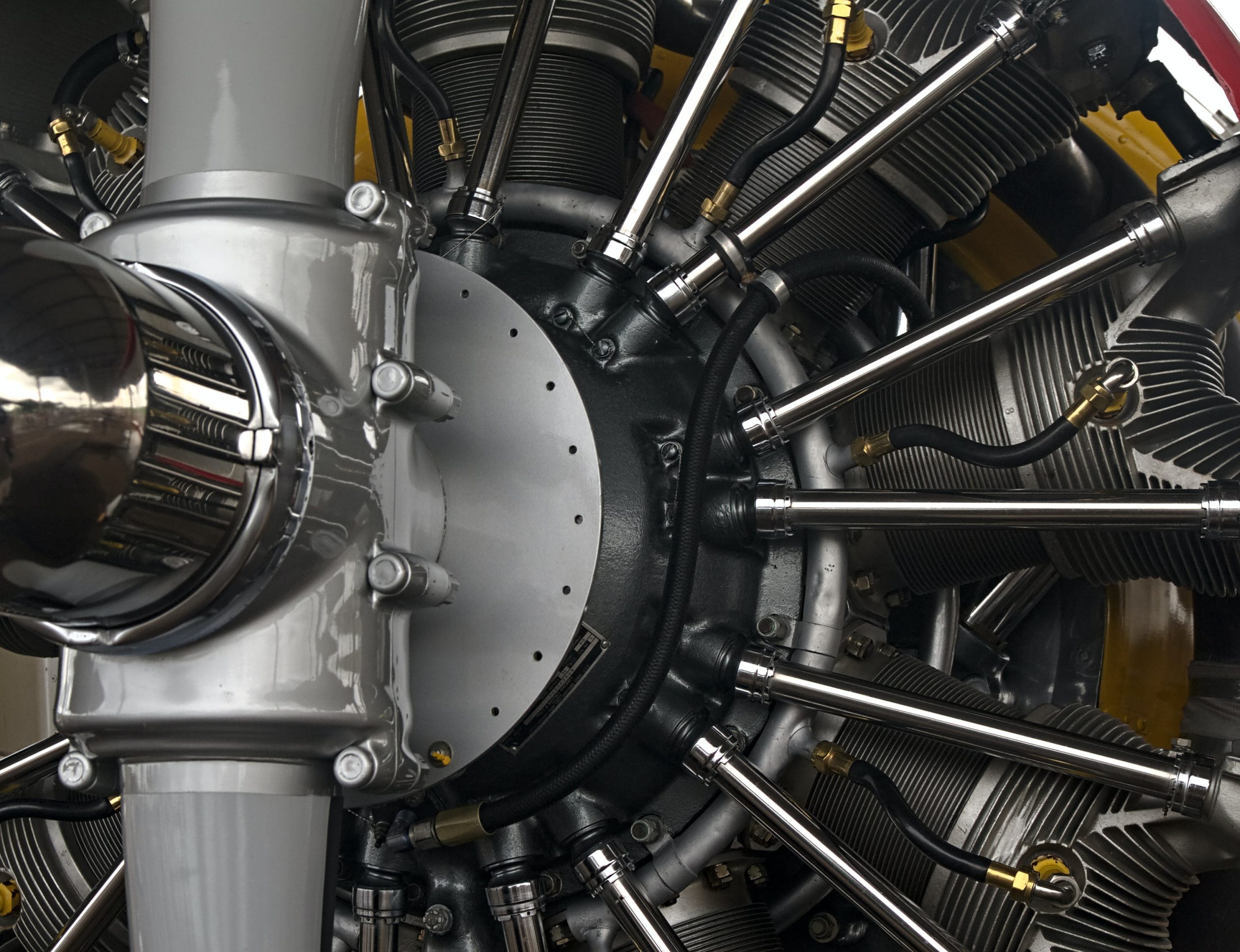

On Monday, General Electric (GE) stock opened at $99.6 and closed at $100.2, up by 0.6% from prior closing price of 99.5. This positive move in stock price is likely caused by the expectation that GE’s aerospace segment will outshine its Q1 Y/Y results. GE’s aerospace segment is a major provider of commercial and military aircraft engines, components, and systems as well as integrated digital, electric power, and mechanical systems for aircraft.

The company has also been making significant investments in new technology such as artificial intelligence and additive manufacturing to improve performance and increase efficiency in the aerospace segment. As a result, it is likely that GE’s aerospace segment will be able to achieve strong Q1 Y/Y results. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for General Electric. More…

| Total Revenues | Net Income | Net Margin |

| 76.56k | -64 | 2.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for General Electric. More…

| Operations | Investing | Financing |

| 5.92k | 2.27k | -5.58k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for General Electric. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 187.79k | 150.21k | 28.81 |

Key Ratios Snapshot

Some of the financial key ratios for General Electric are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -7.0% | -30.3% | 3.9% |

| FCF Margin | ROE | ROA |

| 5.8% | 5.6% | 1.0% |

Analysis

At GoodWhale, we have analyzed the fundamentals of GENERAL ELECTRIC and classified them as ‘cow’ on our Star Chart. This means that the company has a track record of paying out consistent and sustainable dividends. Investors who are looking for reliable dividend income may be interested in this company. Further analysis of GENERAL ELECTRIC’s fundamentals show that the company is strong in dividend but medium in asset, profitability and growth. We conclude that GENERAL ELECTRIC has a high health score of 7/10, taking into account its cashflows and debt, indicating the ability to pay off debt and fund future operations. More…

Peers

In the competitive world of today’s businesses, it is not uncommon for companies to find themselves in head-to-head battles with their competitors. This is certainly the case for General Electric Co, which finds itself up against such companies as Siemens AG, MotorVac Technologies Inc, and Hangzhou Zhongtai Cryogenic Technology Corp. While each of these companies has its own strengths and weaknesses, it is clear that GE has its work cut out for it if it wants to stay ahead of the competition.

– Siemens AG ($OTCPK:SIEGY)

Siemens AG is a German conglomerate company headquartered in Munich and the largest industrial manufacturing company in Europe with branch offices abroad. The principal divisions of the company are Industry, Energy, Healthcare (Siemens Healthineers), and Infrastructure & Cities, which represent the main activities of the company. Siemens AG is organized into four main business sectors: Industry, Energy, Healthcare, and Infrastructure & Cities.

– MotorVac Technologies Inc ($OTCPK:MVAC)

MotorVac Technologies Inc is a publicly traded company with a market capitalization of $4.62 million as of 2022. The company is engaged in the development, manufacturing and marketing of vehicle service equipment for the automotive aftermarket industry. Its products are used in the maintenance and repair of vehicles.

– Hangzhou Zhongtai Cryogenic Technology Corp ($SZSE:300435)

Hangzhou Zhongtai Cryogenic Technology Corp is a publicly traded company with a market cap of 5.42 billion as of 2022. The company has a return on equity of 8.72%. The company is involved in the manufacturing of cryogenic equipment and products. The company’s products are used in a variety of industries, including the medical, scientific, and industrial fields.

Summary

General Electric (GE) is expected to report a year-over-year (Y/Y) drop in its Q1 results, though its aerospace segment is likely to have a brighter outlook. Investors should pay particular attention to the company’s progress in restructuring its portfolio of businesses, cutting costs, and improving its financial situation. GE has already announced plans to sell off several divisions, including its biopharma business, in order to reduce debt and enhance the company’s financial standing.

Additionally, GE has been pursuing a strategy of investing in technologies that are expected to help the company grow over the long-term. Market analysts are keeping an eye on its progress in these areas as it looks to improve its financial results. To date, GE has shown a determination to remain competitive in the face of economic and industry challenges.

Recent Posts