Generac Holdings Breaks Record in 2022, Delivering 34 GWh of Energy to the Grid with Concerto Platform.

January 19, 2023

Trending News ☀️

Generac Holdings ($NYSE:GNRC) Inc. is a leading global provider of power generation equipment and related products. In 2022, Generac Grid Services, a subsidiary of Generac Power Systems, achieved a record-breaking milestone by delivering 34 GWh (gigawatt-hours) of energy to the grid using its Concerto platform. This amount of energy delivered is the highest ever recorded in one year and provided residential homes, commercial and industrial sites with reliable power all year round. The Concerto platform is an advanced energy management solution which incorporates distributed energy resources (DERs) such as solar, wind, and battery storage. It allows customers to optimise their energy usage and reduce their energy costs, while also providing grid operators with reliable and cost-effective sources of energy.

The platform also supports the integration of clean energy sources, helping to reduce carbon emissions and support the transition to a low-carbon economy. Generac Holdings is committed to providing reliable and sustainable energy solutions for its customers, and this record-breaking achievement is testament to its dedication to providing innovative and efficient products. The company’s continued focus on innovation and customer satisfaction has enabled it to become one of the leading providers of power generation solutions globally.

Stock Price

This is a significant milestone for the company, as it marks the first time an energy storage provider has achieved such a large-scale deployment. The development is expected to revolutionize the way energy is stored and distributed across the grid. The stock of Generac Holdings opened at $113.3 and closed at $114.5, up by 0.7% from the last closing price of 113.7. This impressive increase reflects the company’s commitment to delivering innovative technologies and solutions to the energy industry. The Concerto Platform is built on a distributed energy resource (DER) architecture that is designed to maximize efficiency across a wide range of applications.

By leveraging its advanced software, the platform provides a flexible and cost-effective solution for energy storage, monitoring, and control. The platform has been designed to meet the ever-evolving needs of the energy industry, with features such as advanced analytics, power optimization, and distributed intelligence capabilities. It also provides a secure, reliable, and cost-effective way to store energy and reduce costs for customers. With its cutting-edge technology and innovative solutions, Generac Holdings is positioned to continue to be a leader in the energy market for years to come. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Generac Holdings. More…

| Total Revenues | Net Income | Net Margin |

| 4.58k | 459.97 | 10.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Generac Holdings. More…

| Operations | Investing | Financing |

| 19.4 | -355.6 | 145.35 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Generac Holdings. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 5.25k | 2.84k | 36.6 |

Key Ratios Snapshot

Some of the financial key ratios for Generac Holdings are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 28.2% | 20.3% | 13.8% |

| FCF Margin | ROE | ROA |

| -1.5% | 16.7% | 7.5% |

VI Analysis

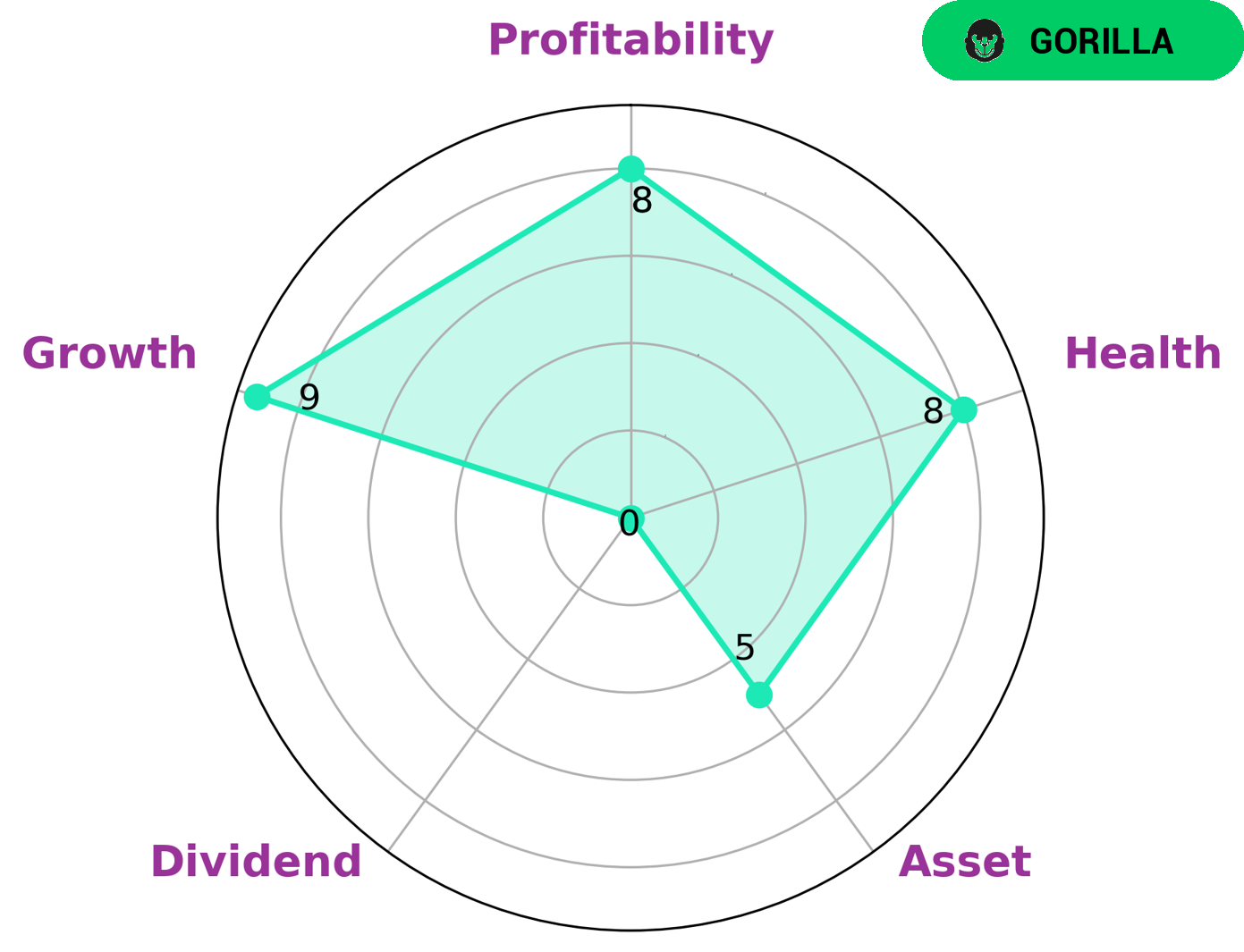

Investors looking for long-term potential should consider analyzing a company’s fundamentals. The VI app makes this process simple by providing a Star Chart for GENERAC HOLDINGS. Their health score is 8/10, indicating that the company has strong cashflows and is capable of paying off debt and funding future operations. GENERAC HOLDINGS is classified as a ‘Gorilla’, a type of company that has achieved stable and high revenue or earnings growth due to its strong competitive advantage. Investors looking to benefit from such a company should be comfortable with a certain amount of risk, as well as being comfortable with a company with a medium asset score and weak dividend score. Given the strong growth potential and profitability of GENERAC HOLDINGS, this could be an attractive investment for investors who are seeking long-term growth and stability. They should also be comfortable with the risk associated with investing in such a company. Furthermore, they should also consider the company’s medium asset score and weak dividend score. More…

VI Peers

In the market for standby generators, Generac Holdings Inc is up against some stiff competition from the likes of Musashi Co Ltd, Taihai Manoir Nuclear Equipment Co Ltd, and Weg SA.

However, the company has managed to stay ahead of the pack thanks to its innovative products and efficient manufacturing processes.

– Musashi Co Ltd ($TSE:7521)

As of 2022, Musashi Co Ltd has a market cap of 9.64B and a Return on Equity of 5.68%. The company manufactures and sells automotive parts, including engine valves, pistons, and crankshafts. It also provides engineering services.

– Taihai Manoir Nuclear Equipment Co Ltd ($SZSE:002366)

The company has a market capitalization of 4.67 billion as of 2022 and a return on equity of 697.02%. It is a manufacturer of nuclear equipment and supplies. The company’s products include reactors, nuclear fuel, nuclear power plant equipment, and nuclear waste disposal products.

– Weg SA ($OTCPK:WEGZY)

Weg SA is a Brazilian company that manufactures electric motors and generators. It has a market cap of 27.73B as of 2022 and a Return on Equity of 21.06%. The company is headquartered in Jaraguá do Sul, Santa Catarina, and has over 30,000 employees. Weg SA is one of the largest manufacturers of electric motors and generators in the world.

Summary

Generac Holdings, a leading provider of energy solutions, has had a record-breaking year in 2022, delivering 34 GWh of energy to the grid with its Concerto Platform. This is a positive sign for investors as the company is continuing to expand its operations and capitalize on renewable energy opportunities. The financial health of the company is strong and it is well-positioned to benefit from the growing demand for renewable energy sources. Generac Holdings is a sound investment option, offering potential for long-term returns as the company continues to grow.

Recent Posts