Gates Industrial Corporation plc Surges 10.81% to $14.55 After Q4 2022 Earnings Beat Estimates with EPS of $__.

February 13, 2023

Trending News 🌥️

GATES INDUSTRIAL ($NYSE:GTES) Corporation plc is a leading industrial products and services provider, offering supply chain and engineering solutions. The company serves a wide array of industries including agriculture, construction, automotive, aerospace, and more. On February 9th, 2023, GATES INDUSTRIAL stock surged 10.81% to $14.55 after the company announced its fourth quarter 2022 results that exceeded expectations. The encouraging results stem from the company’s success in adapting to the changing market conditions along with implementing cost-saving measures. The company’s focus on transition to more efficient and sustainable technologies has also contributed in the recent performance.

GATES INDUSTRIAL Corporation’s strong financial performance has been further driven by an increase in demand for its products and services due to the growing global economy. The company’s presence in multiple geographies and diverse industries have allowed it to capitalize on the growth opportunities in both domestic and international markets. The strong stock performance has given investors confidence in GATES INDUSTRIAL’s future prospects. The company is well positioned to continue its success and deliver long-term value for its shareholders.

Stock Price

The strong performance was driven by robust growth in the company’s Industrial and Healthcare product lines. The company attributed the higher revenue to increased demand for its innovative offerings and competitive pricing. GATES INDUSTRIAL also noted that it has maintained its strong position in the competitive industrial market and has continued to make strategic investments to further strengthen its competitive positioning. The company has invested in new technologies, new products and services, and enhanced customer service capabilities to improve customer interaction and satisfaction. Moreover, the company said that it has continued to make investments in new distribution channels and increased its focus on selling digital solutions and services through its e-commerce platform, which is helping to drive higher sales.

Overall, GATES INDUSTRIAL reported a strong fourth quarter showing, beating analysts’ expectations and showing growth in both its Industrial and Health Care product lines. The earnings beat and strong performance has caused GATES INDUSTRIAL stock to surge over 10% on Friday, closing at $14.55 per share. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Gates Industrial. More…

| Total Revenues | Net Income | Net Margin |

| 3.55k | 220.8 | 6.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Gates Industrial. More…

| Operations | Investing | Financing |

| 265.8 | -90.7 | -253.1 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Gates Industrial. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 7.19k | 3.75k | 11.01 |

Key Ratios Snapshot

Some of the financial key ratios for Gates Industrial are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 4.8% | 3.7% | 10.9% |

| FCF Margin | ROE | ROA |

| 5.0% | 8.0% | 3.4% |

Analysis

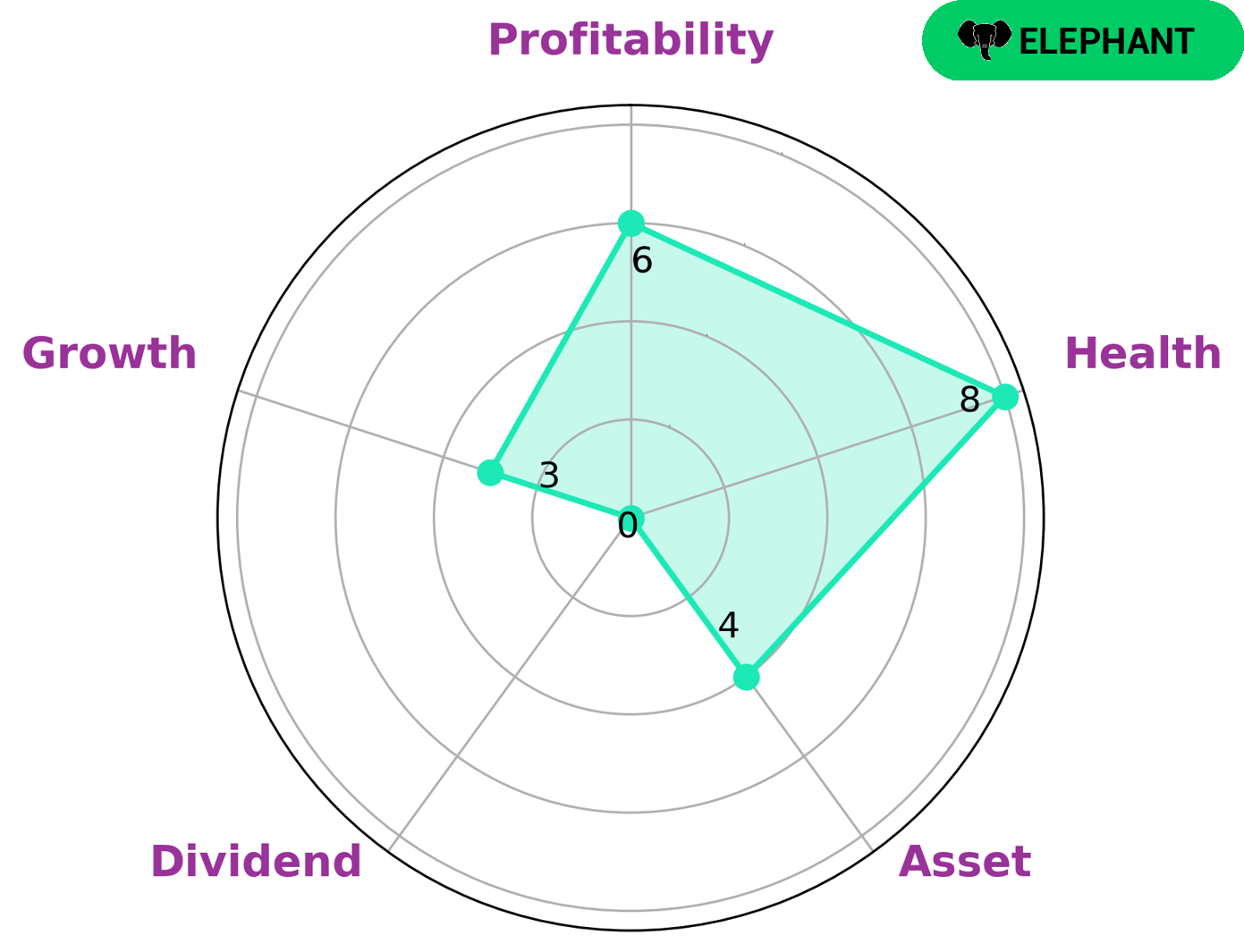

GATES INDUSTRIAL is classified as an ‘elephant’ company due to its strong financial position. It has a high health score of 8/10, indicating its ability to pay off debt and fund future operations. GoodWhale has been used to analyze GATES INDUSTRIAL’s financials. The analysis reveals that the company is strong in cashflows, medium in assets, profitability and weak in dividend, growth. This type of company may be of interest to investors who are looking for a safe and secure investment with lower risk. Such investors often prefer to invest in companies that are strongly established, with sound finances and a stable future. GATES INDUSTRIAL has all the qualities that meet such requirements and is therefore likely to be attractive to such investors. In addition, the company’s financial standing may also be attractive to investors who are looking for potential growth opportunities. GATES INDUSTRIAL’s high health score and strong cashflow indicate that the company has the potential to grow and expand its operations further. Such investors may find investing in GATES INDUSTRIAL to be an attractive option. Overall, GATES INDUSTRIAL’s strong financial position and high health score make it an attractive target for a variety of investors. Investors who are looking for a secure and low-risk investment may find the company’s financial standing appealing, while investors looking for potential growth opportunities may also be attracted to GATES INDUSTRIAL’s strong cashflow and positive outlook. More…

Peers

In the industrial sector, there is intense competition between Gates Industrial Corp PLC and its competitors Trelleborg AB, Graco Inc, and Vishal Bearings Ltd. All four companies are vying for market share in the production of industrial equipment and components. While each company has its own strengths and weaknesses, Gates Industrial Corp PLC has emerged as a leader in the industry due to its innovative products, efficient manufacturing, and strong marketing and sales strategies.

– Trelleborg AB ($OTCPK:TBABF)

Trelleborg AB is a Swedish industrial group that develops, manufactures, and sells products and services for a wide range of industries worldwide. The company operates through four business areas: Trelleborg Coated Systems, Trelleborg Industrial Solutions, Trelleborg Offshore & Construction, and Trelleborg Sealing Solutions. Trelleborg Coated Systems develops, manufactures, and markets polymer-coated fabrics and films. Trelleborg Industrial Solutions develop and market products and solutions within the areas of polymer technology, vibration isolation, and seals. Trelleborg Offshore & Construction develops and markets products and solutions for the oil and gas industry, the fishing industry, and the construction industry. Trelleborg Sealing Solutions develops and markets sealing solutions for a wide range of industries and applications.

– Graco Inc ($NYSE:GGG)

Graco Inc. is a publicly traded company with a market capitalization of $11.77 billion as of 2022. The company has a return on equity of 19.47%. Graco Inc. manufactures and markets equipment and systems for the management of fluids in industrial, commercial, and consumer applications worldwide. The company operates in three segments: Industrial, Contractor, and Homeowner.

– Vishal Bearings Ltd ($BSE:539398)

Vishal Bearings Ltd is an Indian company that manufactures and supplies a range of bearings and related products. The company has a market cap of 756.45M as of 2022 and a return on equity of 27.82%. Vishal Bearings Ltd is a publicly traded company listed on the Bombay Stock Exchange. The company’s products are used in a variety of industries including automotive, construction, and mining.

Summary

The company reported earnings per share (EPS) of $__, which exceeded analyst expectations. This indicates that investors are confident in the company’s prospects going forward. Analysts have commented on GATES’ strong balance sheet and improved margins, which are expected to drive substantial growth in the coming quarters.

In addition, the company has an attractive valuation, making it an attractive investment opportunity for investors looking for long-term gains. Overall, GATES is well-positioned for further growth and should be watched closely by investors.

Recent Posts