Franklin Electric Exceeds Expectations: Reports GAAP EPS of $0.79 and Revenue of $484.55M

May 3, 2023

Trending News 🌥️

Franklin Electric ($NASDAQ:FELE) Co., Inc. (FELE) is a global leader in the supply of systems and components for the movement of water and fuel. Franklin Electric reported their GAAP Earnings per Share (EPS) of $0.79, exceeding the expectations by $0.15. Similarly, their revenue of $484.55M was higher than predicted by $8.29M. He also attributed their success to their continued focus on innovation and their commitment to providing quality products and services to customers.

Trumbull went on to say that he expects the company’s performance to remain strong for the remainder of the year. Overall, Franklin Electric delivered a strong quarter, surpassing expectations and reporting impressive results. Their impressive performance is a testament to their commitment to providing quality products and services to customers, as well as their continued focus on innovation.

Stock Price

Tuesday marked an exciting day for FRANKLIN ELECTRIC shareholders as the company released its quarterly report. FRANKLIN ELECTRIC reported a GAAP earnings per share of $0.79 and revenue of $484.55 million, exceeding expectations. As a result, FRANKLIN ELECTRIC stock opened at $90.0 and closed at $96.8, a 6.9% increase from the prior closing price of $90.5. This impressive performance is sure to be a positive sign for investors and shareholders alike. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Franklin Electric. More…

| Total Revenues | Net Income | Net Margin |

| 2.04k | 186.6 | 9.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Franklin Electric. More…

| Operations | Investing | Financing |

| 101.67 | -43.07 | -48.47 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Franklin Electric. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.69k | 623.4 | 23.12 |

Key Ratios Snapshot

Some of the financial key ratios for Franklin Electric are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 15.8% | 26.0% | 12.1% |

| FCF Margin | ROE | ROA |

| 2.9% | 14.7% | 9.1% |

Analysis

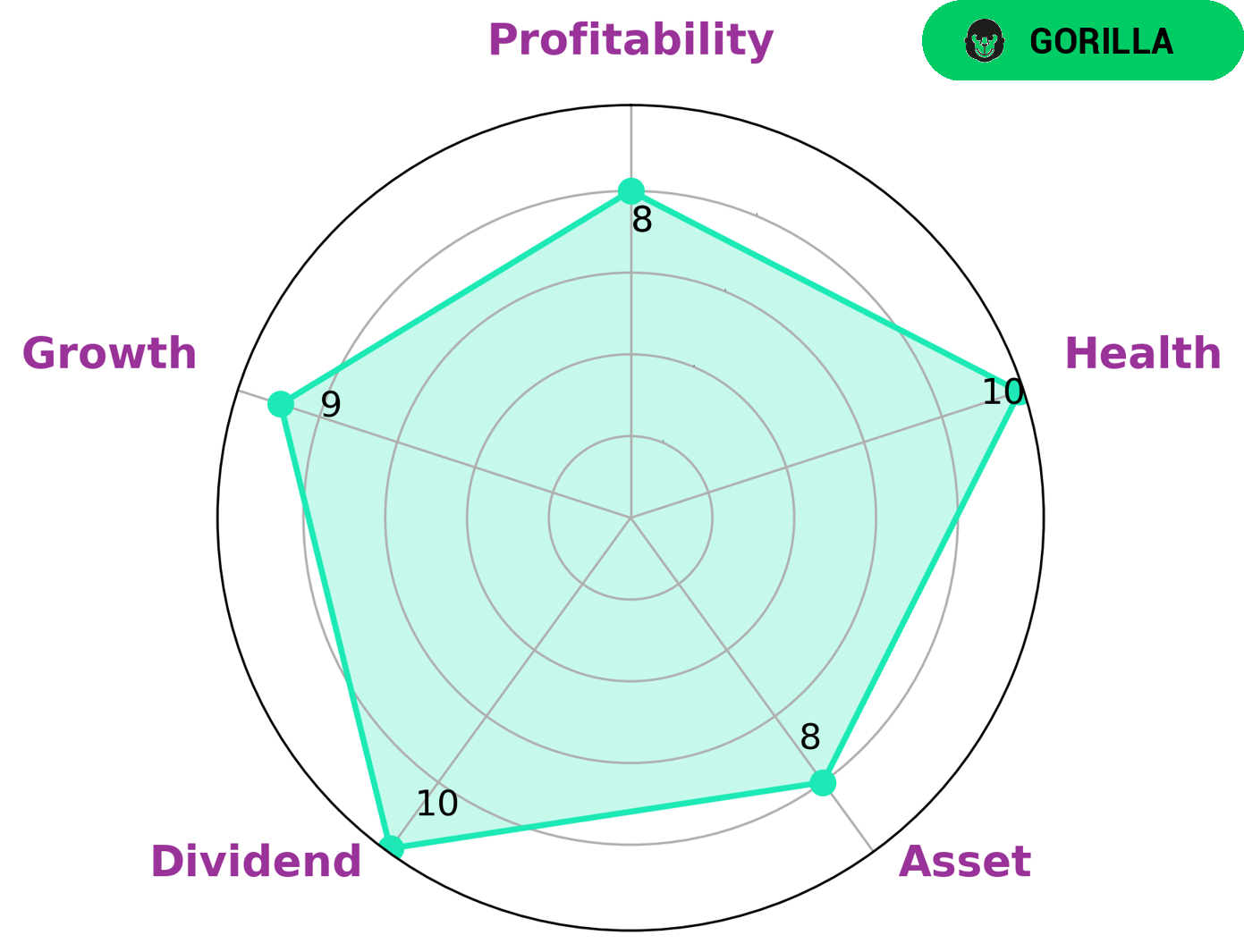

This makes it an attractive investment for many investors, especially those looking for a safe, long-term play. The company’s high health score of 10/10, derived from its cashflows and debt, also indicates that FRANKLIN ELECTRIC is capable of riding out any crisis without the risk of bankruptcy. Furthermore, FRANKLIN ELECTRIC is strong in terms of assets, dividend, growth, and profitability which makes it an even more appealing option for investors. More…

Peers

Franklin Electric Co. Inc. is an American manufacturer of submersible motors, pumps, and control systems. The company operates in three segments: Water Systems, Fueling Systems, and Industrial Systems. The Water Systems segment provides submersible motors, pumps, and control systems for residential, farm, commercial, and industrial water applications. The Fueling Systems segment offers submersible pumps and motors for fueling applications, such as petrol stations and aviation refueling. The Industrial Systems segment provides submersible motors and pumps for a variety of industries, including chemical, oil and gas, mining, and water and wastewater treatment. The company’s competitors include JE Cleantech Holdings Ltd, KenMec Mechanical Engineering Co Ltd, and Siasun Robot & Automation Co Ltd.

– JE Cleantech Holdings Ltd ($NASDAQ:JCSE)

JE Cleantech Holdings Ltd is a solar energy company that designs, develops, manufactures, and sells solar photovoltaic modules and systems. The company has a market cap of 12.09M as of 2022 and a return on equity of -2.6%. JE Cleantech Holdings Ltd is headquartered in Hong Kong.

– KenMec Mechanical Engineering Co Ltd ($TPEX:6125)

KenMec Mechanical Engineering Co Ltd has a market cap of 5.89B as of 2022. Its Return on Equity is -5.05%. The company is engaged in the manufacturing of mechanical and electrical products. Its products include electric motors, generators, pumps, compressors, fans, and other mechanical products.

– Siasun Robot & Automation Co Ltd ($SZSE:300024)

Siasun Robot & Automation Co Ltd is a Chinese company that manufactures robots and automation equipment. The company has a market cap of 14.22B as of 2022 and a return on equity of -7.76%. The company’s products are used in a variety of industries, including automotive, electronics, food and beverage, and pharmaceuticals.

Summary

Franklin Electric Co., Inc., a global leader in the production and marketing of systems and components for the movement of water and fuel, recently reported its quarterly financial results. The company posted a GAAP earnings per share (EPS) of $0.79, which beat analyst expectations by $0.15. Revenue for the quarter came in at $484.55 million, surpassing analyst estimates by $8.29 million. In response to the news, the stock price of Franklin Electric rose that same day.

This further demonstrates the market’s belief in the company’s fundamentals and growth potential. Investors should stay tuned to upcoming news as Franklin Electric continues to expand its product portfolio and capitalize on new opportunities.

Recent Posts