Flowserve Corp. Stock Rises Tuesday, But Underperforms Market

February 2, 2023

Trending News 🌥️

Flowserve Corporation ($NYSE:FLS) is a global leader in the manufacture and design of engineered flow control products and services. Flowserve’s stock rose on Tuesday, however, it failed to keep up with the performance of the broader market. Flowserve produces valves, pumps, seals, automation systems, and other related components for various industries. Its products are designed for maximum reliability and efficiency. The company’s stock has experienced an up-and-down performance over the past few years. The company’s revenue and profits have fallen as a result of reduced demand for its products and services.

The company has implemented cost-cutting measures to address the issue, but these measures have yet to fully offset the losses caused by the pandemic. Despite these challenges, Flowserve remains well-positioned for long-term growth and success. The company continues to invest in new technologies and services, which will ensure that it remains competitive in an ever-changing market. With its strong balance sheet and experienced management team, Flowserve is well-positioned to benefit from any future economic recovery.

Share Price

On Tuesday, the stock of Flowserve Corporation (FLS) rose by 1.4 percent from its previous closing price of $34.0. The stock opened at $34.1 and closed at $34.4, but underperformed the market, which had a positive day overall. At the time of writing, media coverage of the stock was mostly positive. The company has been experiencing strong financial performance lately and has had a positive outlook. Investors have been drawn to Flowserve’s products, which are used in energy, chemical, and water industries. The company has also been investing heavily in its research and development, which has led to the release of several new products and services. This has allowed them to gain more customers and increase their market share.

Additionally, Flowserve announced that they had acquired two smaller companies, giving them access to new markets and technologies. Overall, there is a lot of optimism surrounding Flowserve Corporation stock. Despite its recent underperformance, investors are still bullish on its future prospects. With a strong financial performance and a variety of new products and services, the company has plenty of potential for growth. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Flowserve Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 3.5k | 84.09 | 4.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Flowserve Corporation. More…

| Operations | Investing | Financing |

| -10.47 | -66.41 | -983.83 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Flowserve Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.51k | 2.81k | 12.71 |

Key Ratios Snapshot

Some of the financial key ratios for Flowserve Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -3.3% | -25.6% | 5.4% |

| FCF Margin | ROE | ROA |

| -2.2% | 5.8% | 2.2% |

VI Analysis

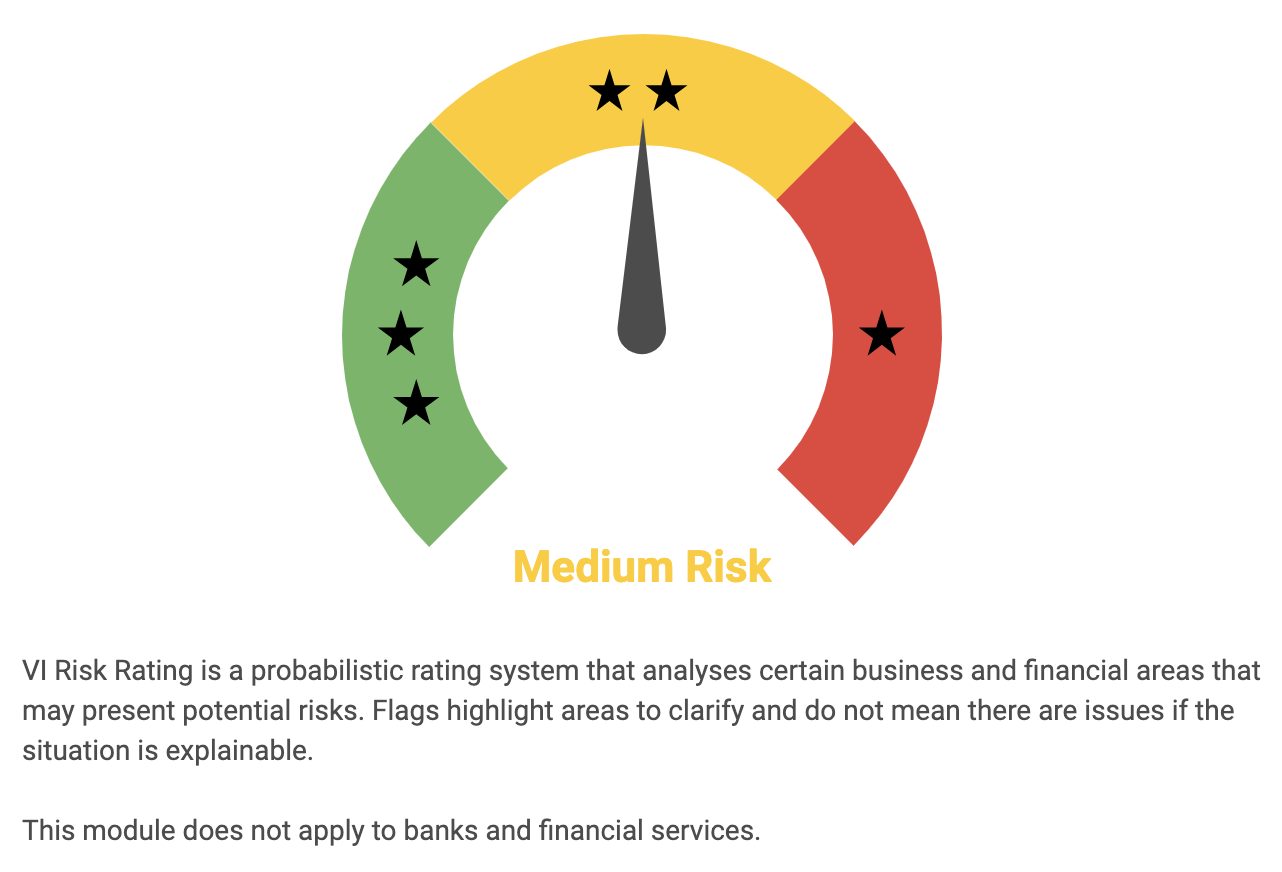

FLOWSERVE CORPORATION is a great example of a company that has made it easier to analyze its fundamentals and long-term potential. Through the use of the VI App, investors can easily gain insights into the company’s financial and business performance. According to the VI Risk Rating, FLOWSERVE CORPORATION is a medium risk investment in terms of its financial and business aspects. This rating provides investors with a sense of security as they can rest assured that the company is a reliable investment. The app also gives users access to an extensive list of risk warnings and events, which can be helpful in understanding the company’s performance. The app has also detected 1 risk warning in the balance sheet of FLOWSERVE CORPORATION.

This is an important factor for investors to consider when looking at the company’s performance over time. To gain further insight into this risk warning, users are encouraged to register on the vi.app website. The VI App provides investors with a comprehensive view of the company’s financial and business performance, as well as a list of potential risks to consider. By registering on vi.app, investors can gain further insight into their investments and make informed decisions regarding their investments in FLOWSERVE CORPORATION.

Peers

Its competitors include ITT Inc, Shanghai Zhenhua Heavy Industries Co Ltd, Sintokogio Ltd.

– ITT Inc ($NYSE:ITT)

3M’s market cap as of 2022 is 5.86B. The company has a return on equity of 12.81%. 3M is a diversified technology company that operates in a variety of industries, including healthcare, industrial, and consumer markets. The company’s products include adhesives, abrasives, laminates, and electro- and optical materials.

– Shanghai Zhenhua Heavy Industries Co Ltd ($SHSE:600320)

Shanghai Zhenhua Heavy Industries Co Ltd is a heavy industries company with a market cap of 14.22B as of 2022. The company has a return on equity of 7.11%. The company manufactures a range of products including cranes, construction machinery, and railway equipment. Shanghai Zhenhua Heavy Industries Co Ltd is a publicly traded company listed on the Shanghai Stock Exchange.

– Sintokogio Ltd ($TSE:6339)

Sintokogio Ltd is a Japanese company that manufactures automotive parts. As of 2022, the company has a market capitalization of 35.83 billion dollars and a return on equity of 2.76%. The company’s products include engine parts, suspension parts, and body parts.

Summary

Flowserve Corporation is a leading provider of flow control products and services for the global infrastructure markets. The stock of Flowserve Corporation rose on Tuesday, however, it underperformed the broader market. The performance of Flowserve Corporation’s stock reflects the current market sentiment. Analysts believe that the company has a potential to increase its revenue and profits by expanding its product portfolio and improving its operational efficiency.

Investors should keep an eye on the company’s performance, especially in the near future as any improvement in the market sentiment can boost the stock price of Flowserve Corporation. Overall, the stock of Flowserve Corporation may be considered as a good long-term investment option due to its strong fundamentals and potential for value appreciation.

Recent Posts