Enovis™ Corporation Management to Participate in Investor Conferences in June

June 17, 2023

🌥️Trending News

Enovis ($NYSE:ENOV)™ Corporation, based in Wilmington, DE, has declared that its management team will be present at the following investor conferences during June. Enovis™ Corporation is a publicly traded company listed on the NASDAQ stock exchange. The company specializes in providing innovative technology solutions to the financial services industry, and is focused on helping businesses succeed by creating new products and services for their customers. During these conferences, management will be available to discuss Enovis™ Corporation’s business strategy, performance, and outlook.

The management team is eager to engage with potential investors and demonstratte the value of Enovis™ Corporation’s offerings. They believe that the company is well-positioned to take advantage of current market trends and continue to drive growth and success for shareholders.

Price History

Enovis™ Corporation, a publicly traded company, announced that its management team will be participating in two investor conferences in June. This comes in the wake of the corporation’s stock opening at $55.2 on Tuesday and closing at $55.4, which is a 0.1% increase from its prior closing price of $55.4. The management team will be present at the conferences to provide investors with a comprehensive overview of the company’s operations and financial performance.

The conferences will also feature presentations from the management team, as well as discussions with investors about Enovis™ Corporation’s business strategy and future potential. The management team is looking forward to the opportunity to share their insights and to answer questions from investors at the upcoming events. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Enovis Corp. More…

| Total Revenues | Net Income | Net Margin |

| 1.59k | -51.71 | -5.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Enovis Corp. More…

| Operations | Investing | Financing |

| -33.98 | -175.61 | -429.81 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Enovis Corp. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.3k | 854.32 | 63.19 |

Key Ratios Snapshot

Some of the financial key ratios for Enovis Corp are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -22.8% | -3.3% | 1.8% |

| FCF Margin | ROE | ROA |

| -9.1% | 0.5% | 0.4% |

Analysis

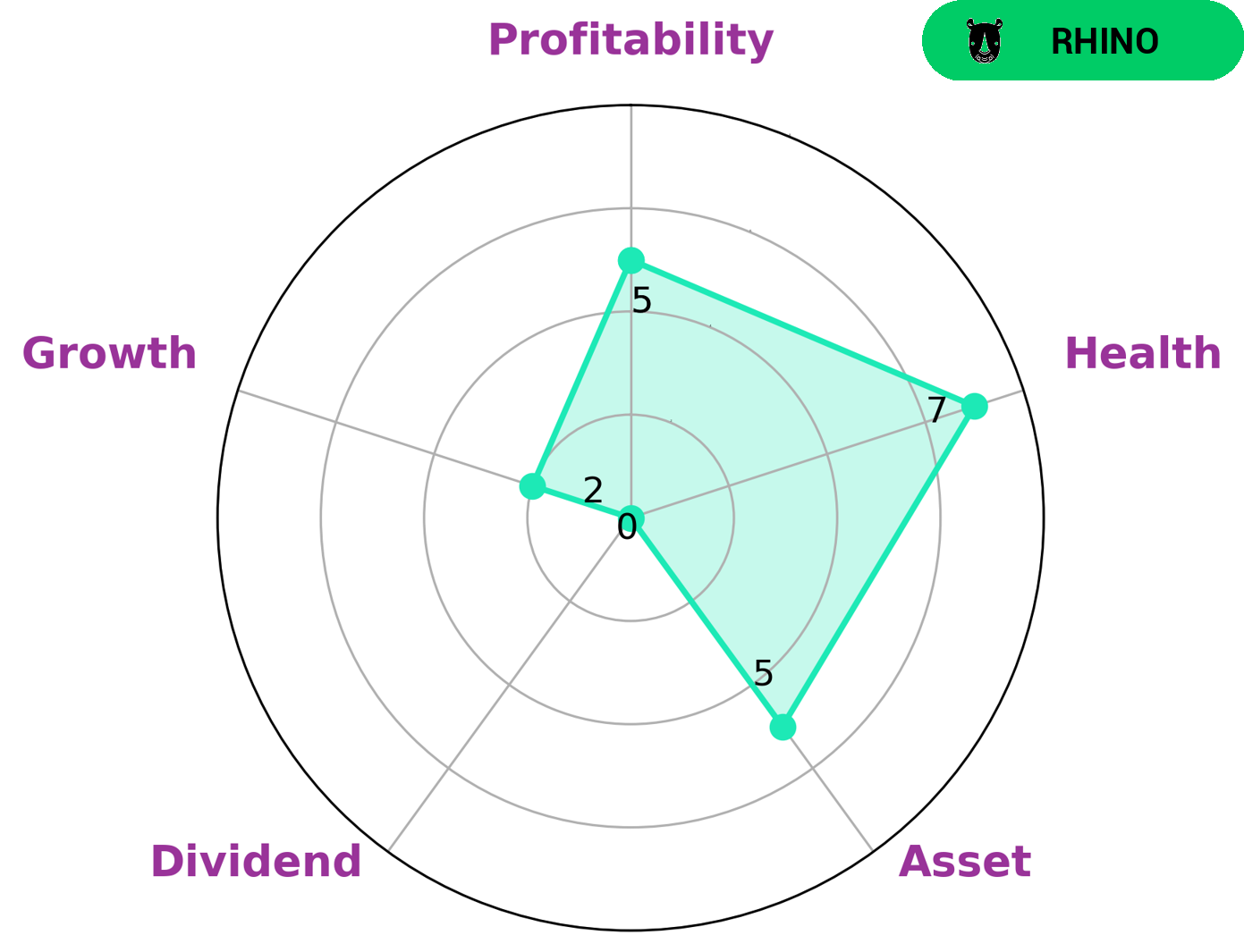

GoodWhale conducted an analysis of ENOVIS CORP‘s wellbeing and the results indicate that ENOVIS CORP is classified as an ‘elephant’, a type of company that is rich in assets after deducting off liabilities. This suggests that ENOVIS CORP has a strong financial position and should be attractive to potential investors. The Star Chart also reveals that ENOVIS CORP has a high health score of 8 out of 10, indicating its strength in cashflows and debt, and its capability to pay off debt and fund future operations. Moreover, ENOVIS CORP is strong in asset, medium in profitability and weak in dividend and growth. This means that ENOVIS CORP has a good base but may need improvement in its ability to generate sales and provide returns to shareholders. Overall, our analysis of ENOVIS CORP’s wellbeing presents a good picture of the company’s financial health and suggests that it is suitable for any type of investor looking for a reliable and profitable investment. More…

Peers

Enovis Corp, a leading provider of optoelectronic products and services, competes with Beyond Medical Technologies Inc, Hefei Meyer Optoelectronic Technology Inc, and Optorun Co Ltd in the optoelectronic market. Enovis Corp has a strong product portfolio and offers a wide range of optoelectronic products and services to its customers. The company has a strong R&D team and a state-of-the-art manufacturing facility. Enovis Corp is committed to providing the best products and services to its customers and has a strong customer base. The company has a strong brand and is well-positioned in the optoelectronic market.

– Beyond Medical Technologies Inc ($OTCPK:DOCKF)

The company’s market cap is 576.96k as of 2022 and its ROE is -135.24%. The company is engaged in the development, manufacture and sale of medical devices and supplies.

– Hefei Meyer Optoelectronic Technology Inc ($SZSE:002690)

Hefei Meyer Optoelectronic Technology Inc is a Chinese company that manufactures optoelectronic products. Its products are used in a variety of industries, including telecommunications, automotive, and consumer electronics. The company has a market cap of 22.2B as of 2022 and a return on equity of 16.74%.

– Optorun Co Ltd ($TSE:6235)

Optorun Co Ltd is a Japanese company that manufactures and sells optical products. The company has a market cap of 89.2 billion as of 2022 and a return on equity of 12.09%. The company’s products include lenses, cameras, and other optical products.

Summary

Enovis Corporation is inviting investors to participate in several conferences in June. The events will allow investors to gain insight into the company’s financial performance and future plans. Analysts can also get the latest information on Enovis’ products and services, as well as their impact on the company’s growth.

Furthermore, investors can get a better understanding of Enovis’ strategy and prospects for future success. The conferences provide an excellent opportunity for investors to analyze the potential of Enovis Corporation as a sound investment.

Recent Posts