EBARA CORPORATION Experiences Significant Rise in Short Interest

February 2, 2023

Trending News ☀️

Ebara Corporation ($TSE:6361) is a global engineering and manufacturing company headquartered in Tokyo, Japan. Recently, the company has experienced a significant rise in short interest, according to data released by FINRA. Short interest is defined as the total amount of shares sold short, or bet against, the company’s stock. A high rate of short interest is usually indicative of investors who are expecting the stock to go down in value. In Ebara’s case, it appears that investors are increasingly betting on the stock’s decline. The rise in short interest could be attributed to several factors. Ebara’s stock has been volatile in recent weeks, with a sharp drop in price following the release of weaker-than-expected earnings results.

In addition, the company has faced heightened competition in certain markets, which could be driving down investor confidence. Despite the rise in short interest, Ebara’s stock has held up relatively well over the past few months. Many analysts remain bullish on the company’s long-term prospects, citing its strong balance sheet and its strong brand presence in many markets. As such, investors may want to consider taking a closer look at Ebara before making any decisions about selling short on the stock.

Stock Price

On Monday, the stock opened at JP¥5410.0 and closed at JP¥5470.0, representing an increase of 0.7% from the previous closing price of 5430.0. This marks a significant rise in the company’s stock, indicating investor confidence in the company’s prospects going forward. The surge in short interest is likely due to the company’s impressive performance over the past few quarters. EBARA CORPORATION has been able to consistently deliver strong results and its growth strategy has been well-received by analysts and investors alike. This has resulted in an increased appetite for the company’s shares and the corresponding rise in its stock price. EBARA CORPORATION is well-positioned to capitalize on the current market conditions and benefit from the growing demand for its products and services.

The company has a strong portfolio of products and services, which will enable it to capitalize on future opportunities. It also has a highly experienced management team that is well-equipped to navigate the rapidly changing business landscape. Overall, EBARA CORPORATION’s stock has been experiencing a strong surge in short interest, which is likely due to the company’s impressive performance over the past few quarters and strong growth strategy. This indicates investor confidence in the company’s prospects going forward and provides an opportunity for investors to capitalize on the current market conditions. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Ebara Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 663.34k | 46.5k | 7.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Ebara Corporation. More…

| Operations | Investing | Financing |

| 31.05k | -30.39k | -17.56k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Ebara Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 808.07k | 453.92k | 3.89k |

Key Ratios Snapshot

Some of the financial key ratios for Ebara Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 9.3% | 27.5% | 10.4% |

| FCF Margin | ROE | ROA |

| 1.3% | 12.6% | 5.3% |

VI Analysis

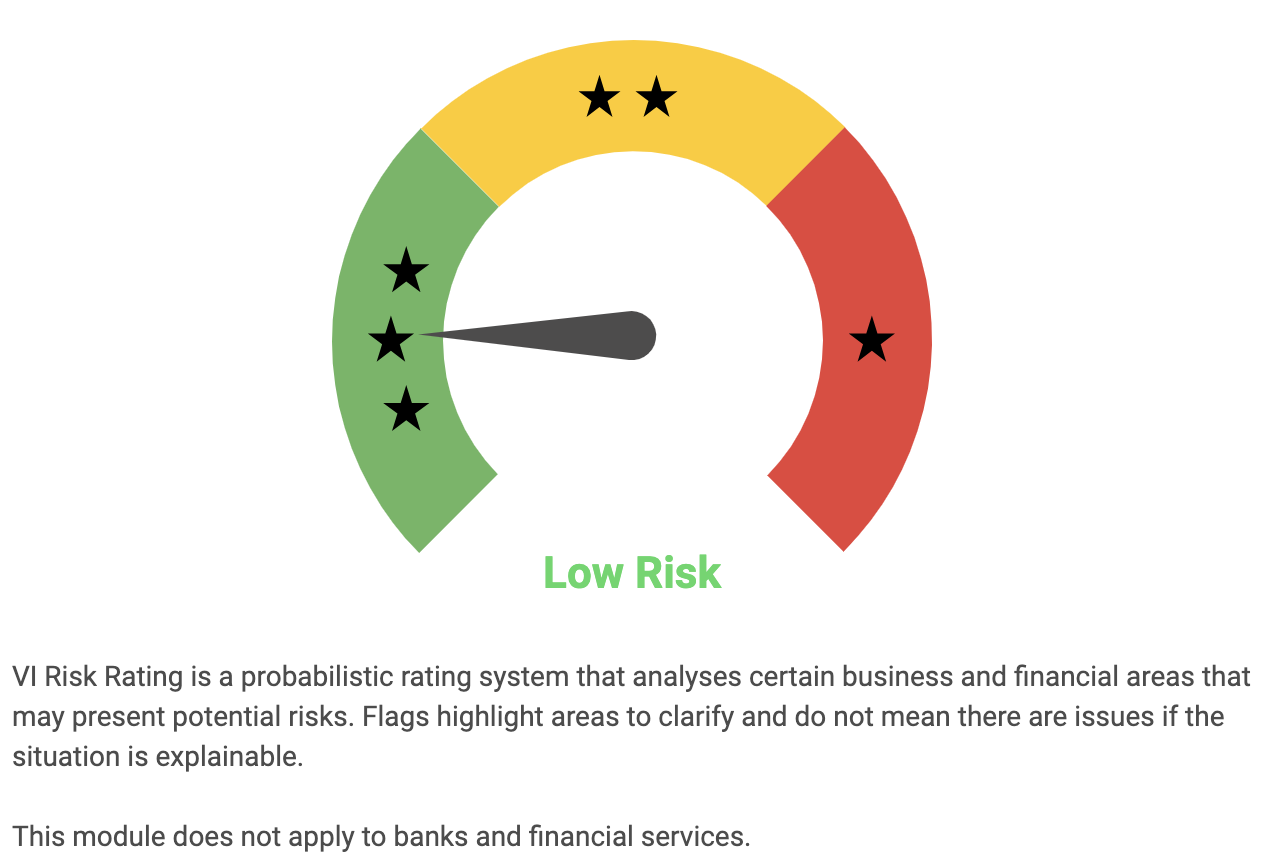

VI App simplifies the analysis of EBARA CORPORATION‘s fundamentals, which reflect its long term potential. Using a comprehensive risk rating system, the app has identified EBARA CORPORATION as a low risk investment in terms of both financial and business aspects. The VI App has identified two risk warnings in the income sheet and balance sheet. As the app is designed to be a comprehensive risk assessment tool, it can easily detect any potential risks which may harm a company’s long term prospects. The app offers comprehensive guidance on risk management and financial decisions. It provides valuable insights into the company’s performance and financial stability, enabling users to make informed decisions about their investments. It also allows investors to compare the risk ratings of different companies and determine which one is a better choice.

The app provides a wide range of analytical tools which allow users to quickly and accurately assess the company’s financial strength and stability. It is also able to detect any changes in the company’s financial performance which could indicate potential problems. VI App is the ideal tool for assessing EBARA CORPORATION’s long term potential. By providing detailed analysis and risk ratings, it helps users to make more informed decisions about their investments. To gain access to its comprehensive analysis, users must register on vi.app.

Peers

They are a key player in the industry, competing against the likes of Hydropneumotechnics AD, IHI Corp and Sumitomo Heavy Industries Ltd. Each of these companies offer a range of products and services, but Ebara Corp stands out with their strong focus on innovation and quality.

– Hydropneumotechnics AD ($LTS:0NWO)

IHI Corp is a Japanese conglomerate that operates in a range of industries including aviation, shipbuilding, construction machinery, and power systems. With a market cap of 571.76B as of 2023, IHI Corp is one of the largest companies in Japan. Its impressive Return on Equity of 16.44% is indicative of the company’s sound management and strong performance.

– IHI Corp ($TSE:7013)

Sumitomo Heavy Industries Ltd is a leading industrial engineering and manufacturing company based in Japan. The company specializes in heavy machinery, energy systems, shipbuilding, and aerospace engineering. With a market capitalization of 324.26B as of 2023, Sumitomo Heavy Industries Ltd is one of the largest industrial conglomerates in the world. The company also has an impressive Return on Equity of 6.86%, indicating that its financial performance is strong. This is likely due to Sumitomo Heavy Industries Ltd’s commitment to innovation and excellent customer service.

Summary

EBARA CORPORATION has recently experienced a considerable increase in short interest, indicating that investors may be anticipating a possible downward trend. Analysis of the current media sentiment shows that it is mostly positive; however, investors should proceed with caution when considering any investment in the company. It is important to research the company’s financials, compare them to industry averages, and closely monitor current events to determine the potential risk or reward of investing in EBARA CORPORATION. Additionally, investors should consider the company’s management team, strategy and long-term plans to determine if they are a good fit for their portfolio.

Recent Posts