Asset Management One Co. Ltd. Purchases Shares of Generac Holdings

February 2, 2023

Trending News ☀️

Generac Holdings ($NYSE:GNRC) Inc. is a leader in the design and manufacture of power generation solutions for residential, industrial, and construction applications. The company’s products are sold through a network of independent dealers and distributors, as well as through home improvement retailers and big-box stores around the world. Generac Holdings Inc. is headquartered in Wisconsin, USA and has operations all over the world. Asset Management One Co. Ltd., a Tokyo-based asset management firm, recently purchased shares of Generac Holdings Inc. This purchase by Asset Management One Co. Ltd. is part of their strategy to diversify their portfolio and add value to their investors. Asset Management One Co. Ltd. is well-known for their disciplined approach to investing, and they have a long history of success in the stock market. This purchase of shares in Generac Holdings Inc. is seen as an opportunity to capitalize on the company’s strong fundamentals, and generate long-term growth for its investors.

Generac Holdings Inc. has been seeing strong growth in recent years and is well-positioned for the future. The company has recently released their new line of industrial generators which have been well-received by the market, and they are also looking to expand their presence in the homebuilder market. This increased demand for their products has caused their stock price to rise steadily over the past few years. The company’s strong fundamentals and potential for growth make it an attractive investment opportunity, and Asset Management One Co. Ltd.’s track record of success in the stock market makes them an ideal partner for this venture. With their purchase of shares, Asset Management One Co. Ltd. is showing their confidence in Generac Holdings Inc., and this could be the start of a very profitable relationship for both parties involved.

Price History

The move has been met with a mostly positive response in the media, which has seen this as a sign of confidence in the company’s future. On Monday, Generac Holdings‘ stock opened at $115.2 and closed at $113.1, down by 3.9% from the prior closing price of 117.7. Despite this drop in price, analysts have pointed out that the company’s fundamentals remain strong and that the dip in share price may represent an opportunity for investors to buy in at a more favorable price.

These positive signs indicate that the company is well-positioned for future growth. This suggests that Generac Holdings is likely to continue to perform well in the future, making it an attractive option for investors. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Generac Holdings. More…

| Total Revenues | Net Income | Net Margin |

| 4.58k | 459.97 | 10.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Generac Holdings. More…

| Operations | Investing | Financing |

| 19.4 | -355.6 | 145.35 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Generac Holdings. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 5.25k | 2.84k | 36.6 |

Key Ratios Snapshot

Some of the financial key ratios for Generac Holdings are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 28.2% | 20.3% | 13.8% |

| FCF Margin | ROE | ROA |

| -1.5% | 16.7% | 7.5% |

Analysis

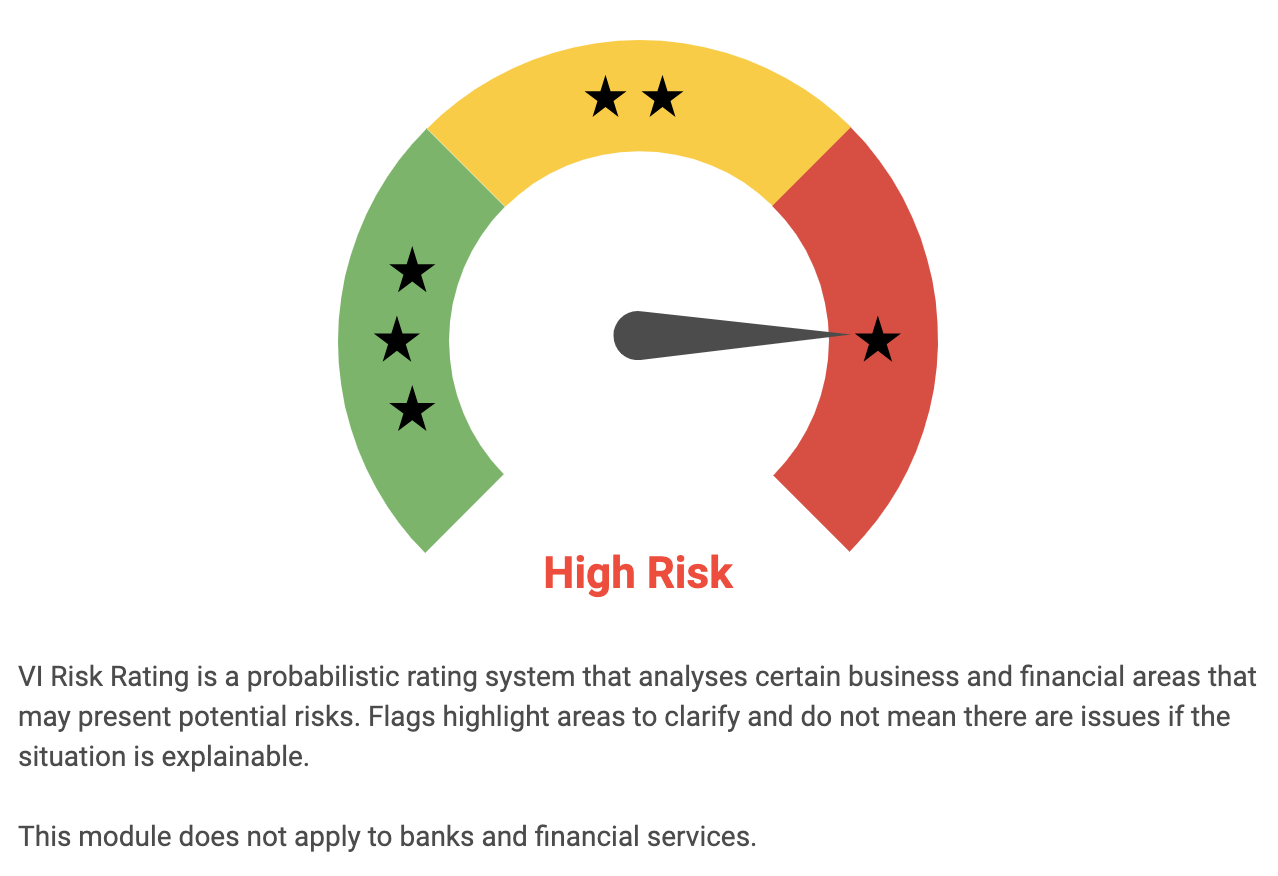

GoodWhale has conducted an analysis of GENERAC HOLDINGS, assessing the company’s well-being in terms of financial and business aspects. The results of the analysis indicate that GENERAC HOLDINGS is a high risk investment according to GoodWhale’s Risk Rating. In addition, GoodWhale has detected two risk warnings in GENERAC HOLDINGS’ balance sheet, which are non-financial in nature. GoodWhale’s Risk Rating system is designed to help investors make informed decisions on their investments. It takes into account both the financial and business risks associated with a company, providing a detailed assessment of its overall health. In addition, GoodWhale’s analysis is designed to detect hidden risks that may not be evident to the casual observer. GoodWhale’s analysis of GENERAC HOLDINGS is an important tool for investors who are considering investing in the company. By registering on goodwhale.com, investors can access the risk warnings and other information about GENERAC HOLDINGS to help them make the best decision for their portfolios. With GoodWhale’s risk rating system, investors can make more informed decisions about their investments and protect their portfolios from potential losses. More…

Peers

In the market for standby generators, Generac Holdings Inc is up against some stiff competition from the likes of Musashi Co Ltd, Taihai Manoir Nuclear Equipment Co Ltd, and Weg SA.

However, the company has managed to stay ahead of the pack thanks to its innovative products and efficient manufacturing processes.

– Musashi Co Ltd ($TSE:7521)

As of 2022, Musashi Co Ltd has a market cap of 9.64B and a Return on Equity of 5.68%. The company manufactures and sells automotive parts, including engine valves, pistons, and crankshafts. It also provides engineering services.

– Taihai Manoir Nuclear Equipment Co Ltd ($SZSE:002366)

The company has a market capitalization of 4.67 billion as of 2022 and a return on equity of 697.02%. It is a manufacturer of nuclear equipment and supplies. The company’s products include reactors, nuclear fuel, nuclear power plant equipment, and nuclear waste disposal products.

– Weg SA ($OTCPK:WEGZY)

Weg SA is a Brazilian company that manufactures electric motors and generators. It has a market cap of 27.73B as of 2022 and a Return on Equity of 21.06%. The company is headquartered in Jaraguá do Sul, Santa Catarina, and has over 30,000 employees. Weg SA is one of the largest manufacturers of electric motors and generators in the world.

Summary

Generac Holdings Inc. is a stock that has recently seen an influx of investment from Asset Management One Co. Ltd. Despite the positive sentiment from the media, the stock price has moved down since the purchase. Investors should consider the potential implications of this decline and any other variables that could affect their decision before investing in Generac Holdings Inc. Analysts should also be aware of the current market conditions and any potential risks associated with investing in the company. Furthermore, investors should study the company’s financials and recent developments in order to gain an understanding of the company’s performance and future prospects.

Recent Posts