American Century Companies Increases Investment in Gates Industrial Corporation PLC, Signifying Growing Investor Confidence

June 9, 2023

☀️Trending News

American Century Companies Inc. has recently announced its increased investment in Gates Industrial ($NYSE:GTES) Corporation PLC, signaling its growing confidence in the company’s prospects. Gates Industrial Corporation PLC is a global manufacturer of power transmission and fluid power components and systems, providing custom solutions to a wide range of industrial and consumer markets around the world. Gates Industrial Corporation PLC’s products offer a wide range of engineering solutions that enable customers to optimize their performance and reduce costs. This includes products such as industrial belts, hoses, and hydraulic fittings.

In addition, the company offers aftermarket services and support for all of its products, including maintenance and repair solutions. The company has an experienced team of engineers and product experts that can provide custom solutions to meet any customer need. With its wide range of products and services, the company is well-positioned to capitalize on the growing demand for industrial components and systems worldwide. Furthermore, the company’s commitment to innovation will continue to ensure that its products remain competitive and meet the changing needs of its customers.

Price History

On Monday, leading industrial products manufacturer Gates Industrial Corporation PLC saw a slight decrease in its stock price on the NASDAQ: GATES. Despite closing at $12.4, a decrease of 0.6% from its previous closing price, American Century Companies Inc., a major U.S. investment firm, announced that it had increased its stake in the company, indicating investor confidence in the industrial giant. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Gates Industrial. More…

| Total Revenues | Net Income | Net Margin |

| 3.56k | 216.3 | 6.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Gates Industrial. More…

| Operations | Investing | Financing |

| 423.7 | -95.6 | -139.4 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Gates Industrial. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 7.28k | 3.73k | 11.28 |

Key Ratios Snapshot

Some of the financial key ratios for Gates Industrial are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 5.9% | 10.4% | 11.4% |

| FCF Margin | ROE | ROA |

| 9.6% | 8.0% | 3.5% |

Analysis

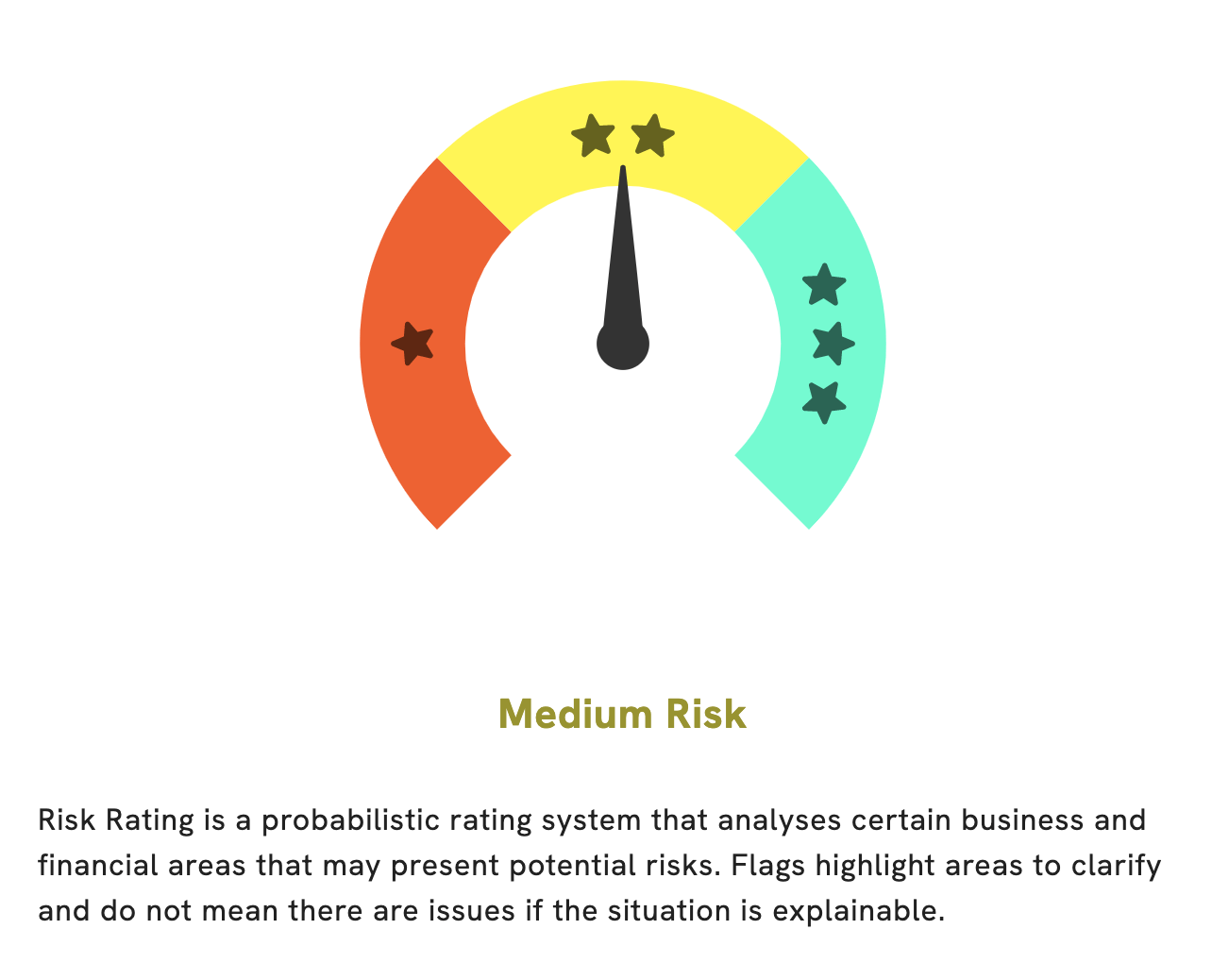

GoodWhale has conducted an in-depth analysis of GATES INDUSTRIAL‘s financials and according to our Risk Rating, GATES INDUSTRIAL is a medium risk investment. While this rating suggests that they are a relatively safe investment, we have detected one risk warning in their balance sheet which should be taken into consideration. If you’re interested in learning more about this risk, please register with us to check it out. More…

Peers

In the industrial sector, there is intense competition between Gates Industrial Corp PLC and its competitors Trelleborg AB, Graco Inc, and Vishal Bearings Ltd. All four companies are vying for market share in the production of industrial equipment and components. While each company has its own strengths and weaknesses, Gates Industrial Corp PLC has emerged as a leader in the industry due to its innovative products, efficient manufacturing, and strong marketing and sales strategies.

– Trelleborg AB ($OTCPK:TBABF)

Trelleborg AB is a Swedish industrial group that develops, manufactures, and sells products and services for a wide range of industries worldwide. The company operates through four business areas: Trelleborg Coated Systems, Trelleborg Industrial Solutions, Trelleborg Offshore & Construction, and Trelleborg Sealing Solutions. Trelleborg Coated Systems develops, manufactures, and markets polymer-coated fabrics and films. Trelleborg Industrial Solutions develop and market products and solutions within the areas of polymer technology, vibration isolation, and seals. Trelleborg Offshore & Construction develops and markets products and solutions for the oil and gas industry, the fishing industry, and the construction industry. Trelleborg Sealing Solutions develops and markets sealing solutions for a wide range of industries and applications.

– Graco Inc ($NYSE:GGG)

Graco Inc. is a publicly traded company with a market capitalization of $11.77 billion as of 2022. The company has a return on equity of 19.47%. Graco Inc. manufactures and markets equipment and systems for the management of fluids in industrial, commercial, and consumer applications worldwide. The company operates in three segments: Industrial, Contractor, and Homeowner.

– Vishal Bearings Ltd ($BSE:539398)

Vishal Bearings Ltd is an Indian company that manufactures and supplies a range of bearings and related products. The company has a market cap of 756.45M as of 2022 and a return on equity of 27.82%. Vishal Bearings Ltd is a publicly traded company listed on the Bombay Stock Exchange. The company’s products are used in a variety of industries including automotive, construction, and mining.

Summary

Gates Industrial Corporation PLC has recently seen an increase in investor interest with American Century Companies Inc. increasing its stake. The industrial firm offers an array of motion control, fluid power and power transmission products and services for automotive, oil and gas, and other industries. The company’s value proposition lies in its ability to design and manufacture custom solutions for its customers that address specific needs. Investors are attracted to Gates Industrial’s commitment to innovation, quality, and customer service, which are expected to drive the company’s future growth.

Recent Posts