AlphaCrest Capital Management LLC Increases Investment in John Bean Technologies Co. in 2023.

March 15, 2023

Trending News 🌥️

AlphaCrest Capital Management LLC is making a substantial investment in John Bean Technologies ($NYSE:JBT) Co. in 2023. This move marks an increase to their existing holdings in the company, indicating a strong vote of confidence from AlphaCrest Capital Management LLC. John Bean Technologies Co. is a global leader in the manufacturing, distribution, and servicing of technology-based solutions for the agricultural, construction, mining, and turf care industries.

With a strong record of innovation and customer satisfaction, it is no surprise that AlphaCrest Capital Management LLC is increasing its investment in the company. This will help the company to expand their reach and further bolster their presence in the global market.

Share Price

On Monday, John Bean Technologies Co. (JBT) saw its stock open at $102.7 and close at $104.7, down by 0.3% from the prior closing price of $105.0. This decrease in stock price was likely offset by the news that AlphaCrest Capital Management LLC had increased its investment in JBT during 2023. AlphaCrest Capital Management LLC is a global principle investment firm which prides itself on its innovative and risk-averse approach to investments, making the increased investment a huge vote of confidence for JBT. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for JBT. More…

| Total Revenues | Net Income | Net Margin |

| 2.17k | 130.7 | 6.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for JBT. More…

| Operations | Investing | Financing |

| 142.3 | -416.1 | 270.6 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for JBT. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.58k | 1.72k | 27.12 |

Key Ratios Snapshot

Some of the financial key ratios for JBT are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 3.6% | -4.6% | 7.8% |

| FCF Margin | ROE | ROA |

| 2.5% | 12.6% | 4.1% |

Analysis

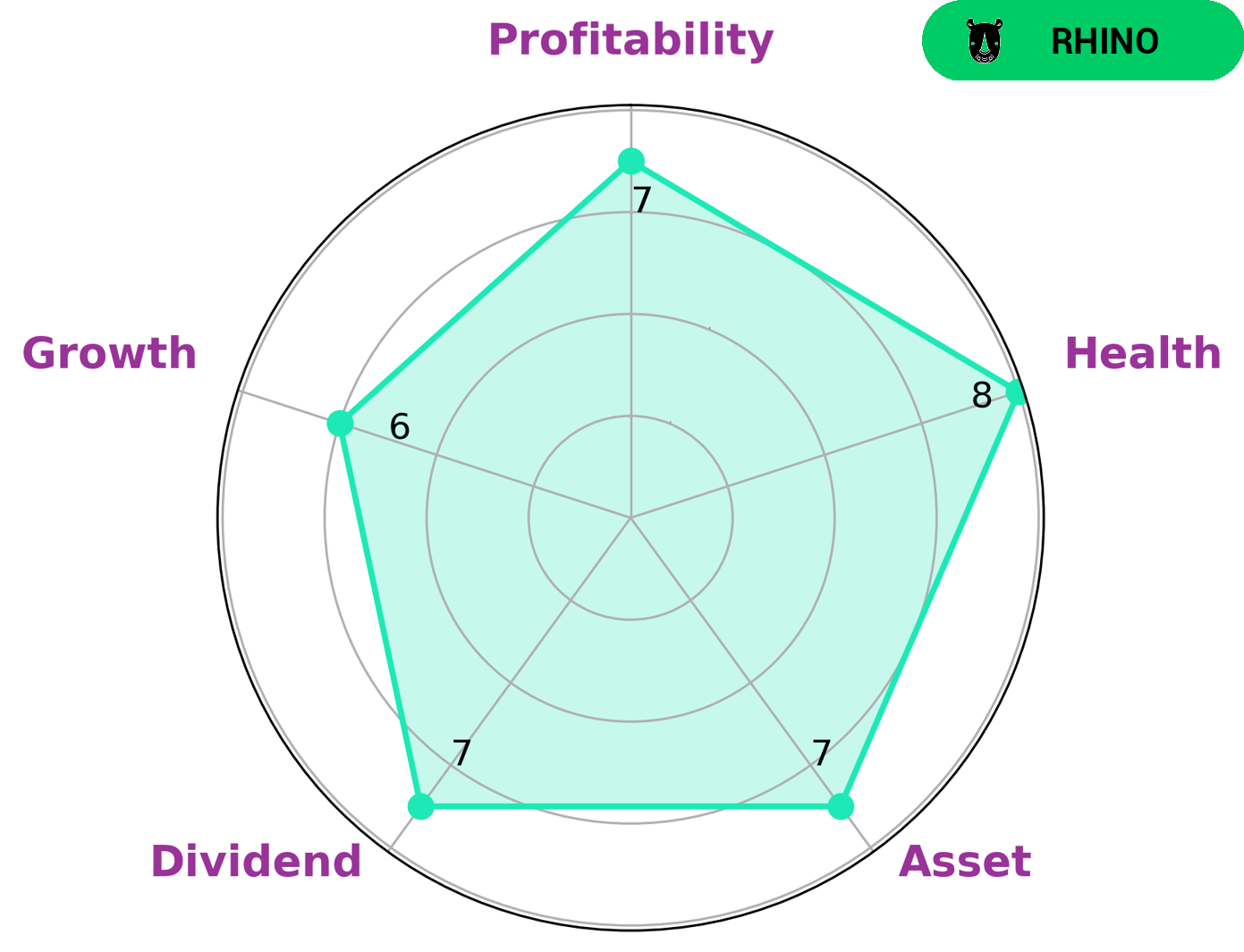

GoodWhale is proud to analyze the wellbeing of JOHN BEAN TECHNOLOGIES. Our Star Chart found that the company has a high health score of 8/10, which is based on cashflows and debt and shows that it is well prepared to sustain future operations in times of crisis. Further, the company is classified as a ‘rhino’, meaning it has achieved moderate revenue or earnings growth. Given the company’s strength in assets, dividend, and profitability, as well as its moderate growth, JOHN BEAN TECHNOLOGIES would be a great option for investors looking for a stable company with potential for later growth. We believe this company has the right balance of risk and reward to make a good investment. More…

Peers

The company’s products are used by customers in more than 100 countries around the world. John Bean Technologies Corp has a strong competitive position in the market, with a wide range of products and a global customer base. The company’s competitors include Dover Corp, Shenzhen Genvict Technologies Co Ltd, Crawford United Corp.

– Dover Corp ($NYSE:DOV)

Dover Corporation is a global manufacturer of industrial products and components. The company’s products are used in a variety of industries, including aerospace, transportation, energy, and medical. Dover’s products are sold through a network of distributors and retailers. The company has a market cap of 18.29B as of 2022 and a Return on Equity of 22.89%. Dover is a publicly traded company on the New York Stock Exchange (NYSE) under the ticker symbol DOV.

– Shenzhen Genvict Technologies Co Ltd ($SZSE:002869)

Shenzhen Genvict Technologies Co Ltd has a market cap of 4.08B as of 2022. The company’s return on equity is -3.9%.

Shenzhen Genvict Technologies Co Ltd is a leading provider of Internet of Things (IoT) solutions. The company’s products and solutions are used in a wide range of industries, including smart city, transportation, energy, environment, healthcare, and manufacturing.

– Crawford United Corp ($OTCPK:CRAWA)

Crawford United Corp is a publicly traded company with a market capitalization of $61.6 million as of 2022. The company has a return on equity of 10.27%. Crawford United Corp is engaged in the business of providing engineering, construction and maintenance services to the energy, industrial and commercial markets.

Summary

AlphaCrest Capital Management LLC has increased its investment in John Bean Technologies Co. (JBT) by 2023. Analysts have highlighted JBT’s strong financial performance and diverse product portfolio as areas of strength.

Additionally, the company is well positioned to benefit from the growth of global demand for food processing equipment, airport services, and automation solutions. JBT has also focused on expanding its presence in emerging markets, as well as leveraging its strong product pipeline to drive future growth. With a strong balance sheet and a growing customer base, JBT is expected to benefit from sustained growth in the years ahead.

Recent Posts