“Wedge Capital Management L L P NC Sells Shares of Minerals Technologies”

December 28, 2023

☀️Trending News

Wedge Capital Management L L P NC recently sold shares of Minerals Technologies ($NYSE:MTX) Inc., a leading specialty minerals and materials company. The company produces a wide range of products and services for industrial and consumer markets around the world, including specialty chemicals, specialty minerals, functional additives, advanced materials, and other related products. The company’s portfolio of products and services span multiple industries, such as paper and packaging, construction, building materials, energy, automotive, and consumer goods. The company operates through three business segments: Specialty Minerals, Performance Materials, and Resource Recovery. Through its Specialty Minerals segment, the company provides high-quality mineral products used in various manufacturing processes, including industrial and consumer markets. Its Performance Materials segment produces a range of materials used in consumer and industrial products. Finally, its Resource Recovery segment utilizes secondary raw materials to produce value-added products. Minerals Technologies Inc. has a strong presence in the markets it serves and is continuously innovating and expanding its product portfolio. Its commitment to sustainability is demonstrated in its commitment to reduce its carbon footprint and create renewable energy sources.

In addition, the company is focused on building long-term relationships with customers and suppliers to ensure the highest quality product standards. Minerals Technologies Inc. is a strong player in its industry and an attractive option for investors.

Stock Price

The stock opened at $70.2 and closed at $71.2, resulting in a 1.1% increase from the previous closing price of $70.4. This move by Wedge Capital Management L L P NC follows the trend of a growing demand for Minerals Technologies Inc services, providing innovative materials solutions to customers worldwide. Specifically, they provide customers with mineral-based building materials technologies, performance-enhancing chemicals and functional fillers, and materials solutions for industrial applications.

Additionally, they offer high-quality products including lime, dolomite and other specialty chemical products. With their commitment to sustainability and focus on innovation, Minerals Technologies Inc has established itself as a leader in the industry. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Minerals Technologies. More…

| Total Revenues | Net Income | Net Margin |

| 2.15k | 64.2 | 6.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Minerals Technologies. More…

| Operations | Investing | Financing |

| 180.4 | -101.5 | -33.8 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Minerals Technologies. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.34k | 1.72k | 48.83 |

Key Ratios Snapshot

Some of the financial key ratios for Minerals Technologies are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 10.3% | 7.5% | 6.6% |

| FCF Margin | ROE | ROA |

| 4.0% | 5.6% | 2.7% |

Analysis

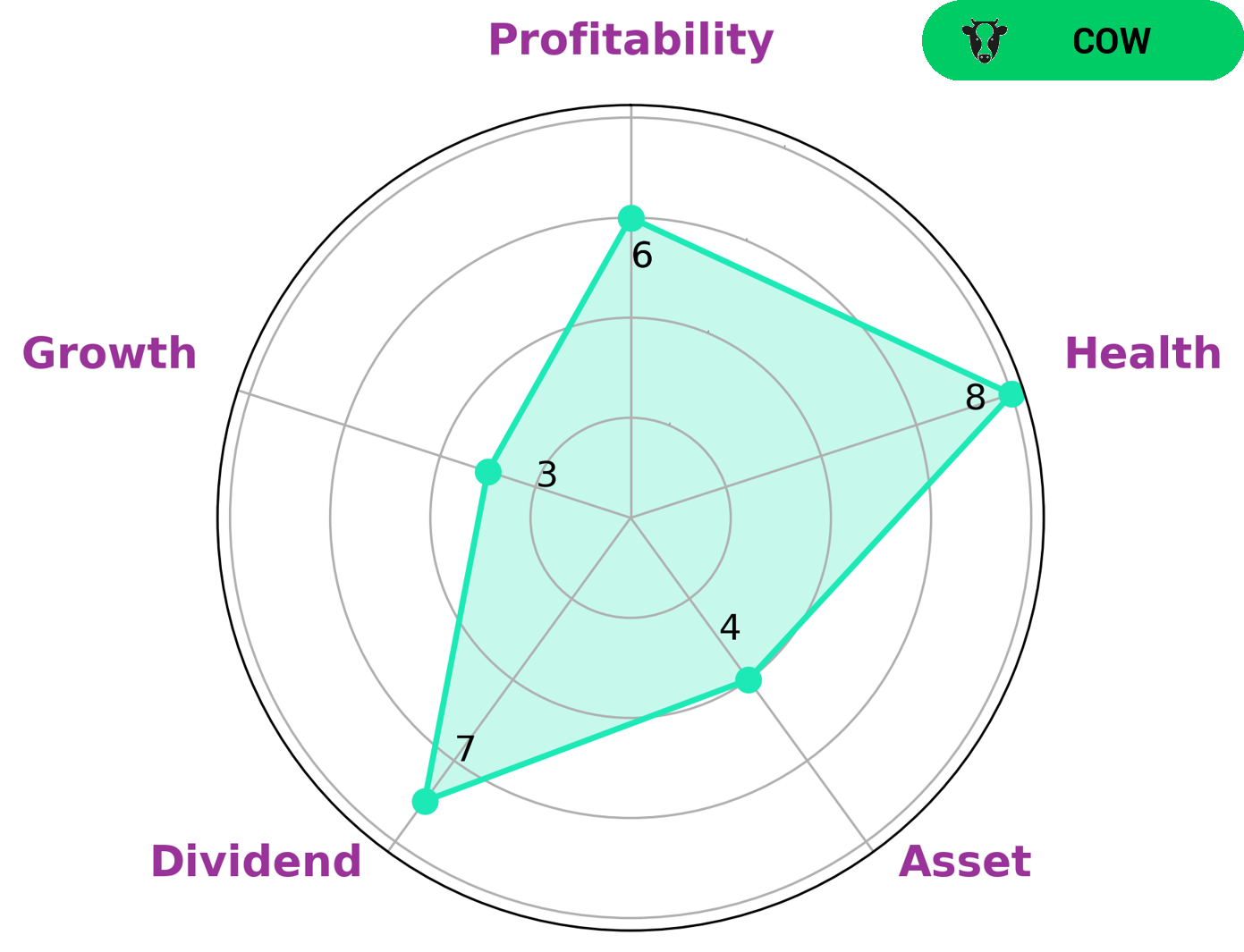

GoodWhale has conducted a financial analysis of MINERALS TECHNOLOGIES, and our Star Chart shows that the company is strong in dividend, medium in asset, profitability and weak in growth. Based on these results, we classify MINERALS TECHNOLOGIES as a ‘cow’, a type of company with a track record of paying out consistent and sustainable dividends. This makes MINERALS TECHNOLOGIES an attractive option for investors who prioritize dividend returns above all else, such as retirees or those seeking regular income from their investments. Additionally, MINERALS TECHNOLOGIES has a high health score of 8/10 with regard to its cashflows and debt, indicating that it is capable to pay off debt and fund future operations. This further boosts the attractiveness of MINERALS TECHNOLOGIES for dividend-seekers. More…

Peers

The company’s products are used in a variety of industries including building & construction, transportation, ceramics & glass, and more. The company has a wide range of competitors including Cabot Corp, Borregaard ASA, and Koppers Holdings Inc.

– Cabot Corp ($NYSE:CBT)

Cabot Corporation is a leading global specialty chemicals and performance materials company headquartered in Boston, Massachusetts. The company operates in five segments: Carbon Black, Reinforcement Materials, Specialty Fluids, Purification Solutions, and Performance Chemicals. Cabot’s products are used in a variety of applications, including tires, plastics, textiles, inks, coatings, and adhesives. The company has approximately 3,700 employees and operates in more than 30 countries.

As of 2022, Cabot Corporation had a market capitalization of 4.15 billion dollars. The company’s return on equity was 27.26%. Cabot Corporation is a leading global specialty chemicals and performance materials company. The company’s products are used in a variety of applications, including tires, plastics, textiles, inks, coatings, and adhesives. Cabot Corporation has approximately 3,700 employees and operates in more than 30 countries.

– Borregaard ASA ($OTCPK:BRRDF)

Borregaard ASA is a Norwegian chemical company. The company produces chemicals and bio-based products derived from wood. Its products are used in a variety of industries, including paper, food and beverage, construction, textiles, and cosmetics. The company has a market cap of 1.42B as of 2022 and a return on equity of 17.66%.

– Koppers Holdings Inc ($NYSE:KOP)

Koppers Holdings Inc is a chemical and wood products company with a market cap of 591.83M as of 2022. The company has a Return on Equity of 26.29%. Koppers Holdings Inc produces a variety of treated wood products, chemicals, and coke. The company’s products are used in a variety of applications, including the construction, transportation, and industrial sectors.

Summary

Minerals Technologies Inc. (MIN) has seen a notable decline in its share prices over the past few months. This has been due to a sell-off by Wedge Capital Management L L P NC, who has disposed of a significant percentage of their shares in MIN. This could be a potential sign of a bearish outlook on the stock and caution should be exercised by investors when considering opening or increasing positions in MIN.

A thorough analysis of the company’s financials should be made, focusing on profitability, cash flow, debt levels, share repurchases, industry trends and any other pertinent factors. Existing investors should also assess their current positions and whether to reduce, hold or increase their current holdings in order to maximise returns.

Recent Posts