TRINSEO PLC Reports 8100-Gallon Latex Emulsion Release at Bristol Plant in 2023.

March 30, 2023

Trending News 🌥️

Trinseo ($NYSE:TSE) PLC has reported an unfortunate incident involving the release of approximately 8100 gallons of latex emulsion product from its Bristol Plant into a nearby waterway. The incident took place in 2023 and efforts were immediately initiated by Trinseo PLC to contain and clean up the spill. The company has taken remedial action and is working with local authorities and environmental organizations to mitigate the effects of the spill. The incident has raised questions about the safety protocols in place at the Bristol Plant, and Trinseo PLC has stated that they are conducting a thorough investigation into the cause of the release and any potential environmental impacts.

The company has committed to taking all necessary steps to ensure similar incidents do not occur in the future. Trinseo PLC is offering its sincere apologies for any inconvenience caused by the incident and is working to make sure that any contamination of the waterway is mitigated as soon as possible. The company is also providing updates to local residents and stakeholders through their website and social media channels.

Stock Price

TRINSEO PLC reported an 8100-gallon latex emulsion release from their Bristol plant on Wednesday. The incident occurred on the evening of March 3, 2023. TRINSEO PLC opened at $20.5 and closed at $20.2 on the same day, which was a 0.1% increase from its previous closing price of 20.2. The incident was contained, and no other nearby plants were affected. An investigation is being conducted to determine the cause of the release.

TRINSEO PLC has taken necessary steps to ensure that the incident does not happen again. TRINSEO PLC is taking responsibility for the incident and is committed to ensuring that their plants are safe and secure. They are also providing support to their employees, customers, and other stakeholders affected by the incident. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Trinseo Plc. More…

| Total Revenues | Net Income | Net Margin |

| 4.97k | -430.9 | -3.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Trinseo Plc. More…

| Operations | Investing | Financing |

| 43.5 | -164 | -233.7 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Trinseo Plc. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.76k | 3.34k | 11.97 |

Key Ratios Snapshot

Some of the financial key ratios for Trinseo Plc are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 9.6% | 11.6% | -7.2% |

| FCF Margin | ROE | ROA |

| -2.1% | -39.9% | -5.9% |

Analysis

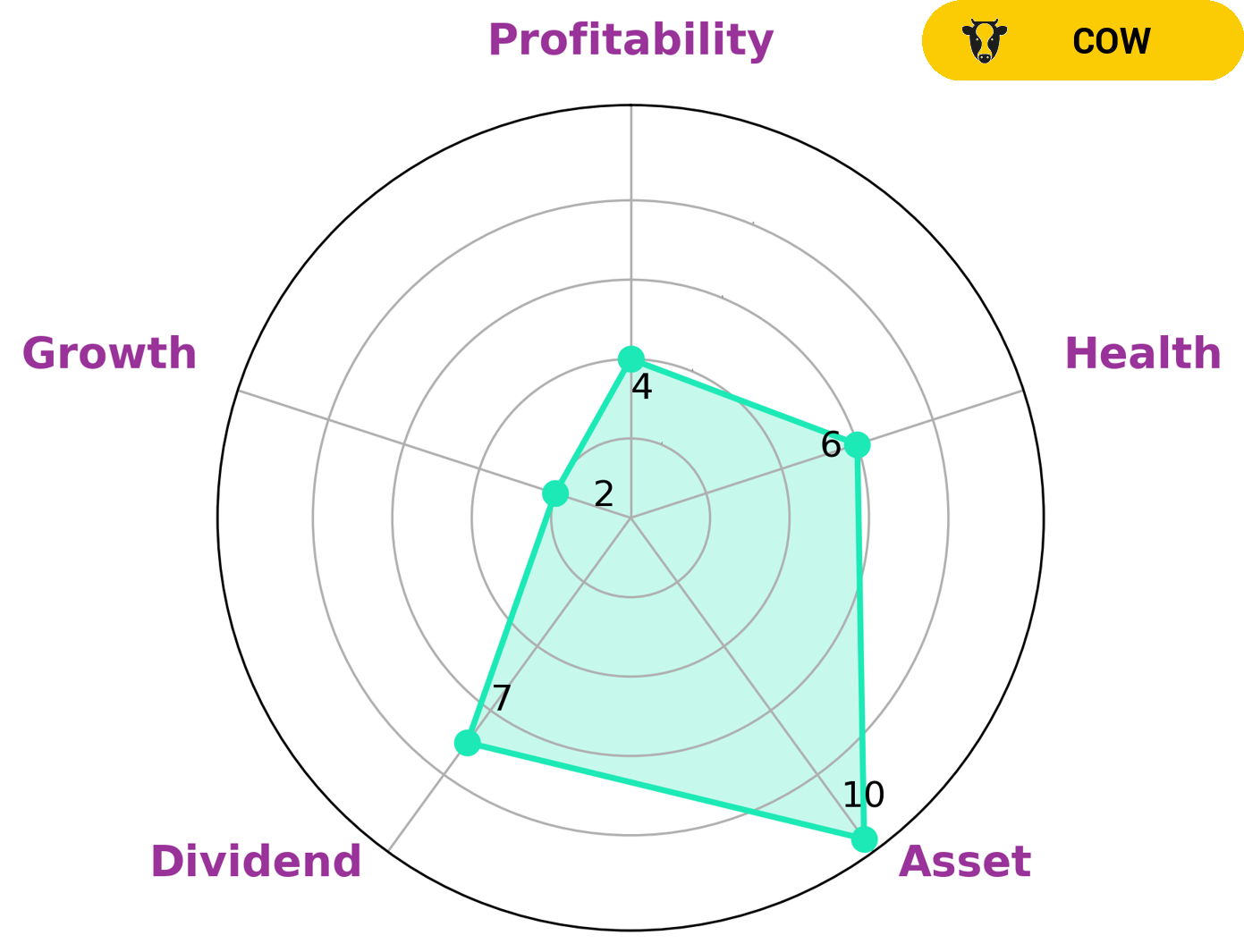

GoodWhale recently conducted an analysis of TRINSEO PLC‘s wellbeing. Our findings lead us to classify the company as a ‘cow’ based on Star Chart. This type of company is known to have a track record of paying out consistent and sustainable dividends, making them an attractive investment option for those seeking such a profile. We also evaluated the company’s financial health and determined it had an intermediate score of 6/10. This means that TRINSEO PLC has enough cashflows and debt that it should be able to safely ride out any crisis without the risk of bankruptcy. Our analysis of the company further revealed that TRINSEO PLC was strong in asset, dividend, and medium in profitability, but weak in growth. This makes them a potential fit for investors seeking a reliable income flow, but may not satisfy those seeking more upside potential. More…

Peers

In the global market for specialty chemicals, Trinseo PLC competes with several large multinational companies, including Evonik Industries AG, PPG Industries Inc, and Shandong Dongyue Organosilicon Materials Co Ltd. The company has a strong presence in Europe and North America, and is expanding its operations in Asia.

– Evonik Industries AG ($OTCPK:EVKIF)

Evonik Industries AG is a German chemical company with a market cap of 9.4 billion as of 2022. The company’s return on equity is 8.43%. Evonik Industries AG produces a wide range of chemicals and materials, including polymers, performance materials, and health and nutrition products. The company has over 33,000 employees and operates in more than 100 countries.

– PPG Industries Inc ($NYSE:PPG)

PPG Industries, Inc., is an American Fortune 500 company and global supplier of paints, coatings, and specialty materials. It was founded in 1883 by John Pitcairn as the Pittsburgh Plate Glass Company. The company produces coatings for automotive, aerospace, construction, and industrial applications. PPG’s headquarters are located in Pittsburgh, Pennsylvania.

– Shandong Dongyue Organosilicon Materials Co Ltd ($SZSE:300821)

Shandong Dongyue Organosilicon Materials Co., Ltd. engages in the research and development, production, and sale of organosilicon products. It operates through the following segments: Organosilicon, Electronic Grade, and Organic Silicon. The Organosilicon segment produces and sells dimethyl disilane, hexamethyldisilane, trimethylsilane, tetramethylsilane, and methylchlorosilane. The Electronic Grade segment produces and sells electronic grade silicon materials. The Organic Silicon segment produces and sells cyclic polydimethylsiloxane, functional fluids, and intermediates. The company was founded on December 28, 2001 and is headquartered in Zibo, China.

Summary

TRINSEO PLC is an investment opportunity for investors interested in the chemical industry. In 2023, the company reported a release of 8100 gallons of latex emulsion from their Bristol plant. Investors should consider the potential risks this may have on the financial performance of the company as well as any environmental or safety risks associated with a release of this size. It is important to analyze the company’s financials and take into account any potential liabilities related to the incident.

Additionally, investors should review the company’s policies and procedures for addressing a release of this size and evaluate their plans for mitigating any long-term financial or environmental risks associated with the incident.

Recent Posts