Keppel Infrastructure Trust Achieves 2023 Sustainability Goals and Beyond

March 31, 2023

Trending News ☀️

KEPPEL ($SGX:A7RU): KIT is a Singapore-based exchange-traded trust that invests primarily in infrastructure-related businesses and assets across a range of sectors. KIT has been making strides towards achieving these goals. The trust plans to double down on its efforts to reduce greenhouse gas emissions, increase energy efficiency, and increase its reliance on renewable sources of energy. Additionally, KIT will continue to take an active role in promoting sustainability initiatives within the infrastructure sector and will continue to invest in projects that support sustainable development.

Price History

On Friday, KIT’s stock opened at SG$0.5 and closed at SG$0.5, thus proving the success of KIT’s sustainability strategy. This sustainability strategy was implemented to ensure that KIT meets its commitments to deliver long-term economic, environmental and social value to stakeholders, as well as its shareholders. KIT is also committed to ensuring the social and environmental sustainability of projects it invests in. KIT has worked hard to reach its 2023 sustainability goals, and is already making plans to reach new goals in the future.

Overall, KIT is well on its way to achieving its 2023 sustainability goals, and will be pushing for even greater success in the years to come. The trust’s commitment to sustainability has been a major factor in its success, and will continue to serve as an important part of its business strategy in the future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for A7RU. More…

| Total Revenues | Net Income | Net Margin |

| 2.01k | 0.87 | 0.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for A7RU. More…

| Operations | Investing | Financing |

| 244.6 | -1.58k | 1.06k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for A7RU. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 5.96k | 4.06k | 0.34 |

Key Ratios Snapshot

Some of the financial key ratios for A7RU are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 8.6% | 15.2% | 6.6% |

| FCF Margin | ROE | ROA |

| 10.0% | 5.1% | 1.4% |

Analysis

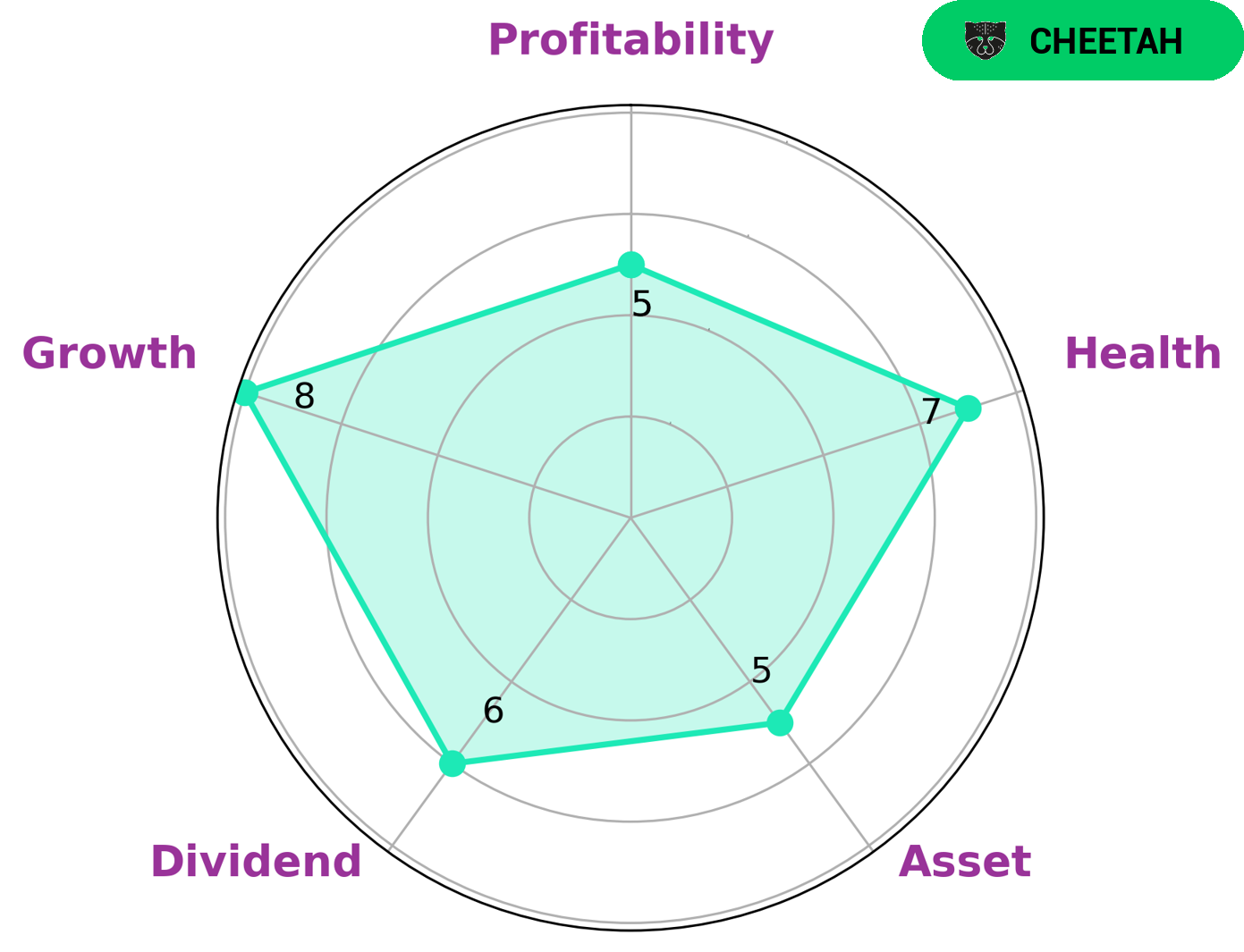

At GoodWhale, we have performed an analysis of KEPPEL INFRASTRUCTURE TRUST. After looking at the star chart, it is clear that KEPPEL INFRASTRUCTURE TRUST is classified as ‘cheetah’, which is indicative of a company that achieved high revenue or earnings growth but is considered less stable due to lower profitability. Given KEPPEL INFRASTRUCTURE TRUST’s strong growth and medium rating in asset, dividend, and profitability, this type of company may be attractive to investors looking for above-average growth opportunities. Additionally, KEPPEL INFRASTRUCTURE TRUST has a high health score of 7/10 considering its cashflows and debt, meaning it is capable to safely ride out any crisis without the risk of bankruptcy. This makes KEPPEL INFRASTRUCTURE TRUST an attractive investment choice for those looking for stable, short-term investments. More…

Peers

The competition between Keppel Infrastructure Trust and its competitors, Gulf Resources Inc, Ise Chemicals Corp, and Suzhou Jinhong Gas Co Ltd, is fierce. Each company is vying for a larger market share and striving to become the leader in their respective industries. While each company brings a unique set of services and products to the table, the race is on to see who will come out on top.

– Gulf Resources Inc ($NASDAQ:GURE)

Gulf Resources Inc is a leading chemical products manufacturer and distributor in the world. The company is based in Houston, Texas and its products include bromine, crude salt, and natural gas. As of 2023, its market cap stands at 36.83M and its return on equity (ROE) is 4.84%. Gulf Resources Inc has a strong presence in the chemical products market and enjoys a large customer base due to its consistent quality of products. The company’s impressive market cap and ROE are a testament to its consistent financial performance over the years.

– Ise Chemicals Corp ($TSE:4107)

Ise Chemicals Corp is a global chemicals manufacturer based in Japan. The company produces a variety of chemicals for industrial, agricultural and healthcare uses. As of 2023, the company has a market cap of 26.41B and a Return on Equity (ROE) of 7.54%. This market cap indicates that the company has a significant size and presence in the industry. The ROE, which is a measure of profitability and efficiency, is also very healthy. This indicates that the company’s management is able to generate good returns from its assets.

– Suzhou Jinhong Gas Co Ltd ($SHSE:688106)

Suzhou Jinhong Gas Co Ltd is a Chinese gas production and distribution company that is currently valued at a market cap of 10.17B as of 2023. The company has been able to maintain a respectable Return on Equity (ROE) of 6.0%. As a gas production and distribution company, Suzhou Jinhong Gas Co Ltd is responsible for creating and delivering natural gas to its customers across China. The company has grown significantly over the years and is now one of the most respected companies in China’s energy sector.

Summary

Keppel Infrastructure Trust (KIT) has delivered a strong performance in its sustainability efforts, achieving its 2023 sustainability goals and setting the bar even higher for the coming years. KIT has invested in renewable energy, upgraded its water and wastewater treatment facilities, improved its resource efficiency, and enhanced its environmental standards. Investors in KIT benefit from its sustainability agenda, as the trust is well-positioned to capitalize on the growing demand for green infrastructure and renewable power.

The trust’s investments are expected to grow in value over time, and its commitment to sustainability initiatives should help drive long-term performance. With the trust’s diversified portfolio and strong risk management strategies, KIT provides an attractive option for investors seeking consistent returns while at the same time championing environmental causes.

Recent Posts