IFF Stock Intrinsic Value – International Flavors & Fragrances Reports Mixed Results – EPS Misses by $0.02 But Revenue Beats by $50M

May 9, 2023

Trending News 🌧️

INTERNATIONAL ($NYSE:IFF): Non-GAAP earnings per share (EPS) of $0.87 missed analysts’ estimates by $0.02. On the other hand, revenue of $3.03B beat expectations by $50M. IFF is a leading global creator and manufacturer of flavors and fragrances used in a wide variety of consumer products, such as beverages, food, health and beauty products, personal care items, and household goods. IFF is dedicated to creating innovative flavor and fragrance solutions that capture the imaginations of consumers around the world and help customers create great-tasting, quality products.

Earnings

In its earning report of FY2022 Q4 as of December 31 2022, INTERNATIONAL FLAVORS & FRAGRANCES reported mixed results, with earnings per share missing by $0.02 but total revenue beating estimates by $50 million. Total revenue reached 2844.0 million USD, a 6.2% decrease from the previous year, while net income was 3.0 million USD, a 96.7% decrease from the previous year. Over the last 3 years, INTERNATIONAL FLAVORS & FRAGRANCES’s total revenue has grown from 1270.07 million USD to 2844.0 million USD.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for IFF. More…

| Total Revenues | Net Income | Net Margin |

| 12.44k | -1.87k | -3.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for IFF. More…

| Operations | Investing | Financing |

| 397 | 745 | -1.23k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for IFF. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 35.41k | 17.63k | 69.36 |

Key Ratios Snapshot

Some of the financial key ratios for IFF are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 34.3% | 14.7% | -10.4% |

| FCF Margin | ROE | ROA |

| -0.9% | -4.7% | -2.3% |

Share Price

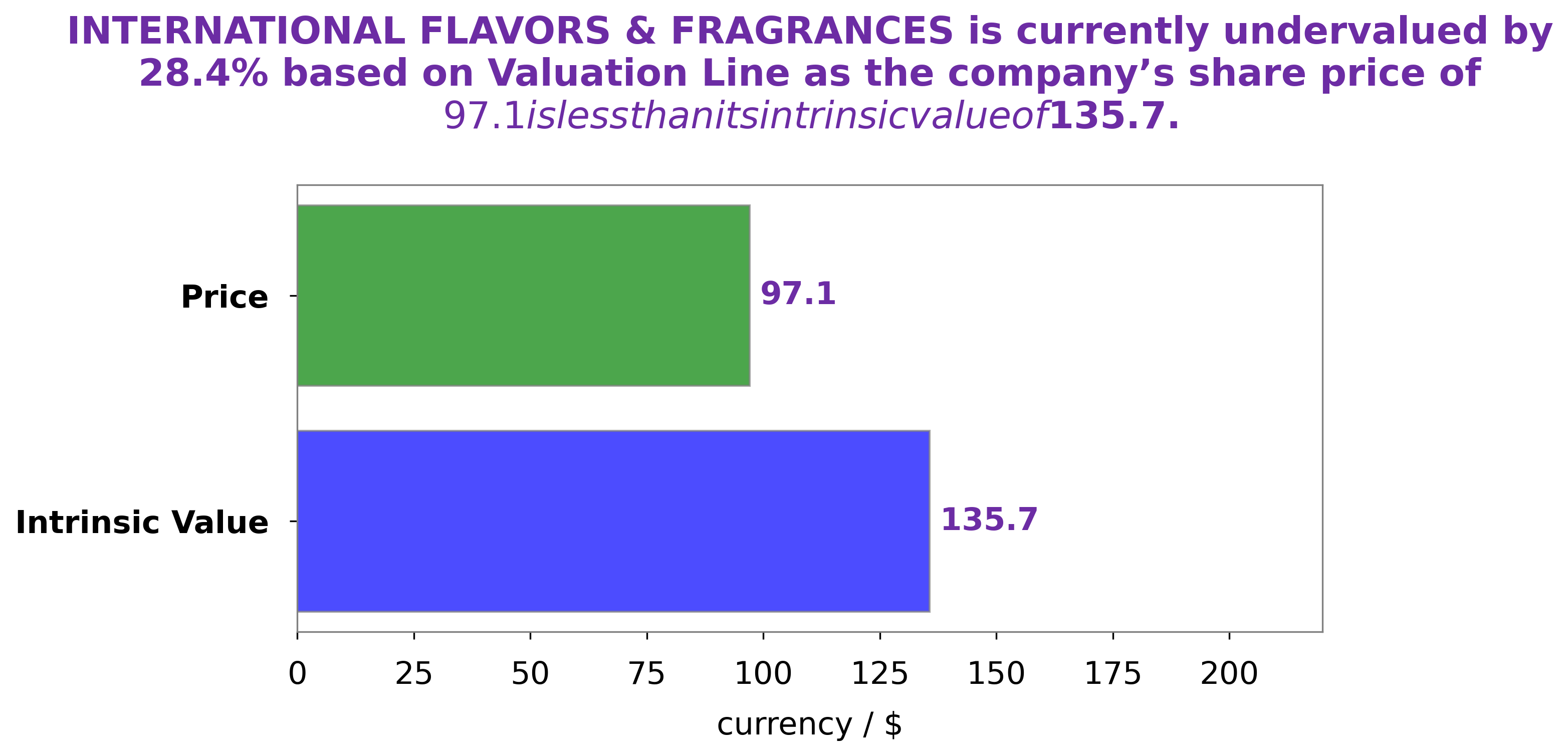

The stock opened on Monday at $96.5 and closed at $97.1, up 0.7% from its previous closing price of $96.4. Live Quote…

Analysis – IFF Stock Intrinsic Value

At GoodWhale, we have conducted an analysis of INTERNATIONAL FLAVORS & FRAGRANCES’s financials. According to our proprietary Valuation Line, the fair value of INTERNATIONAL FLAVORS & FRAGRANCES share is estimated to be around $135.7. However, the current trading price of INTERNATIONAL FLAVORS & FRAGRANCES stock is only at $97.1, undervalued by 28.4%. This presents an engaging opportunity for investors looking to buy INTERNATIONAL FLAVORS & FRAGRANCES stocks at a discounted price. More…

Peers

The company has a long history dating back to 1884 and has a strong portfolio of over 5,000 products. Koninklijke DSM NV, Ashland Global Holdings Inc, and Chr. Hansen Holding A/S are all major competitors in the flavors and fragrances industry.

– Koninklijke DSM NV ($LTS:0NPP)

Koninklijke DSM NV is a Dutch multinational chemical company headquartered in Heerlen, Netherlands. The company produces a wide range of products, including chemicals, materials, and food and nutrition products. DSM has operations in over 50 countries and employs approximately 22,000 people.

DSM’s market cap as of 2022 is 20.77B. The company’s ROE is 6.75%. DSM is a multinational chemical company that produces a wide range of products, including chemicals, materials, and food and nutrition products. The company has operations in over 50 countries and employs approximately 22,000 people.

– Ashland Global Holdings Inc ($NYSE:ASH)

Ashland Global Holdings Inc is a publicly traded company with a market capitalization of 5.33 billion as of 2022. The company has a return on equity of 4.57%. Ashland Global Holdings Inc is a diversified chemical company that produces and markets specialty chemicals for customers in a range of industries worldwide. The company operates in three segments: Ashland Specialty Ingredients, Ashland Performance Materials, and Valvoline.

– Chr. Hansen Holding A/S ($LTS:0MR6)

Chr. Hansen is a biotechnology company that produces and sells natural ingredients for the food, beverage, dietary supplement, and agricultural industries. The company has a market cap of 55.93B as of 2022 and a return on equity of 19.79%. Chr. Hansen was founded in 1874 and is headquartered in Hørsholm, Denmark.

Summary

The reported revenue of $3.03B beat expectations by $50M. This could indicate that the company is struggling to keep up with expected growth, as the EPS missed expectations while the revenue beat them. Investors should pay close attention to how the company adjusts its strategy to meet the growth expectations going forward. It is important to consider the company’s cash flow and profits when analyzing the stock for potential investments, as analysts will most likely take a closer look at these numbers when considering the stock.

Recent Posts