Eastman Chemical Co. Shares Slip 0.14% Amid Grim Trading Session

May 16, 2023

Trending News 🌧️

Eastman Chemical ($NYSE:EMN) Co. is a large, publicly-traded company that produces and distributes specialty chemicals, fibers, and plastics. On Friday, the company’s stock slipped 0.14%, closing at $78.70 in a generally grim trading session. The company has generated strong revenue growth over the past few quarters, and investors are optimistic about Eastman Chemical’s future prospects. Analysts have given the stock a “buy” rating, indicating that they believe the stock is undervalued and that the company is attractive for investment.

Analysis

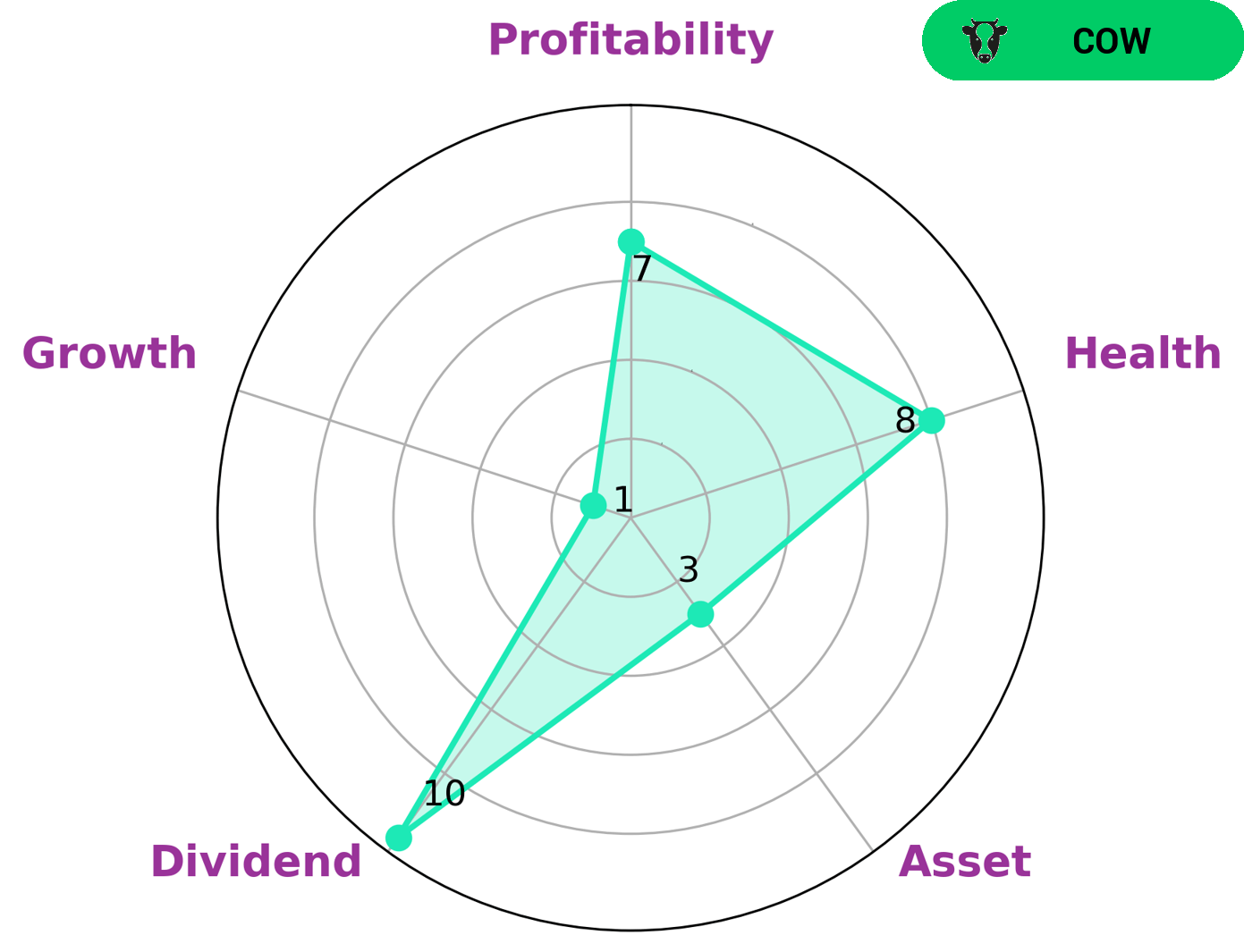

At GoodWhale, we examined the fundamentals of EASTMAN CHEMICAL and analyzed them. According to our Star Chart, EASTMAN CHEMICAL is strong in dividend and profitability, but weak in asset and growth. We classified EASTMAN CHEMICAL as ‘cow’, a type of company that has the track record of paying out consistent and sustainable dividends. This makes it an attractive option for investors looking for a steady income stream. We also looked at EASTMAN CHEMICAL’s health score, which scored 8/10 considering its cashflows and debt. This indicates that the company is capable of sustaining future operations in times of crisis. In conclusion, we believe that EASTMAN CHEMICAL is a good investment option for those looking for a reliable, low-risk income stream. More…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Eastman Chemical. More…

| Total Revenues | Net Income | Net Margin |

| 10.28k | 692 | 7.7% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Eastman Chemical. More…

| Operations | Investing | Financing |

| 956 | 257 | -1.09k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Eastman Chemical. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 14.67k | 9.43k | 43.25 |

Key Ratios Snapshot

Some of the financial key ratios for Eastman Chemical are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 4.0% | -5.3% | 10.5% |

| FCF Margin | ROE | ROA |

| 2.6% | 13.1% | 4.6% |

Peers

Eastman Chemical Co is one of the world’s leading producers of chemicals and related products, with manufacturing facilities in over 30 countries. Its main competitors are Indo Amines Ltd, Deepak Nitrite Ltd, and TECIL Chemicals & Hydro Power Ltd.

– Indo Amines Ltd ($BSE:524648)

Indo Amines Ltd is a publicly traded company with a market capitalization of 8.96 billion as of 2022. The company has a return on equity of 16.75%. Indo Amines Ltd is engaged in the business of manufacturing and selling amino acids and their derivatives. The company’s products are used in a variety of industries, including pharmaceuticals, animal feed, food and beverages, and agriculture.

– Deepak Nitrite Ltd ($BSE:506401)

Deepak Nitrite Ltd is an Indian company that manufactures and sells chemicals. The company has a market cap of 305.73B as of 2022 and a Return on Equity of 25.76%. Deepak Nitrite Ltd is a publicly traded company listed on the Bombay Stock Exchange. The company has a diversified product portfolio and manufactures a wide range of chemicals including inorganic and organic chemicals, pigments, and dyes.

Summary

Eastman Chemical Co. (EMN) saw its stock slip 0.14% on Friday, ending the trading session at $78.70. The overall poor performance of the market likely contributed to the decline in EMN’s stock. Analysts have noted that the chemical industry is healthy and this bodes well for Eastman’s future. Investors should be mindful of the company’s ability to maintain a consistent dividend and its ability to generate strong cash flows from operations.

Additionally, Eastman’s cost control measures and investments in technology should be monitored in order to assess the company’s prospects. Overall, Eastman Chemical remains an attractive option for investors seeking an established company with a long track record of success.

Recent Posts