Alpha Paradigm Partners LLC Invests $992,000 in H.B. Fuller in 2023.

March 19, 2023

Trending News 🌥️

In 2023, Alpha Paradigm Partners LLC made a significant investment in H.B. ($NYSE:FUL) Fuller, a global leader in adhesives, sealants, and other specialty chemicals. This investment of 992,000 USD is a major vote of confidence in H.B Fuller’s potential to serve customers and grow their business in the future. The company operates in a wide range of industries, including construction, automotive, electronics, and textiles, and is dedicated to sustainable chemistry and creating intelligent solutions for their customers. This new investment will help them to expand their current operations, develop new products and services, and drive growth for the future.

The investment from Alpha Paradigm Partners LLC is a major opportunity for H.B. Fuller to build on their success and reach new heights in their industry. With this additional capital and support from Alpha Paradigm Partners LLC, H.B. Fuller can continue to pursue its mission of creating sustainable value for its customers and the world.

Share Price

On Monday, Alpha Paradigm Partners LLC announced the investment of $992,000 in H.B. Fuller for 2023. Despite the investment, the stock has seen mostly negative media exposure and opened at $65.7 before closing at $65.6, a 1.7% drop from its previous closing price of $66.8. This marks a continued decline in H.B. Fuller’s stock performance since the start of the year. Despite the current downtrend in stock, Alpha Paradigm Partners LLC stands behind their decision to invest in H.B. Fuller and remain optimistic about the future of the company. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for H.b. Fuller. More…

| Total Revenues | Net Income | Net Margin |

| 3.75k | 180.31 | 4.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for H.b. Fuller. More…

| Operations | Investing | Financing |

| 256.51 | -375.29 | 160.32 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for H.b. Fuller. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.46k | 2.85k | 30 |

Key Ratios Snapshot

Some of the financial key ratios for H.b. Fuller are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 9.0% | 12.6% | 9.2% |

| FCF Margin | ROE | ROA |

| 3.4% | 13.5% | 4.8% |

Analysis

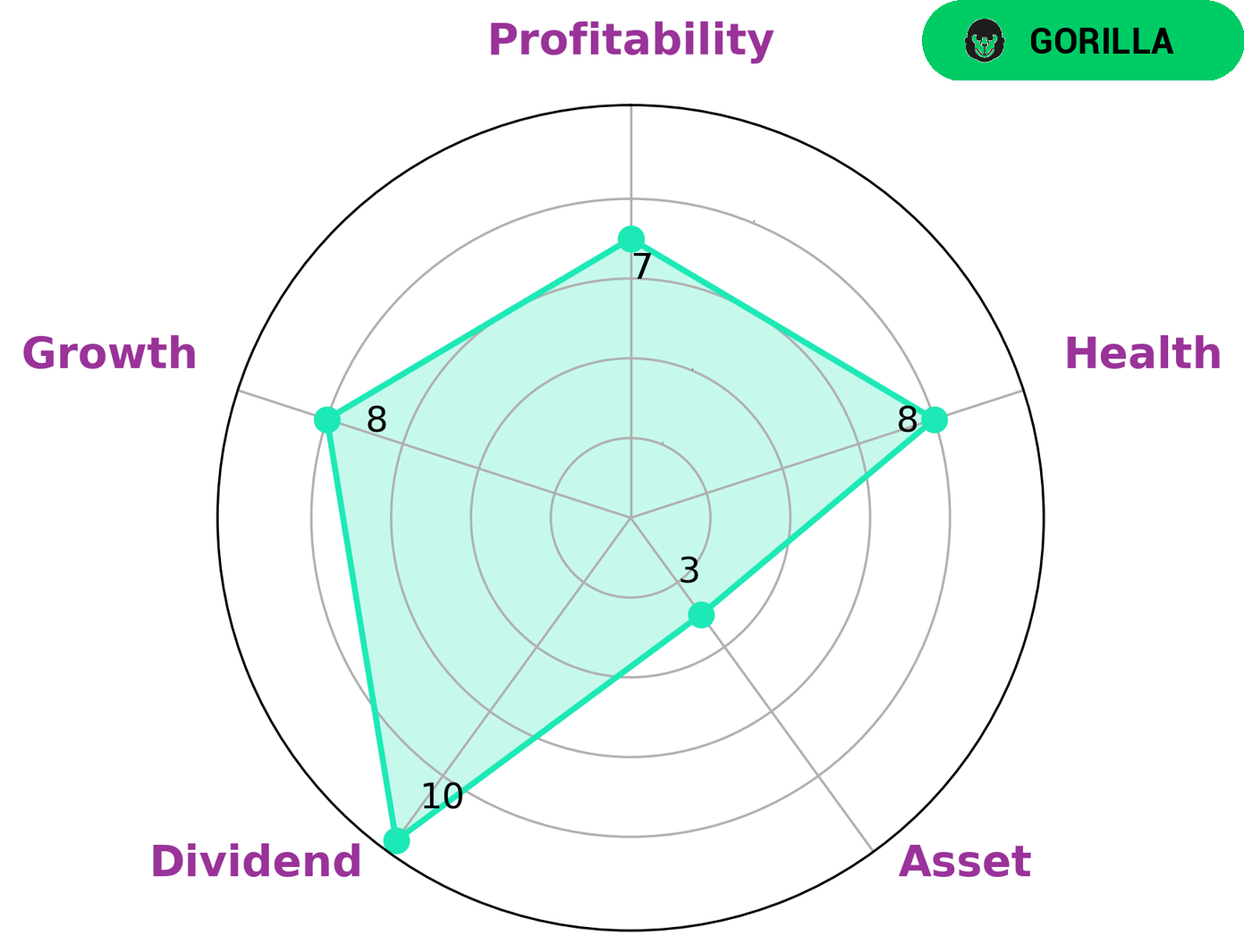

GoodWhale conducted an analysis of H.B. FULLER‘s wellbeing and found that the company had a high health score of 8/10 when it comes to its cashflows and debt. It appears that H.B. FULLER is capable of paying off its debt and funding future operations. Further analysis of H.B. FULLER shows that the company is strong in dividend, growth, and profitability, but weak in asset. We have classified H.B. FULLER as a ‘gorilla’, a type of company we conclude is achieving stable and high revenue or earning growth due to its strong competitive advantage. Investors interested in such a company can expect strong results and potential appreciation of the value of their investment in the long run. Therefore, this type of company may be an attractive option for those looking for long-term returns. More…

Peers

H.B. Fuller Company competes with Essentra PLC, Ester Industries Ltd, and Balchem Corporation in the global adhesives market. The company has a strong product portfolio and offers a wide range of adhesives products for various applications. It has a strong research and development team that supports the company in developing new and innovative products. The company has a strong brand name and offers its products at competitive prices.

– Essentra PLC ($LSE:ESNT)

Essentra PLC is a multinational company that manufactures and sells small plastic and fibre products. Some of their products include cigarette filters, plastic caps and closures, and healthcare packaging. The company has a market cap of 636.57M as of 2022 and a Return on Equity of 5.25%.

– Ester Industries Ltd ($BSE:500136)

Ester Industries Ltd is a publicly traded company with a market capitalization of 14.81 billion as of 2022. The company has a return on equity of 23.17%. Ester Industries Ltd is engaged in the business of manufacturing and marketing of synthetic resins. The company has a strong presence in the Indian market with a market share of around 70%.

– Balchem Corp ($NASDAQ:BCPC)

Balchem Corporation, together with its subsidiaries, develops, manufactures, and markets specialty performance ingredients and products for the food, nutritional, feed, pharmaceutical, and medical sterilization industries in the United States and internationally. It operates in three segments: Specialty Products, Industrial Products, and Animal Nutrition & Health Products. The company was founded in 1967 and is headquartered in New Hampton, New York.

Summary

H.B. Fuller has recently received an investment of $992,000 from Alpha Paradigm Partners LLC in 2023. Despite this, the media has generally portrayed the company in a negative light. Investment analysis of the company is difficult to come by due to the lack of available data.

However, it appears that H.B. Fuller holds a solid market position and is well positioned for future growth. Furthermore, with the investment from Alpha Paradigm Partners LLC, the company’s financial resources and capabilities have been significantly enhanced. Thus, investors may want to consider H.B. Fuller as a viable long-term investment option.

Recent Posts