Air Products and Chemicals Gains 0.27% in 2023, Despite Lagging Behind Market.

March 26, 2023

Trending News ☀️

Air ($NYSE:APD) Products and Chemicals, a manufacturer and supplier of industrial gases, chemicals and related products, closed at $267.67 in the latest trading session, representing a slight 0.27% increase compared to the previous day’s closing price. This suggests that Air Products and Chemicals is lagging behind the market, as investors are not as optimistic about the company’s outlook. This is largely due to the company’s exposure to the gas industry, which has seen a slowdown in demand due to the pandemic-induced travel restrictions and other economic uncertainties. Despite this, the company has managed to maintain profitability, thanks to its diversified portfolio of products and services. Looking ahead, Air Products and Chemicals is well-positioned to benefit from the ongoing economic recovery.

The company has recently announced a number of major projects that are expected to further boost its revenue and earnings in the long term. This includes a new plant in Saudi Arabia that is expected to increase its production capacity significantly. As such, it is likely that Air Products and Chemicals will see an improved performance in the coming months and years and may even outpace the market in terms of growth.

Share Price

Despite media sentiment being mostly negative, Air Products and Chemicals (APD) managed to close at a 0.3% gain on Friday, opening at $265.4 and closing at $267.7. This was a modest increase from the previous closing price of $266.9 and the gain came despite lagging behind the market as a whole. Although the stock has been unable to keep up with the bull market for the year so far, having gained only 0.27% since the start of 2023, this small victory provided a glimmer of hope for investors in APD. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for APD. More…

| Total Revenues | Net Income | Net Margin |

| 12.88k | 2.27k | 18.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for APD. More…

| Operations | Investing | Financing |

| 3.16k | -2.39k | -501.1 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for APD. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 28.28k | 13.76k | 62.75 |

Key Ratios Snapshot

Some of the financial key ratios for APD are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 12.9% | 4.2% | 22.9% |

| FCF Margin | ROE | ROA |

| 0.5% | 13.6% | 6.5% |

Analysis

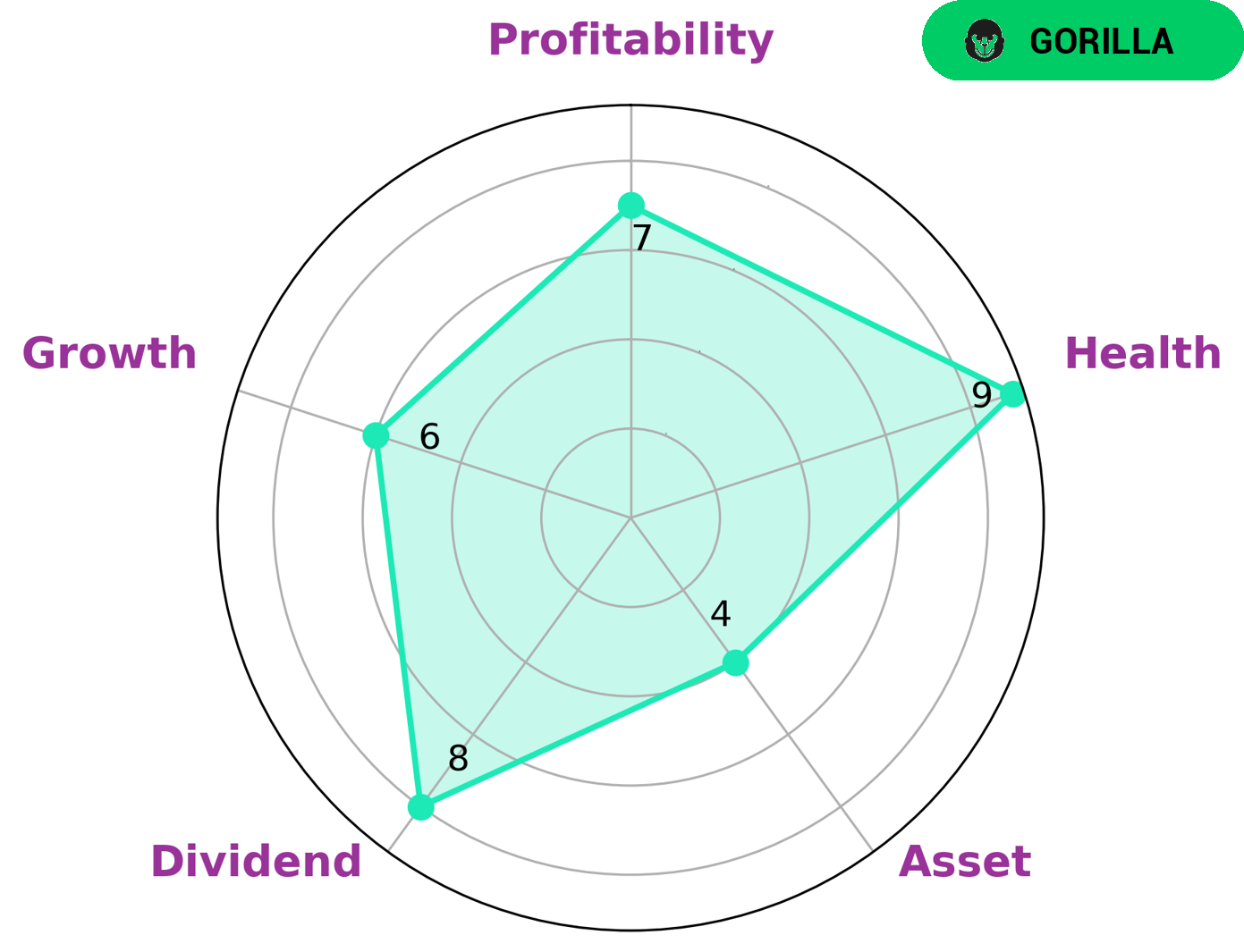

At GoodWhale, we have conducted an analysis of AIR PRODUCTS AND CHEMICALS’s wellbeing. Our Star Chart shows that the company is strong in dividend, profitability, and medium in asset, growth. We classified AIR PRODUCTS AND CHEMICALS as a ‘gorilla’, a type of company that is able to achieve stable and high revenue or earning growth due to its strong competitive advantage. We believe that this makes AIR PRODUCTS AND CHEMICALS an attractive option for a wide range of investors. Its high health score of 9/10 considering its cashflows and debt, also indicates that AIR PRODUCTS AND CHEMICALS is capable to safely ride out any crisis without the risk of bankruptcy. This stability, combined with its competitive advantage, makes AIR PRODUCTS AND CHEMICALS an attractive choice for investors looking for a long-term investment. More…

Peers

Air Products & Chemicals Inc is an American multinational corporation whose principal business is the supply of gases and chemicals for industrial uses. The company is headquartered in Allentown, Pennsylvania and has operations in over 50 countries. Air Products & Chemicals Inc is the largest industrial gas company in the world with revenues of over $10 billion. Air Liquide SA, Linde PLC, and Autris are its main competitors.

– Air Liquide SA ($LTS:0NWF)

As of 2022, Air Liquide SA has a market cap of 68.08B with a ROE of 11.4%. The company is engaged in the business of gas and service provider. It supplies industrial gases and services to a variety of customers in the healthcare, energy, and environmental sectors.

– Linde PLC ($NYSE:LIN)

The company’s market cap is 147.13B as of 2022 and its ROE is 8.63%. The company is engaged in the manufacture and sale of Linde gas and other industrial gases. The company has a strong presence in Europe, North America, and Asia Pacific.

– Autris ($OTCPK:AUTR)

Autris is a global leader in providing innovative solutions for the automotive industry. The company has a market cap of 690.7k as of 2022 and a return on equity of 146.32%. Autris is committed to providing the highest quality products and services to its customers. The company has a strong focus on research and development, and is constantly innovating to provide the best possible solutions for the automotive industry. Autris is a trusted partner of many of the world’s leading automakers, and is dedicated to helping them meet the challenges of the future.

Summary

Investors in Air Products and Chemicals have seen a slight positive return of 0.27% in 2023 compared to the wider market, despite the company lagging behind. Currently, the market sentiment and outlook is fairly negative, however, there are a number of factors to consider when looking at the investment potential of this company. Factors such as its strong financials, impressive product portfolio and growing customer base show that Air Products and Chemicals is well positioned for growth in the future. The company’s commitment to innovation and technology are further indications of its potential as an attractive investment option.

Additionally, Air Products and Chemicals has an extensive global presence, with a number of subsidiaries operating in various parts of the world. This gives investors the opportunity to diversify their portfolio and benefit from global growth. For those looking for an investment with potential for long-term gains, Air Products and Chemicals may be worth considering.

Recent Posts