Air Products and Chemicals Exceeds Q2 Expectations, Raises Forecast for FY23

May 10, 2023

Trending News 🌥️

Air ($NYSE:APD) Products and Chemicals, a leading manufacturer and supplier of industrial gases, chemicals, and related products, recently released their second quarter earnings report that exceeded expectations. In addition to their stellar performance, Air Products and Chemicals also increased their forecast for fiscal year 2023, citing a stronger-than-expected demand for their products. The company also expressed optimism for the third quarter, predicting further growth in the near future.

It is also a testament to the company’s ability to quickly adapt to changing market conditions and remain competitive in an increasingly difficult business environment. With their success in the second quarter and continued optimism for the third quarter, Air Products and Chemicals looks well positioned to finish the year on a strong note.

Market Price

The stock opened at $296.0 but closed at $279.9, a 5.3% drop from its previous closing price of 295.6. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for APD. More…

| Total Revenues | Net Income | Net Margin |

| 12.88k | 2.27k | 18.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for APD. More…

| Operations | Investing | Financing |

| 3.16k | -2.39k | -501.1 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for APD. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 28.28k | 13.76k | 62.75 |

Key Ratios Snapshot

Some of the financial key ratios for APD are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 12.9% | 4.2% | 22.9% |

| FCF Margin | ROE | ROA |

| 0.5% | 13.6% | 6.5% |

Analysis

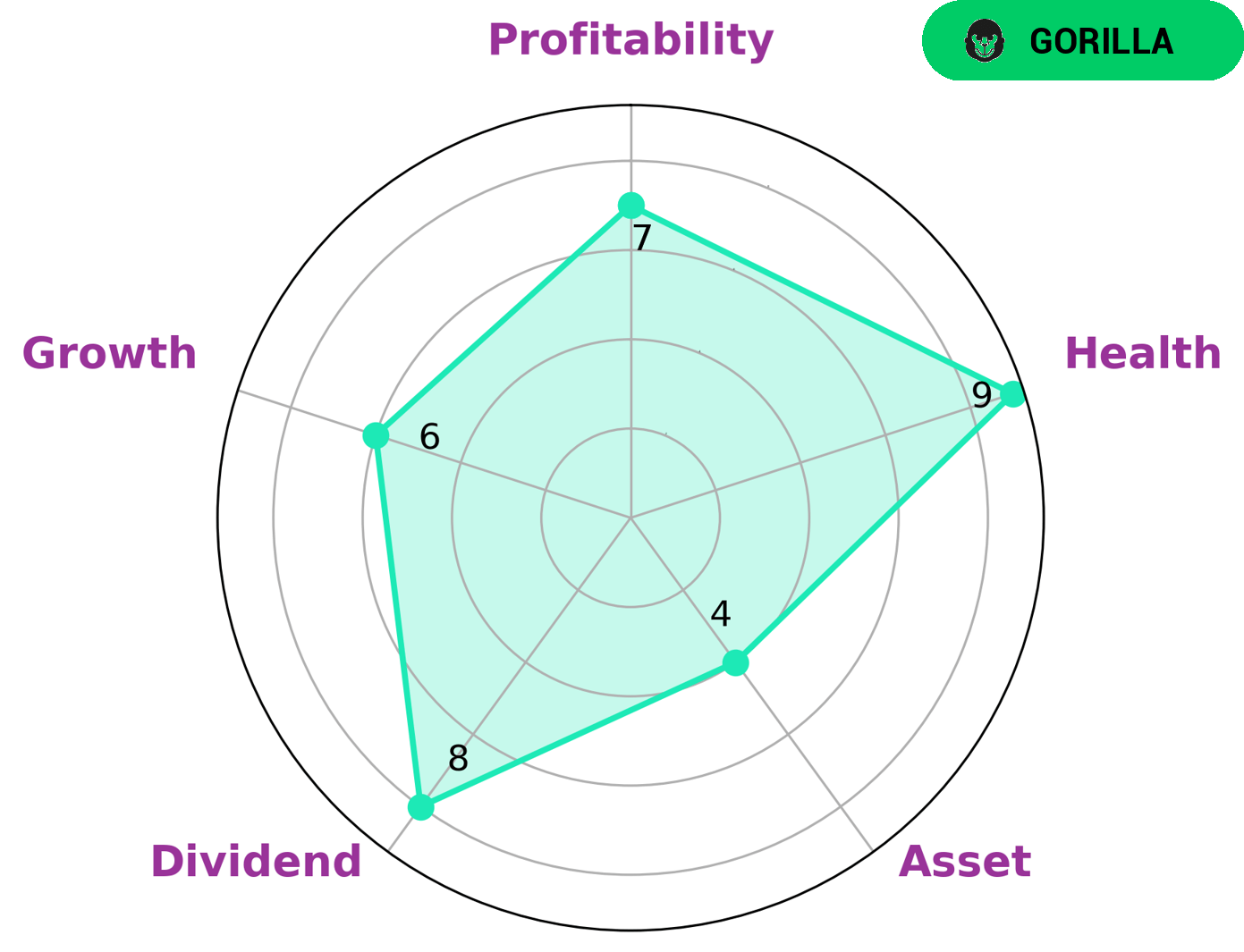

At GoodWhale, we conducted an analysis of AIR PRODUCTS AND CHEMICALS’s wellbeing. According to our Star Chart, AIR PRODUCTS AND CHEMICALS is classified as ‘gorilla’, a type of company we conclude that achieved stable and high revenue or earning growth due to its strong competitive advantage. As such, the company is likely to attract investors such as Growth Investors, Dividend Investors, Value Investors and Passive Investors. AIR PRODUCTS AND CHEMICALS has a high health score of 9/10 considering its cashflows and debt, which indicates it is capable to safely ride out any crisis without the risk of bankruptcy. From our analysis, AIR PRODUCTS AND CHEMICALS is strong in dividend, profitability, and has medium ratings in asset and growth. This provides investors with a balance of safety with some growth potential. Altogether, AIR PRODUCTS AND CHEMICALS is a solid investment option for the right investor. More…

Peers

Air Products & Chemicals Inc is an American multinational corporation whose principal business is the supply of gases and chemicals for industrial uses. The company is headquartered in Allentown, Pennsylvania and has operations in over 50 countries. Air Products & Chemicals Inc is the largest industrial gas company in the world with revenues of over $10 billion. Air Liquide SA, Linde PLC, and Autris are its main competitors.

– Air Liquide SA ($LTS:0NWF)

As of 2022, Air Liquide SA has a market cap of 68.08B with a ROE of 11.4%. The company is engaged in the business of gas and service provider. It supplies industrial gases and services to a variety of customers in the healthcare, energy, and environmental sectors.

– Linde PLC ($NYSE:LIN)

The company’s market cap is 147.13B as of 2022 and its ROE is 8.63%. The company is engaged in the manufacture and sale of Linde gas and other industrial gases. The company has a strong presence in Europe, North America, and Asia Pacific.

– Autris ($OTCPK:AUTR)

Autris is a global leader in providing innovative solutions for the automotive industry. The company has a market cap of 690.7k as of 2022 and a return on equity of 146.32%. Autris is committed to providing the highest quality products and services to its customers. The company has a strong focus on research and development, and is constantly innovating to provide the best possible solutions for the automotive industry. Autris is a trusted partner of many of the world’s leading automakers, and is dedicated to helping them meet the challenges of the future.

Summary

Air Products and Chemicals (APD) reported second quarter earnings that exceeded both the top and bottom line estimates, and the company also initiated third quarter guidance and raised its full year forecast. Despite the better-than-expected results, the stock price declined on the same day in response to the news. Investors may be concerned that the company’s financial performance may not be able to sustain its current valuation. Analysts will be closely watching future earnings releases to determine whether Air Products and Chemicals can continue to deliver strong results and stay ahead of its competitors.

Recent Posts