Yousif Capital Management LLC Cuts Stake in UniFirst Corporation (NYSE:UNF)

March 31, 2023

Trending News 🌧️

UNIFIRST ($NYSE:UNF): Yousif Capital Management LLC recently disclosed that they have disposed of their stake in UniFirst Corporation (NYSE:UNF). The company, which is headquartered in Wilmington, Massachusetts, is a provider of workplace uniforms and protective clothing, facility service products, and custom corporate image wear. UniFirst Corporation offers its products through its Uni

First, Unitex, and Imperial Textile business units. Its services include corporate identity apparel programs, custom logo design and embroidery, garment alteration and repair, garment rental and cleaning services, and inventory management and tracking systems.

In addition, the company provides flame-resistant clothing, spill containment supplies, air purification systems, custom-printed promotional products, and carpet-cleaning services. Its customer base consists of companies in the automotive, food processing, manufacturing, health care, hospitality, retail, transportation, and warehousing industries.

Price History

On Monday, UNIFIRST CORPORATION‘s stock opened at $191.1 and closed at $191.8, up by 0.7% from prior closing price of $190.4. This increase in stock price is likely due to news of Yousif Capital Management LLC reducing their stake in the company, which can be seen as a vote of confidence in UNIFIRST CORPORATION’s future performance. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Unifirst Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 2.11k | 103.02 | 4.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Unifirst Corporation. More…

| Operations | Investing | Financing |

| 141.93 | -266.59 | -54.65 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Unifirst Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.45k | 499.23 | 103.93 |

Key Ratios Snapshot

Some of the financial key ratios for Unifirst Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 4.3% | -16.3% | 6.2% |

| FCF Margin | ROE | ROA |

| -0.8% | 4.2% | 3.3% |

Analysis

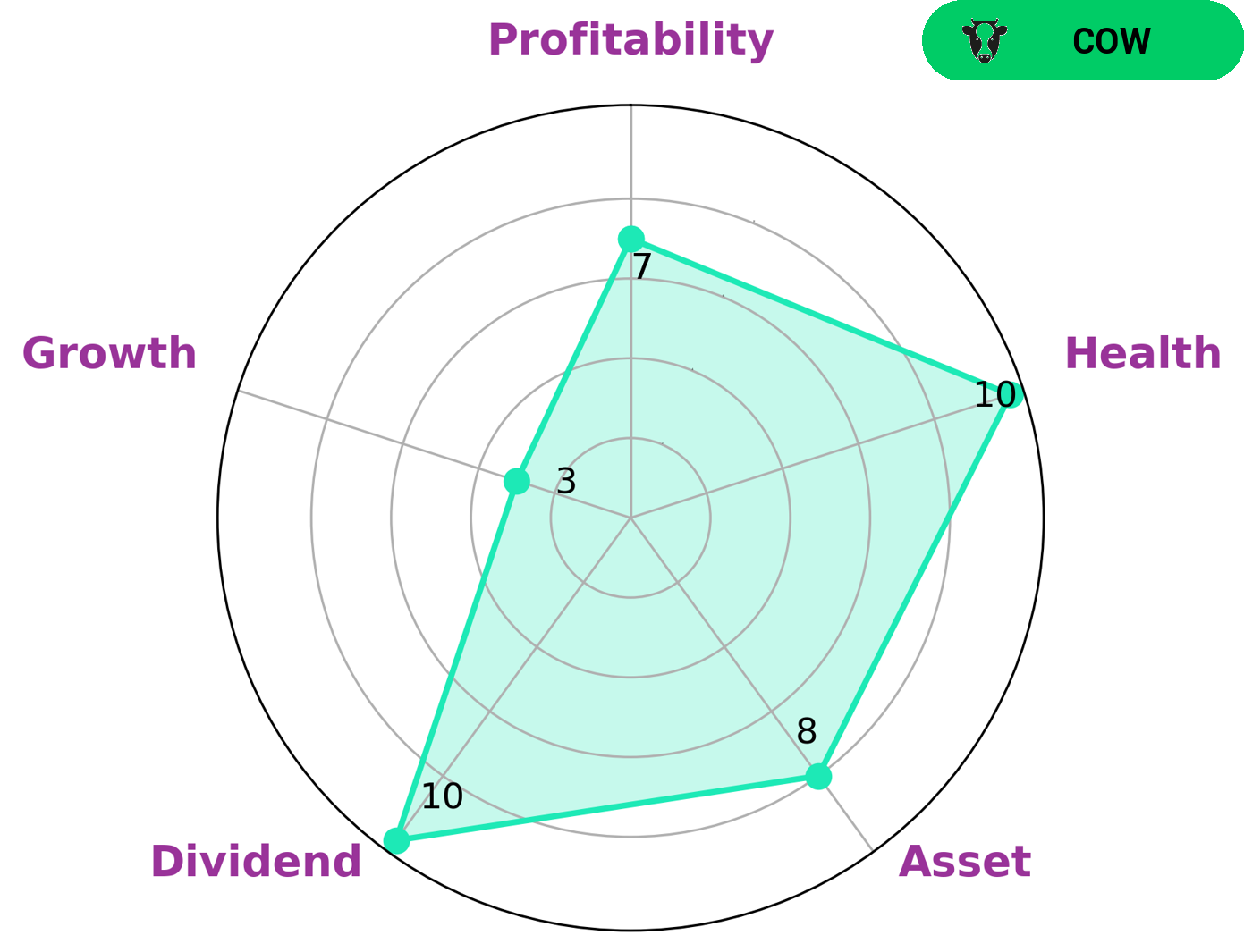

GoodWhale conducted an analysis of UNIFIRST CORPORATION‘s wellbeing. According to the Star Chart, UNIFIRST CORPORATION is classified as a ‘cow’, a type of company that has a track record of paying out consistent and sustainable dividends. As such, UNIFIRST CORPORATION would likely be attractive to dividend investors and those looking for a dependable source of income. UNIFIRST CORPORATION is strong in asset, dividend, and profitability and slightly weaker in growth. The company has a high health score of 10/10 with regard to its cashflows and debt, indicating that it is capable of paying off its debts and funding future operations. This, combined with its steady returns, makes UNIFIRST CORPORATION an attractive option for investors looking for reliable returns. More…

Peers

Its main competitors are Johnson Service Group PLC, Target Hospitality Corp, and Servizi Italia SpA.

– Johnson Service Group PLC ($LSE:JSG)

The company’s market cap is 421.43M as of 2022, a Return on Equity of 6.15%. The company provides engineering and technical services to customers in the UK, US, Canada, and Australia. It also provides support services to the UK Ministry of Defence.

– Target Hospitality Corp ($NASDAQ:TH)

Hospitality Corp is a leading provider of hospitality services. It has a market cap of 1.13B and a ROE of 43.39%. The company operates in the hotel, restaurant, and tourism industries. Hospitality Corp provides a wide range of services including hotel management, food and beverage management, event planning, and marketing. The company has a strong presence in the United States, Europe, Asia, and the Middle East.

– Servizi Italia SpA ($LTS:0NJ3)

Servizi Italia SpA is a holding company that provides services in the information and communication technology, environmental, and energy sectors in Italy and internationally. The company was founded in 2003 and is based in Rome, Italy. Servizi Italia SpA operates as a subsidiary of Telecom Italia S.p.A.

Summary

Yousif Capital Management LLC recently sold shares of UniFirst Corporation (NYSE:UNF), a leading provider of workplace uniforms, corporate attire, and facility service products. Analysts have recently commented on the stock, with one rating it a “hold,” three rating it a “buy,” and one rating it a “strong buy.”

Additionally, UNIFIRST CORPORATION has seen strong returns on equity and assets over the last few years. Overall, UNIFIRST CORPORATION appears to be a good investment for the long term. With a strong balance sheet, solid earnings report, and favorable analyst ratings, investors should take a closer look at the stock before making any decisions.

Recent Posts